Overnight – Initial claims for unemployment benefits reached their lowest level since 2022

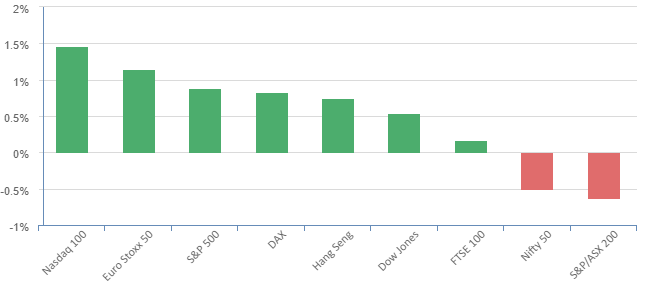

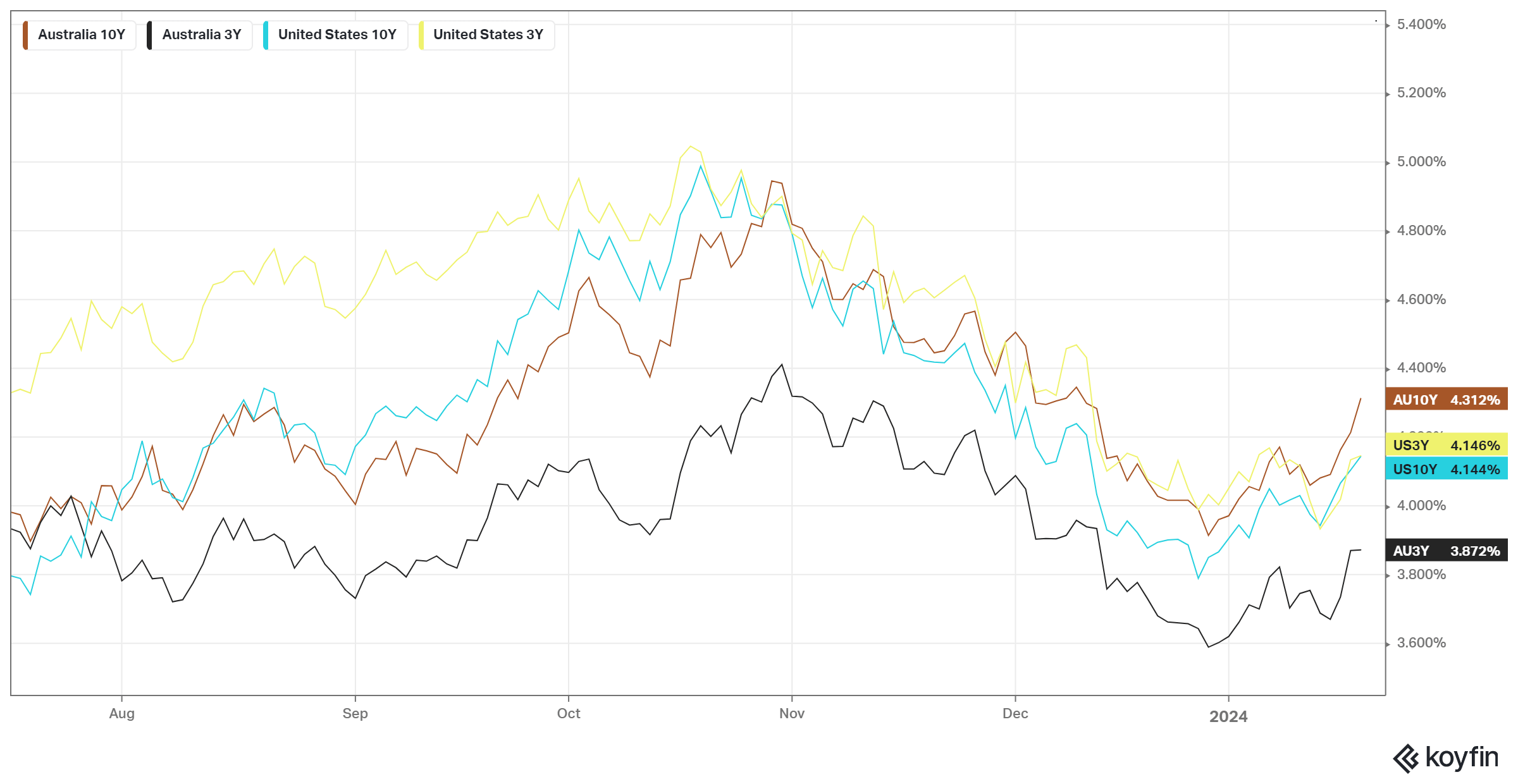

Global financial markets experienced mixed movements overnight. US unemployment claims hit a low not seen since 2022, reducing expectations for a Federal Reserve rate cut in March, now down to a 56% likelihood. The European Central Bank’s minutes suggested it’s too soon for policy easing, though the Atlanta Fed President is open to earlier rate cuts if inflation drops quickly.

