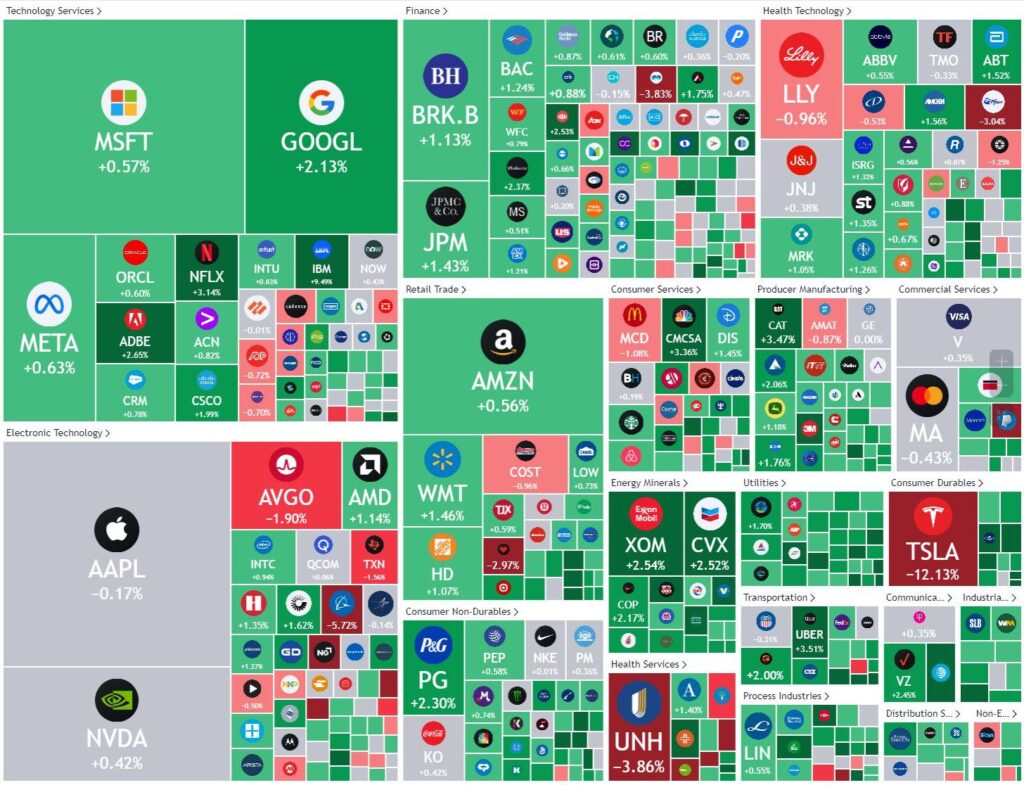

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Rate cut hopes take another hit as US GDP posts stronger than expected growth

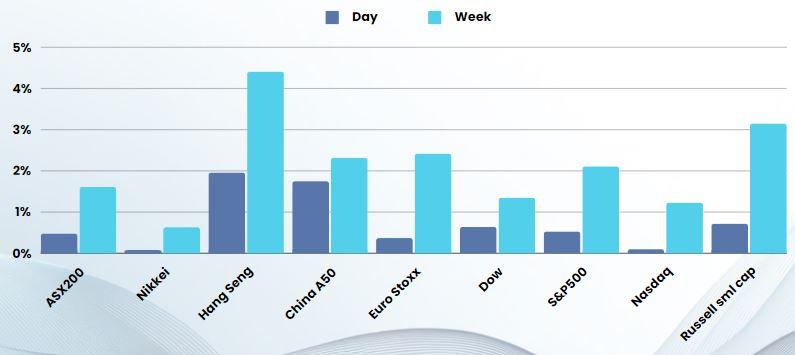

Stocks closed at record levels for the fifth-straight session Thursday as investors mulled mostly upbeat corporate earnings, while stronger-than-expected economic growth and slowing inflation bolstered expectations for a soft landing, pushing Treasury yields lower.

