Overnight – Fed gives market reality check on early rate cut calls

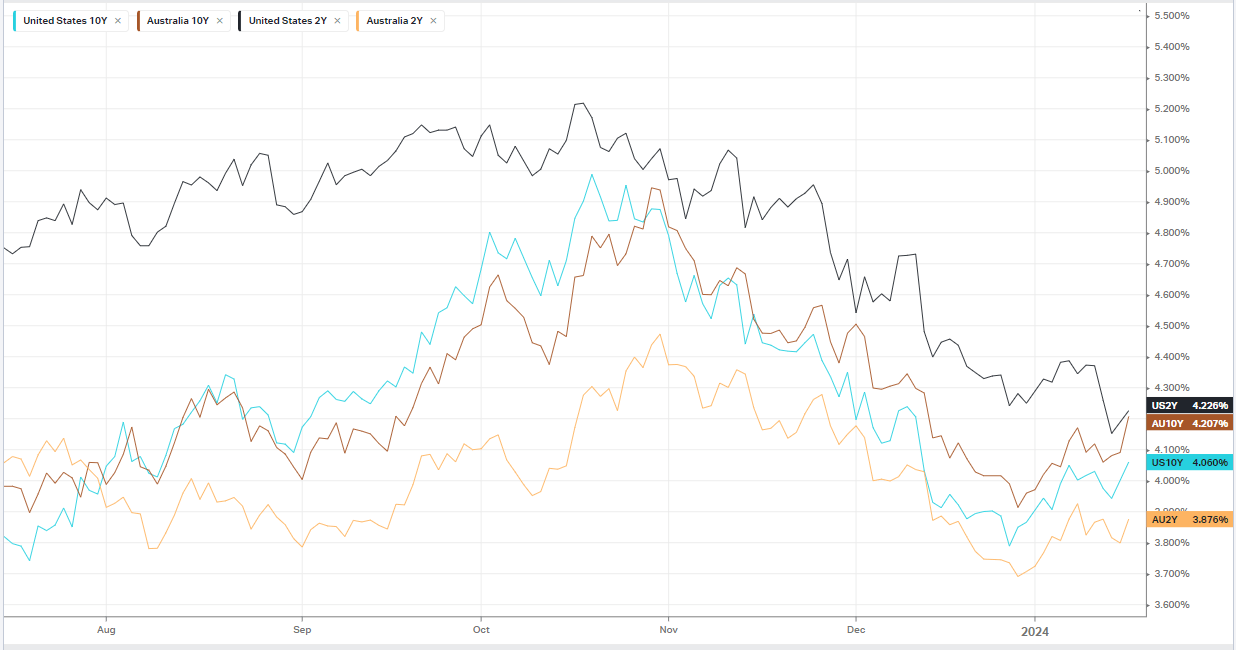

Federal Reserve Governor Christopher Waller said he expects the Fed to cut rates this year, but stressed that there was no need to the central bank to cut rates quickly as the economy remains in good shape. The remarks cooled some optimism for a cuts to begin in March, sending Treasury yields sharply higher.

“In many previous cycles, the FOMC cut rates reactively and did so quickly and often by large amounts,” Waller said Tuesday. “However, with economic activity and labor markets in good shape and inflation coming down gradually to 2 percent, I see no reason to move as quickly or cut as rapidly as in the past,” he added.

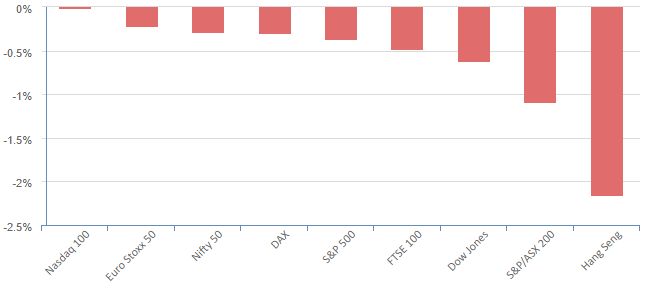

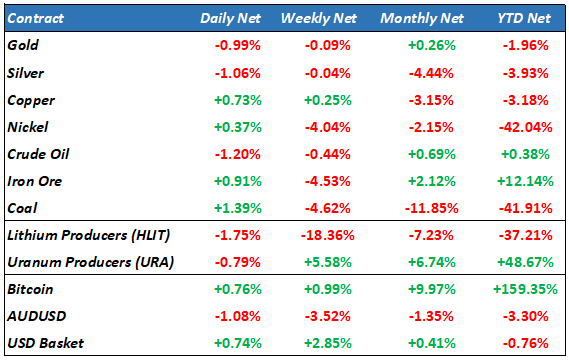

The USD had its best day in 4 weeks on the hawkish commentary, dragging down commodities like gold, silver and oil, while Treasuries across the curve jumped around 8-10bps

Uranium took a breather, settling unchanged for the first day in a month. The URA ETF in the US made a fresh record high

Energy stocks were among the biggest decliners on the Wall Street as oil prices swung between gains and losses amid ongoing tensions in the Middle East including fresh attacks by Houthi rebels on cargo vessels in the Red Sea. Oil prices were also dragged lower by stronger dollar after Fed Governor Waller played down sooner rather later rate cuts.