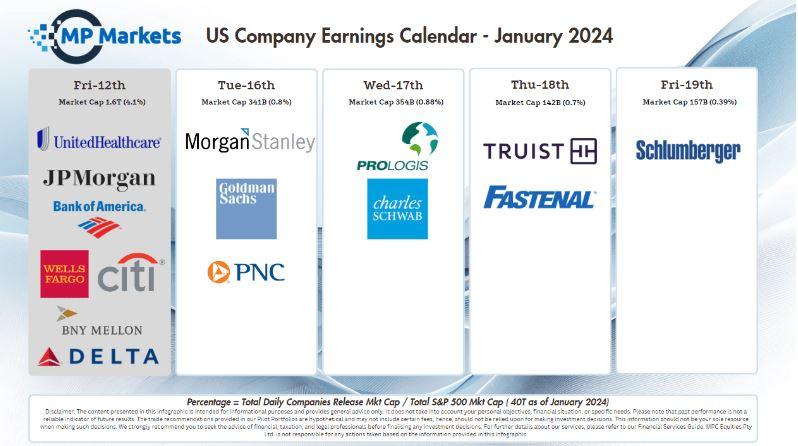

Tech stocks in the US, especially Apple and semiconductor companies, surged. Apple’s stock rose over 4% after an optimistic assessment by Bank of America, buoyed by prospects of iPhone upgrades and service sector growth, leading to a higher stock price target. Alphabet Inc. also gained over 1% amidst potential job cut reports.

Semiconductor stocks, like AMD, NVIDIA, and Taiwan Semiconductor, rallied, with Taiwan Semiconductor increasing by over 9% following strong quarterly results.

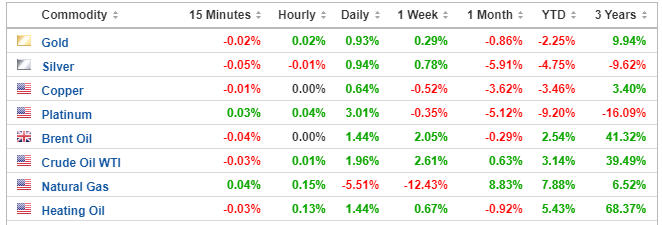

Commodity markets saw a rebound in iron ore prices amid hopes of Chinese economic support, while oil prices increased due to Middle East tensions. However, concerns over Chinese construction sectors and steelmaker margins make the Commonwealth Bank cautious about iron ore.

The Australian dollar dipped to US65.65¢, with a further fall to US63¢ expected before a potential recovery driven by global interest rate cuts. In cryptocurrencies, Bitcoin’s value continued to drop after the US approved several bitcoin ETFs.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7375.5 (+0.31%)

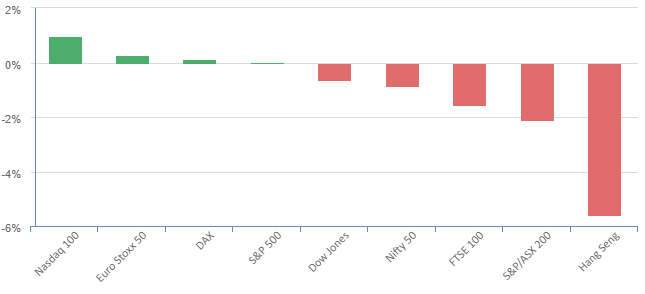

Australian shares are set for an uplift at the open, aligning with a Wall Street tech rally sparked by positive US labor data. This optimism is somewhat tempered by uncertainties around interest rate cuts. ASX futures indicate a 0.9% increase to 7380, following a close at a one-month low on Thursday, with the S&P/ASX 200 index down 2% for the week.

- Synlait Milk boosts 2023/2024 milk price forecast to $NZ7.50/kgMS, up from $NZ7.25, due to rising dairy prices.

- Whitehaven Coal presents its latest quarterly production update.

- Rio Tinto‘s CEO, Jakob Stausholm, meets with the Serbian president to discuss the revival of the $3.7 billion Jadar lithium project, following its license withdrawal two years ago in Belgrade.