Overnight – Uranium run continues as US shut for Martin Luther King Day

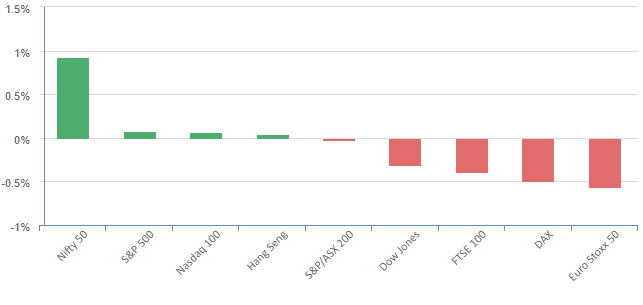

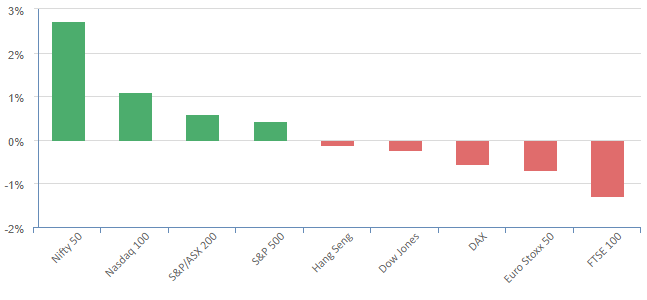

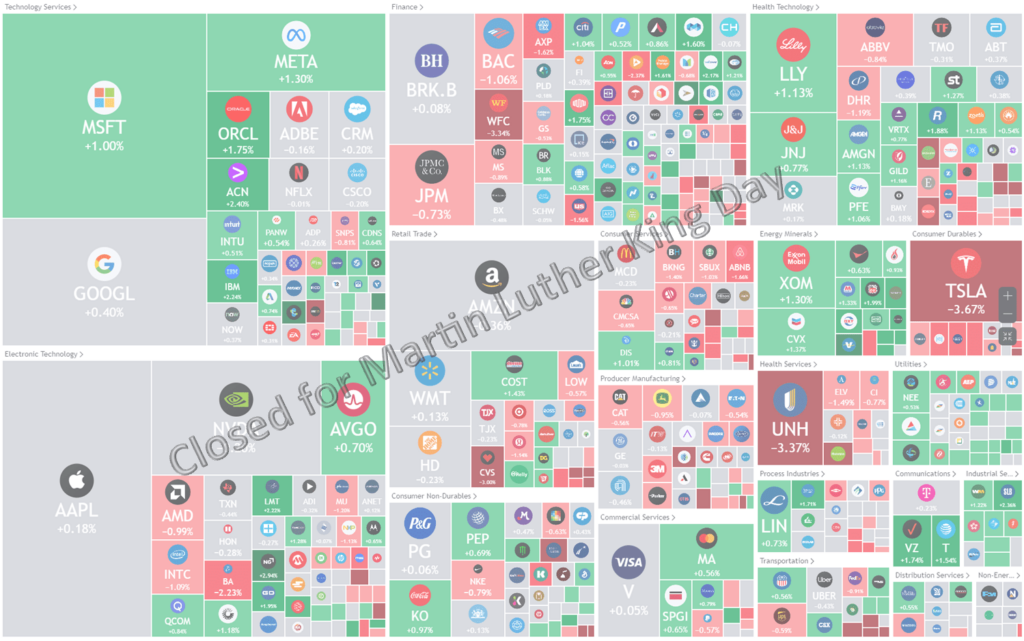

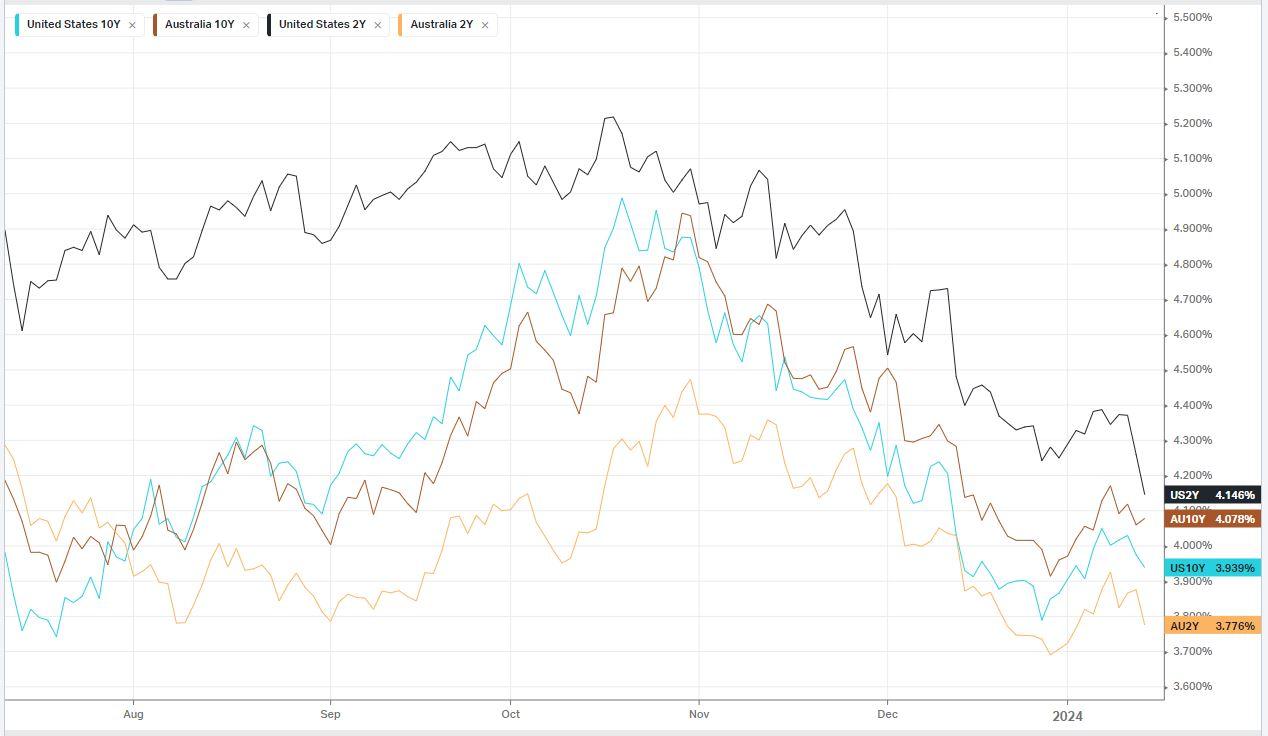

Equities in the US were closed overnight for Martin Luther King Day. Equity index futures were open, with the DOW -0.06% S&P500 -0.09% and Nasdaq –0.02%

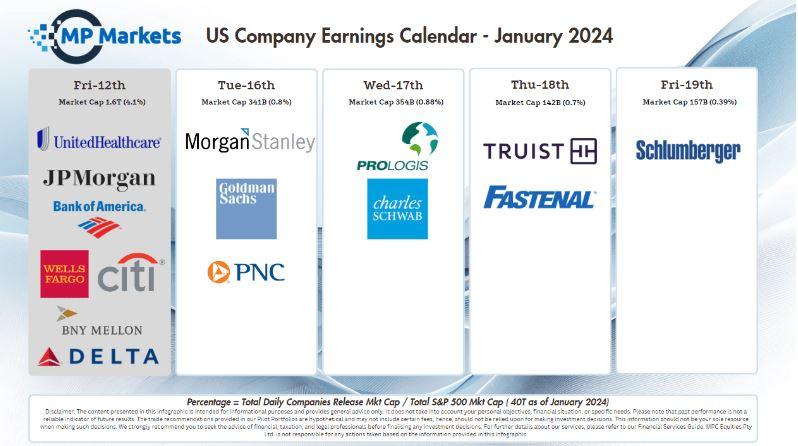

This week will be dominated by bank earnings for the US market with Morgan Stanley, Goldman Sachs and broker Charles Schwab releasing earnings in the first half of the week.

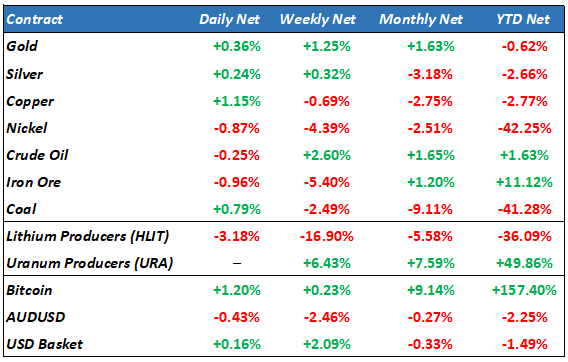

Uranium continued its strong run, settling at another fresh 16 year high of $106lb. The US was shut but Canadian uranium stocks were up around 5% with Cameco, Sprott Uranium trust and Nexgen which is listed here all making new 52-week highs. Kazakhstan’s national uranium producer, Kazatompom (2nd biggest in the world) has a Sulfuric Acid shortage (key to refining) forcing them to buy on the spot market to fulfill existing orders