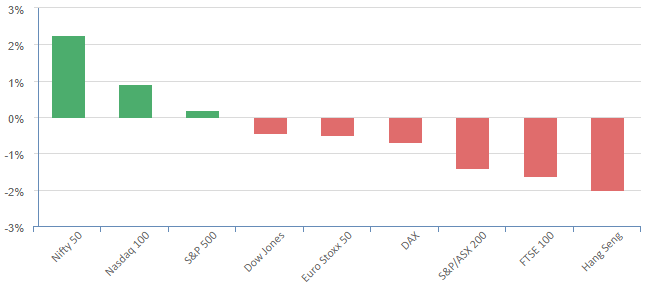

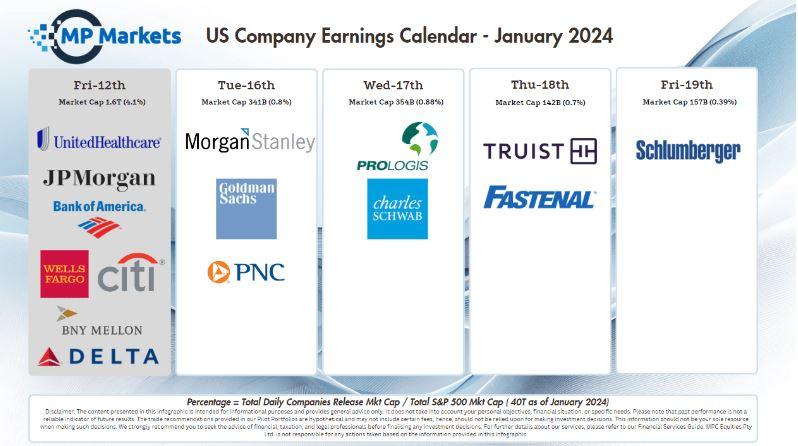

US Earnings

- Goldman Sachs rose nearly 1% after reporting better-than-expected fourth-quarter results as strength in equity sales and trading helped offset weakness at the Wall Street giant’s core investment banking unit.

- Morgan Stanley reported mixed fourth-quarter results as earnings fell short of analyst expectations after profit was hurt by $535 million in charges.

- PNC Financial meanwhile, was flat after delivering a beat on the top and bottom lines, though the super regional bank also provided a soft outlook for 2024, forecasting revenue to be flat to down 2% from $21.5B in 2023.

- JPMorgan Chase edged 0.73% lower after reporting its best ever annual profit and forecasting higher-than-expected interest income for 2024.

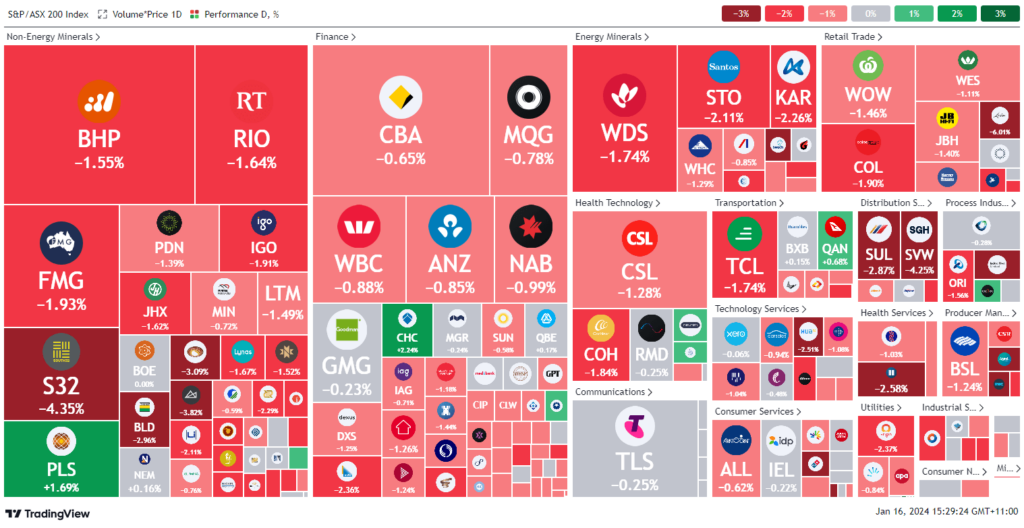

S&P 500 - Heatmap

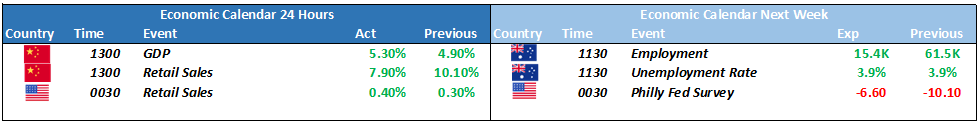

The Day Ahead

ASX SPI 7385 (+0.01%)

The ASX should have a relatively positive day despite the overnight weakness in the US. The materials sector should see a bid tone due to Chinese officials said to be weighing up a 1 Trillion Yuan ($189B USD) in special bonds to sure up the economy.

- building activity and payroll jobs data are released.

- Evolution Mining is set to issue a production update.