S&P 500 - Heatmap

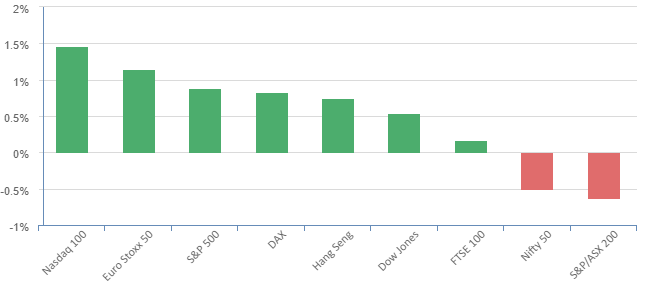

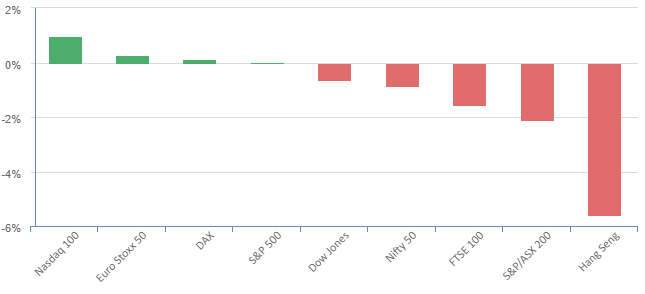

Overnight – Chipmakers pull market to record highs

Equities posted a record high close on Friday for the first time in two years, fueled by a rally in chipmakers and other heavyweight technology stocks on optimism around artificial intelligence.

The benchmark’s close confirmed that the S&P 500 has been in a bull market since it closed at its low on Oct. 12, 2022, according to one measure which also puts that date as the end of a bear market.

Nvidia climbed 4.2% and Advanced Micro Devices rallied over 7% after server maker Super Micro Computer lifted its second-quarter profit forecast, sending its shares soaring 36%. Investors exchanged $31 billion worth of Nvidia’s stock and $23 billion worth of AMD shares, higher turnover than any other company on Wall Street, according to LSEG data.

Chipmaker stocks have gained since Taiwan Semiconductor Manufacturing Company, the world’s largest contract chipmaker, on Wednesday said it saw booming demand for high-end chips used in AI.

Stock investors were also cheered on Friday by the University of Michigan’s preliminary survey showing consumer sentiment improved in January to its highest level since the summer of 2021.

The resiliency of the U.S. economy in general, and most businesses in particular, has been notable. Interest rate traders now see a 52% chance of a March rate cut, down from 70% 2 weeks ago and likely to disappear completely with the economic strength

