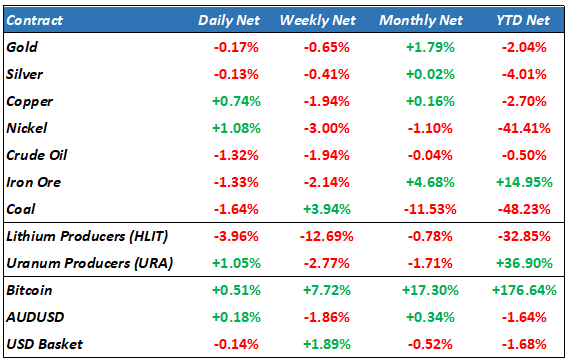

Overnight – Megacaps rally as market waits on Inflation data

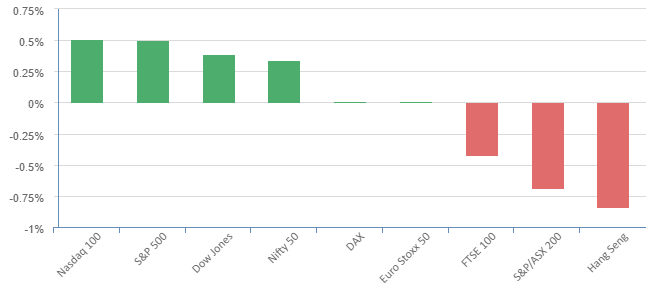

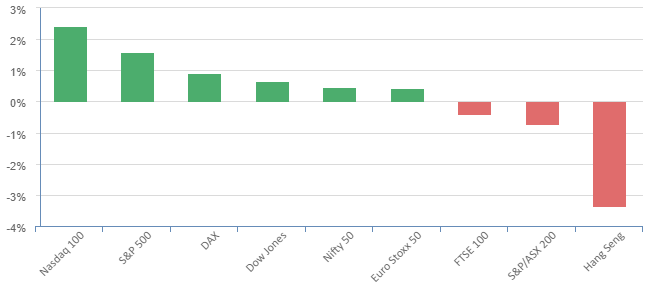

Equities were firm overnight, built on the strength in megacaps, but gains were limited ahead of inflation reports and major bank earnings later in the week.

