Last Night's Market Recap

S&P 500 - Heatmap

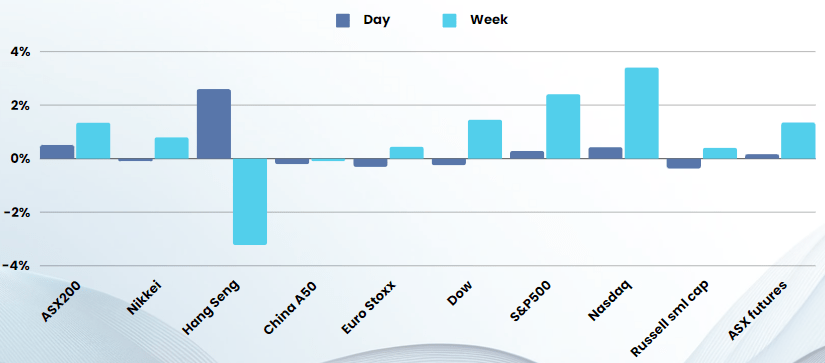

Overnight – Rally continues on tech strength

The S&P 500 closed at a new all-time high for the third-straight session Tuesday as bullish bets on tech continued to power stocks.

The focus was squarely on earnings for the US market, a factor that could see the indices ignore the broader market for the coming weeks. The “melt-up” effect of tech at the moment may defy logic, however, the tone set so far this earnings season is optimism, no matter the actual result

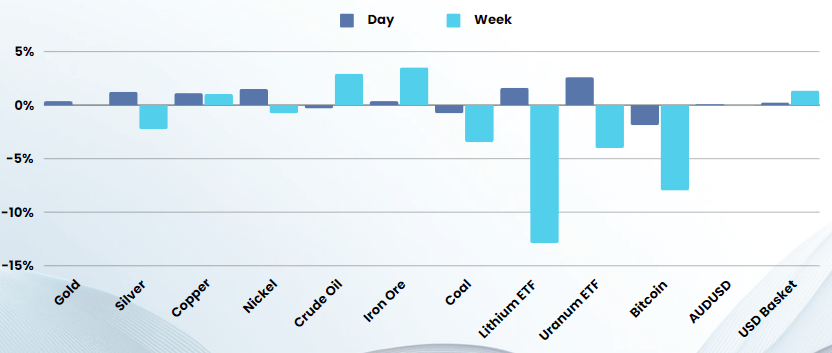

The dollar climbed to six-week peaks against a basket of currencies on Tuesday, as investors resumed buying the greenback after a brief respite, on continued expectations the Federal Reserve would be in no rush to cut interest rates given a still stable U.S. economy.

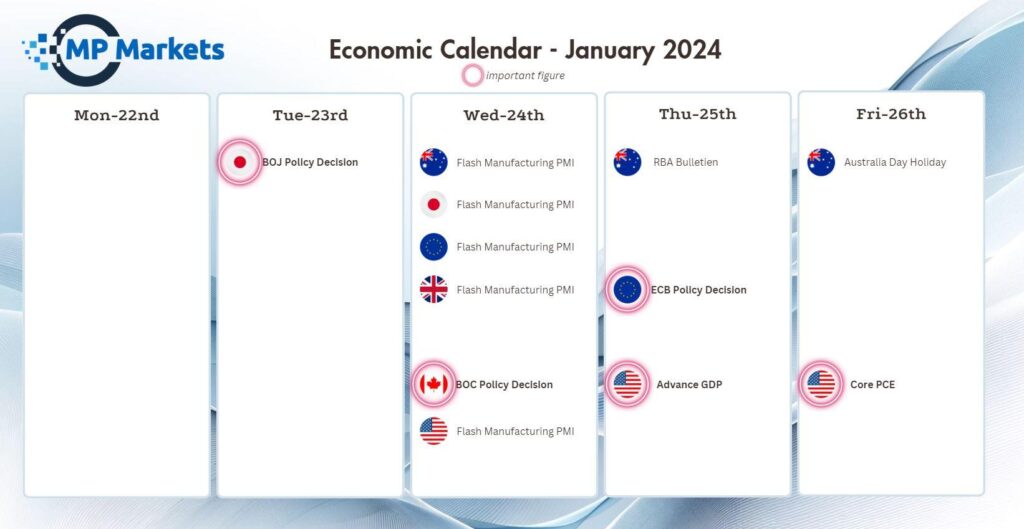

Investors are gearing up for the European Central Bank policy meeting on Thursday. No change in interest rates is expected but investors will watch the tone of the ECB statement and ECB President Christine Lagarde’s press conference for clues on where rates are headed