Comments out of the World Economic Forum (WEF) in Davos have been mixed however the consensus is for a “subdued growth, according to a survey conducted ahead of the World Economic Forum’s closely-monitored annual meeting. Growth prospects in 2024 are “subdued,” the survey of the world’s top economists found, with 56% of respondents expecting conditions to weaken in the coming year. However, nearly a quarter foresee a stronger economy, while 20% predict that the environment will stay unchanged.

Oil prices will be watched as Yemen’s Houthi movement will expand its targets in the Red Sea region to include U.S. ships, an official from the Iran-allied group said on Monday, as it vowed to keep up attacks after U.S. and British strikes on its sites in Yemen.

S&P 500 - Heatmap

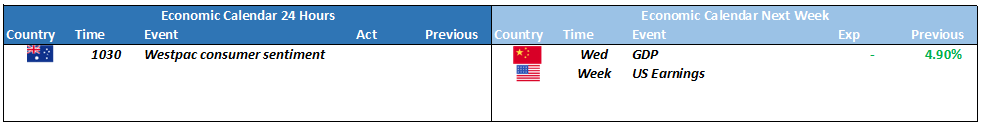

The Day Ahead

ASX SPI 7444(-0.29%)

Australian shares are in for a soft day, tracking weakness in Europe after data confirmed German’s economic malaise. Consumer sentiment data tops Tuesday’s data prints. Uranium stocks will have another strong day, while gold stocks may find a small bid. Iron ore was weaker for the 8th consecutive session which will weigh on the big miners. Rio Tinto is scheduled to release its latest quarterly production update at 8.30am.