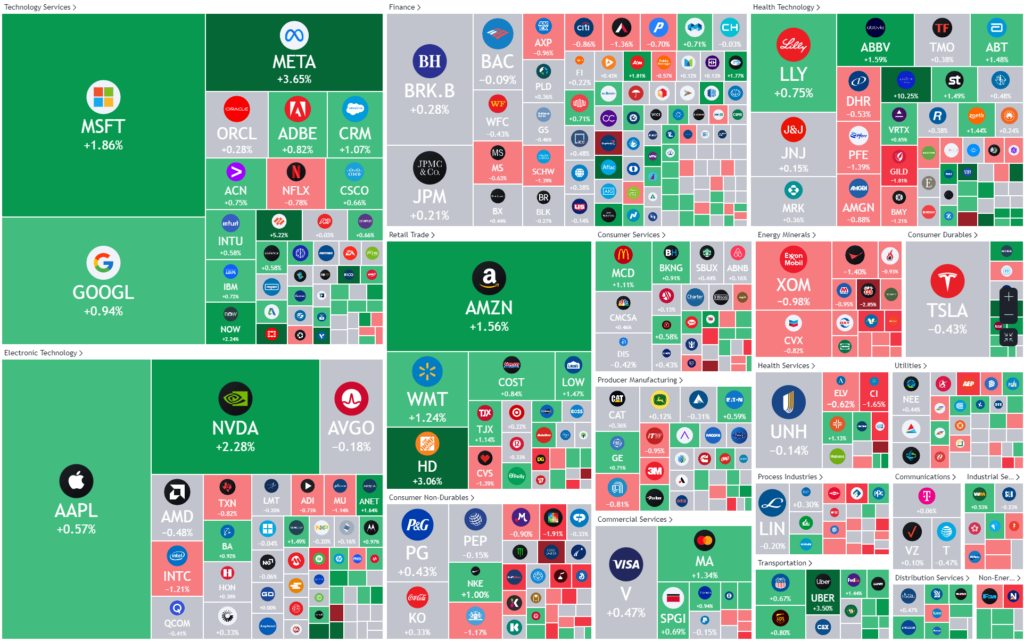

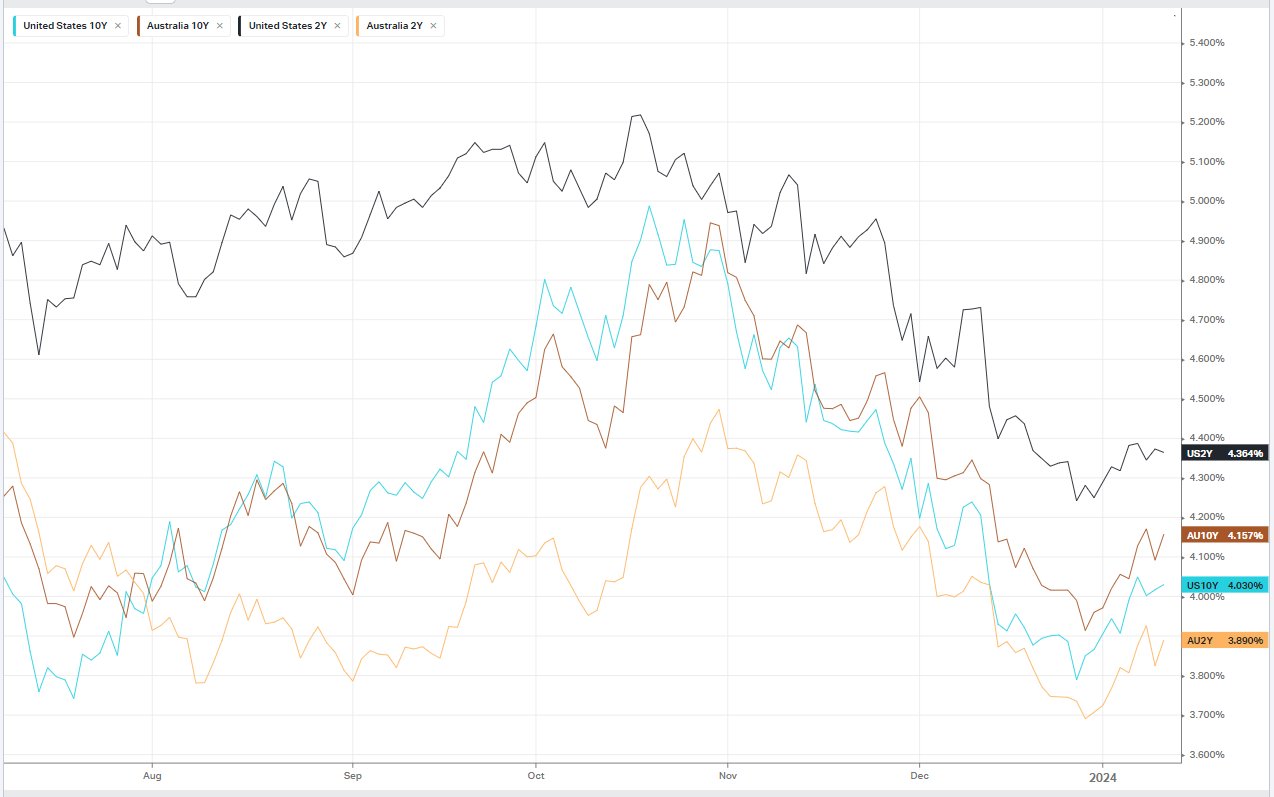

Microsoft, Meta Platforms and Nvidia were the biggest boosts to the S&P500, as the benchmark 10-year Treasury note yield held near 4%and a $37 billion auction of the notes drew above-average demand.

Communication stocks were the best performers of the 11 major S&P sectors, lifted by a roughly 4% rise in Meta Platforms’ stock to the highest level since September 2021, after Mizuho raised its price target to $470 from $400. Nvidia hit a record high after fellow chipmaker TSMC beat fourth-quarter revenue expectations.

After ending 2023 with a strong rally, stocks have struggled to find upward momentum, with the S&P 500 barely positive on the year, as mixed economic data and comments from Federal Reserve officials have led investors to dial back expectations for the timing and size of any rate cuts from the central bank this year.

Uranium continued its strong run, settling at another fresh 16 year high of 94.50

The SEC also approved Bitcoin ETF’s, another step in the direction of legitimizing Crypto currency as an asset class.

S&P 500 - Heatmap

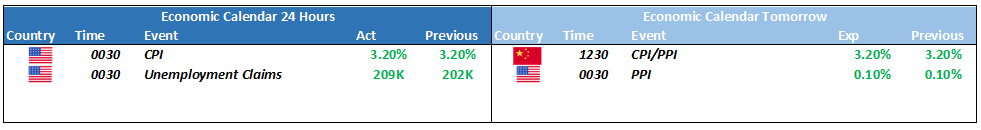

The Day Ahead

ASX SPI 7458 (+0.17%)

The ASX is likely to underperform our US peers due to a 4% fall in Iron ore prices on the Singapore market will drag down the big miners. The Banks may be in a holding pattern until US bank earnings on Friday. Outside that, markets will be focused on tonights US CPI data, a clue to the Fed’s future direction

Uranium stocks should again be strong after leading the market yesterday.