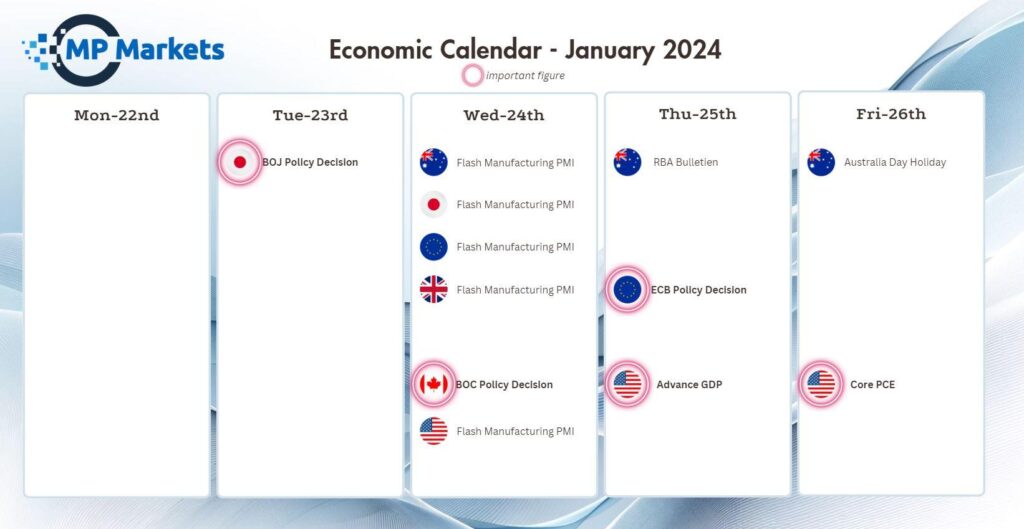

Economic data released earlier Thursday showed that the U.S. economy grew at a faster than anticipated rate in the fourth quarter, with further signs that inflation pressures are receding supporting bets that the economy is likely to avoid a recession.

Real gross domestic product in the world’s largest economy expanded at an annual rate of 3.3% in the three months to the end of December, decelerating from 4.9% in the third quarter, though well above economists’ forecast for 2%, driven by stronger consumer spending. Core personal consumption expenditure prices, the Fed’s preferred inflation measure, remained at 2% for the second-straight month.

“Bottom line, the consumer went nuts in Q3, spending tons of money on vacation, entertainment, and recreation experiences, though signs of broader weakness in the data should emerge soon.

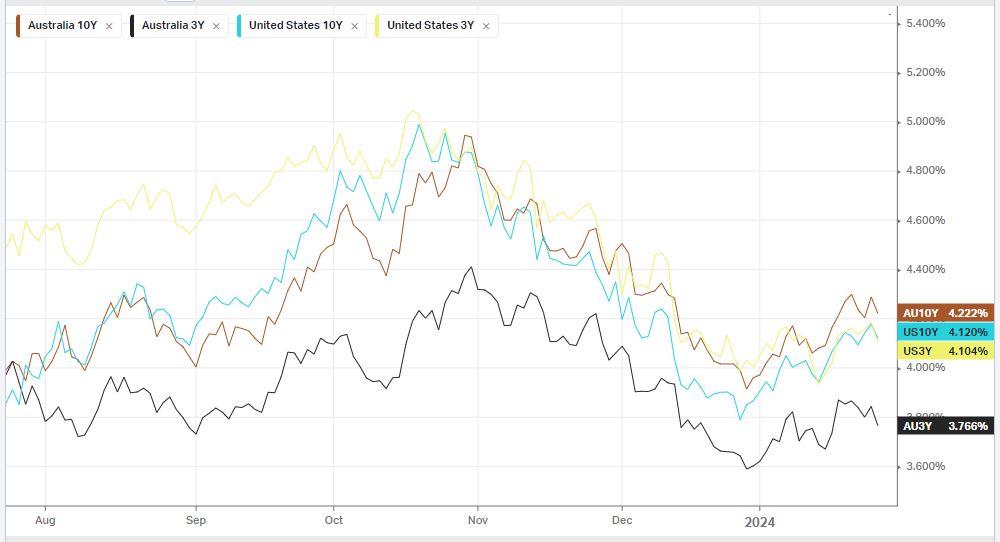

Treasury yields fell following the data, with the yield on the 10-year down 4.5 basis points to 4.135%.

CNN’s Fear and Greed Index has entered ‘extreme greed’ territory with a 77 out of a 100 reading.