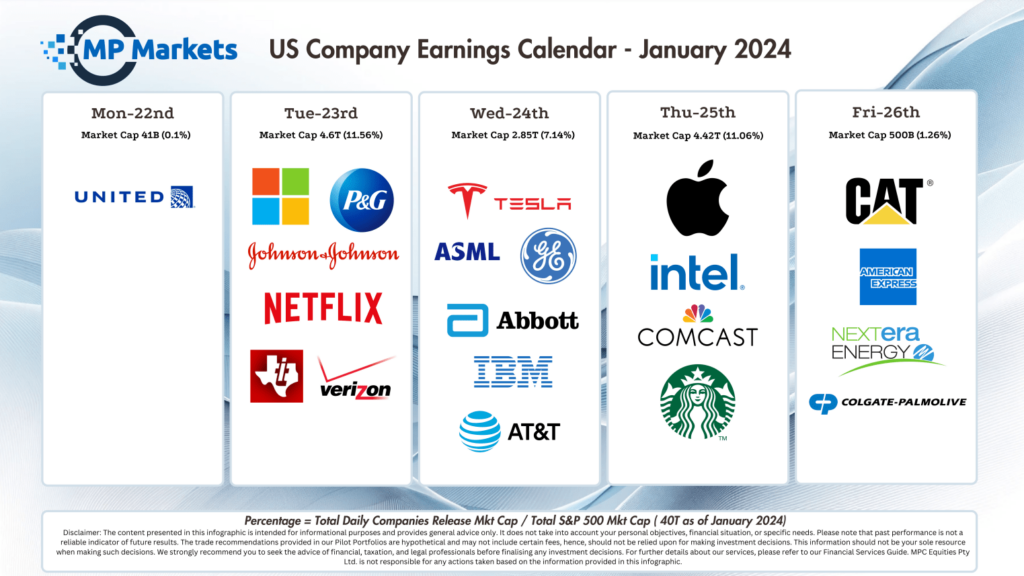

US Earnings

- Netflix (+7% after market) reported Tuesday fourth-quarter earnings that missed estimates, but revenue topped Wall Street estimates as a strong slate of shows helped the streaming giant rack up much more subscribers than expected in the quarter.

- 3M Company fell about 11%, leading the decliner in industrials after the diversified manufacturing conglomerate’s weaker than expected full-year guidance overshadowed Q3 results that topped Wall Street analysts.

- Lockheed Martin meanwhile, slipped 4% after the defense company reported a decline in sales in Q4, pressured by weakness in its rotary and mission systems business as well as its missiles and fire control division.

- United Airlines , however, proved to be a bright spot, rising more than 5% following better-than-expected Q4 results that were bolstered by a strong-holiday-related demand for travel. The stronger quarterly results helped offset guidance that called for a wider-than-expected loss in Q1, owing to the impact of the grounding of Boeing’s 737 Max 9.

- General Electricfell 1% after the industrial conglomerate disappointed with its first-quarter outlook even as its fourth-quarter earnings came in ahead of expectations on strong demand for parts and services at its jet engine business.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7501 (+0.17%)

The ASX shares should be led higher by the US, although production updates from some large ASX200 constituents may help or hinder that rise. Manufacturing PMI’s globally could give the materials sector a boost.

- Nanosonics missed sales guidance for the six months to December 31, with total revenue down 2.4 per cent to $79.6 million, versus analysts’ growth forecasts of 17 per cent.

- Northern Star Resources, Perseus Mining, Pilbara Minerals, St Barbara and Woodside Energy release quarterly production updates.

Economic Calendar

Earnings Calendar