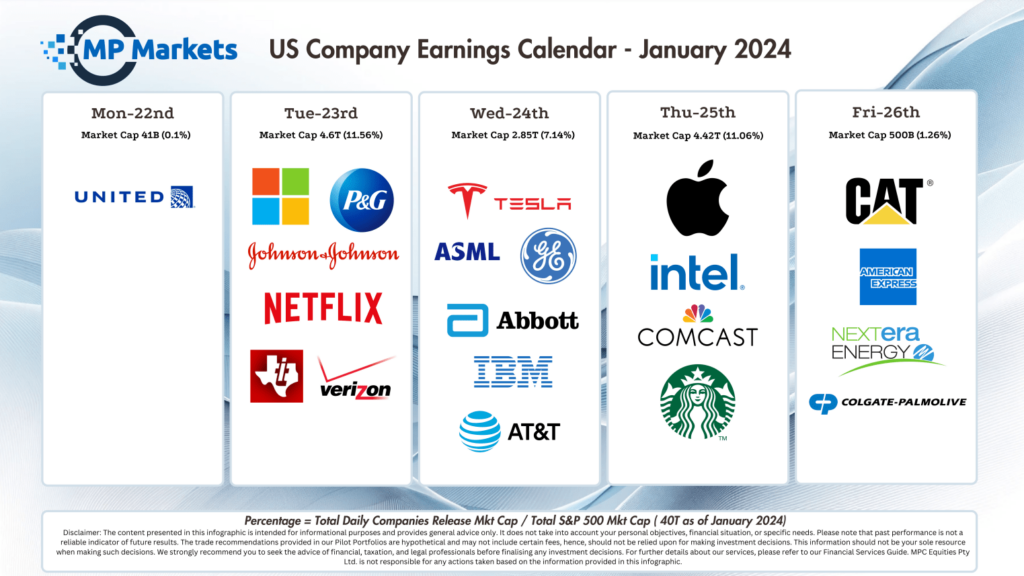

US Earnings

- Travelers Cos jumped 6.7% after the insurer’s fourth-quarter profit more than doubled, while State Street advanced 2.1% after the lender reported record net inflows in its Global Advisors unit in the fourth quarter.

- Spirit Airlines rebounded 17% from losses earlier this week as it assessed options to refinance its 2025 debt maturities amid concerns over the airline’s ability to remain afloat.

Bonds

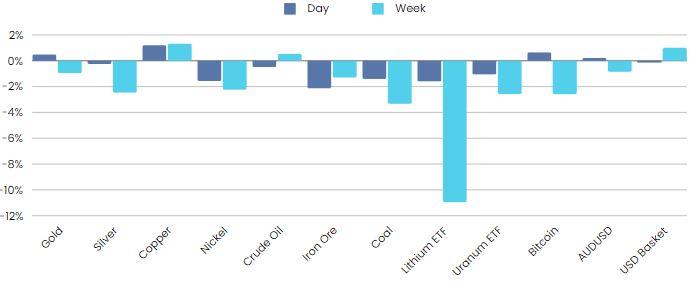

Commodities & FX

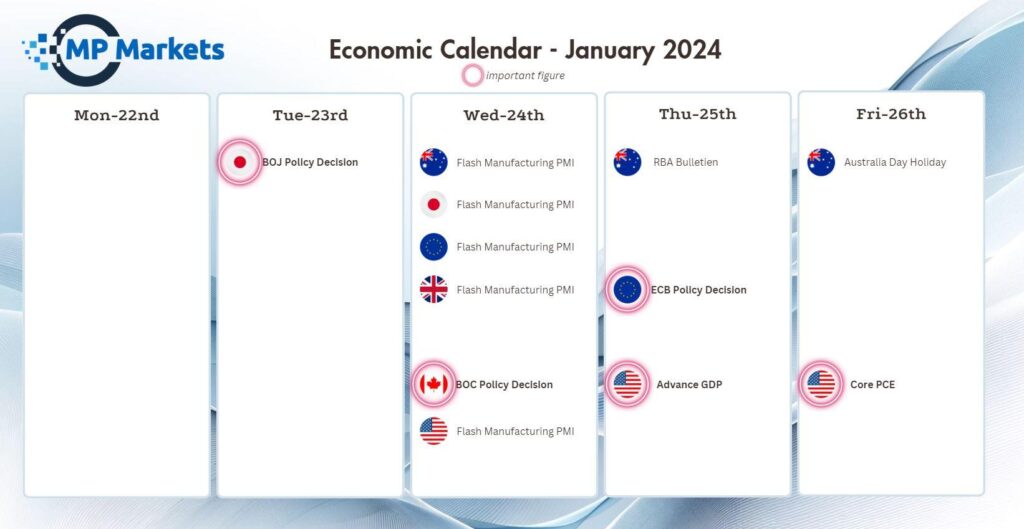

The Day Ahead

ASX SPI 7418 (+0.35%)

The ASX is likely to follow the US lead early and then fizzle out as most of the gains were in sectors the ASX200 has little allocation to. The bounce in iron ore will likely help pull up the index, while healthcare will be a drag. A big week of economic number and central bank meetings ahead so investors are likely to be cautious committing to any upside move

Economic Calendar

Earnings Calendar