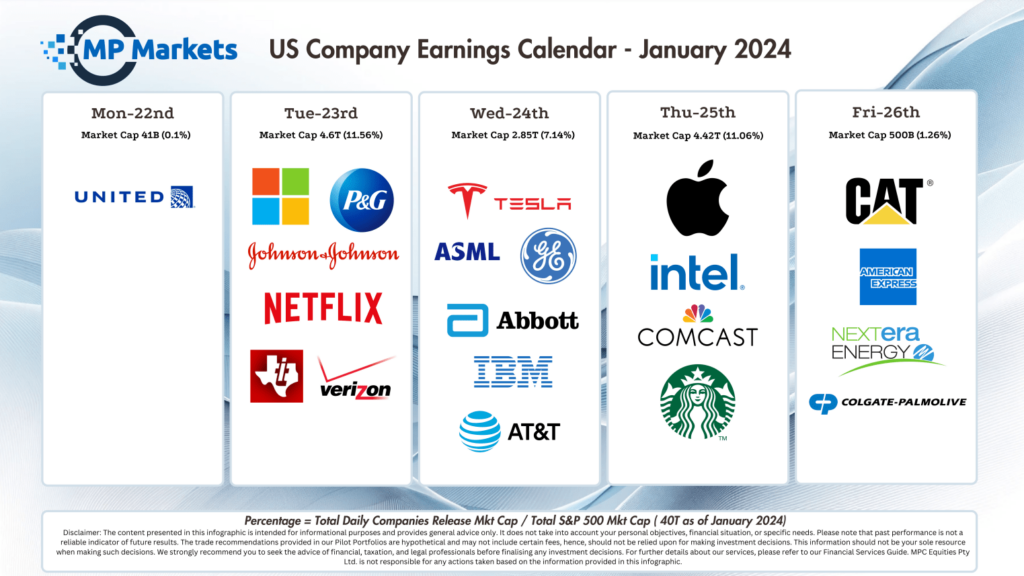

US Earnings

- IBM up 9%, was the torchbearer for rising tech stocks after the tech company reported Q4 results that topped analyst estimates, with an upside surprise in free cash flow stoking bullish sentiment as ‘big blue’ artificial intelligent offering drummed up demand. “Management highlighted that the book of business around generative AI and watsonx had doubled from the prior quarter,” RBC said in a note, as it lifted its price target on the stock to $200 from $179.

- United Rentals, meanwhile, was one of the top gainers, surging nearly 13% to a new 52-week high following better-than-expected Q4 results that beat on both the top and bottom lines. The equipment rental also unveiled plans to buyback $1.5 billion of stock in 2024 and lifted its quarterly dividend.

- American Airlines, up 10%, was also a big winner on the earnings stage after flying in a better-than-expected quarterly report and annual guidance as strong travel demand is expected to boost performance

- Tesla fell more than 12% after reporting weaker-than-expected Q4 results, warning of “notably lower” volume growth this year and delivering a “trainwreck” in the eyes of analysts

Bonds

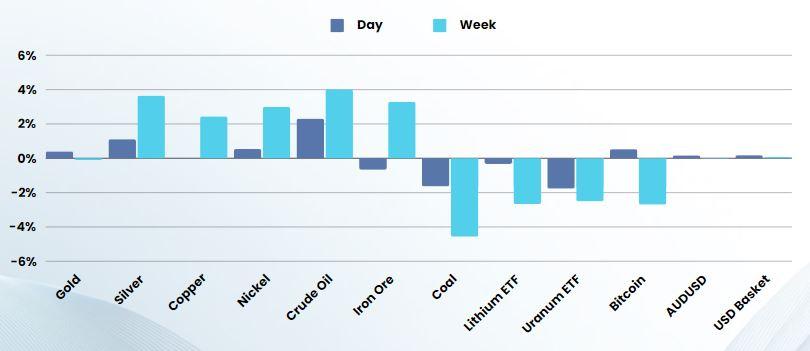

Commodities & FX

The Day Ahead

ASX SPI 7538 (+0.19%)

The ASX is closed for Australia Day. So in lieu of market news here are some quotes from famous Australians

- “To live in Australia permanently is rather like going to a party and dancing all night with one’s mother” – Barry Humphries

- “the things that are most important don’t always scream the loudest” – Bob Hawke

- “Crikey, it means gee whiz, wow” – Steve Irwin

- “[On an economics textbooks] How can you be bothered reading this boring sh*t” – Kerry Packer

Economic Calendar

Earnings Calendar