Overnight – Equities soften into Inflation and earnings data

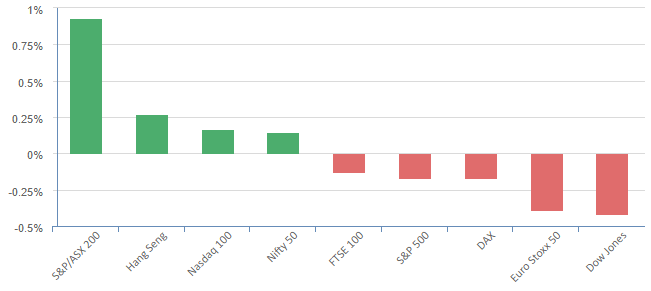

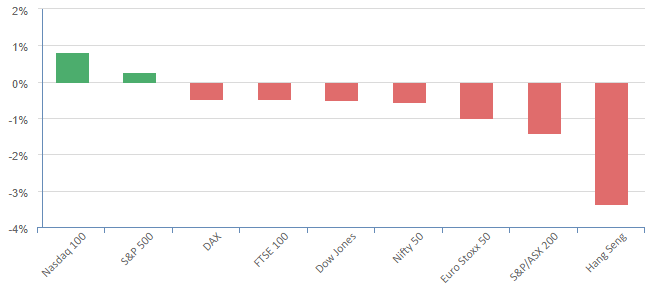

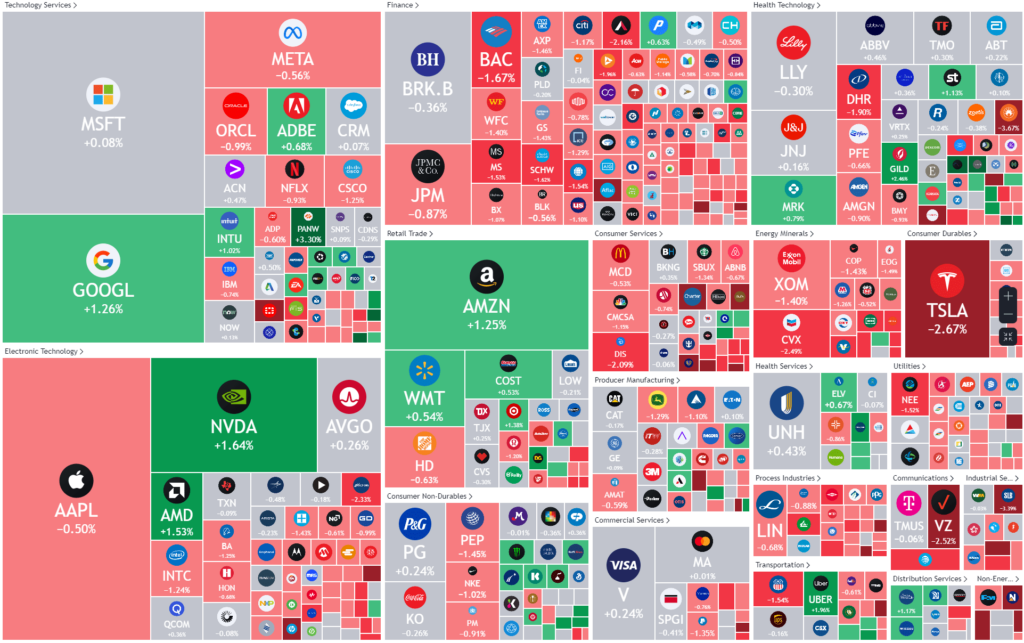

Equities closed lower on Tuesday, pressured a rise in Treasury yields as investors assess the timing and size of any Federal Reserve interest rate cuts in 2024 ahead of inflation data this week.

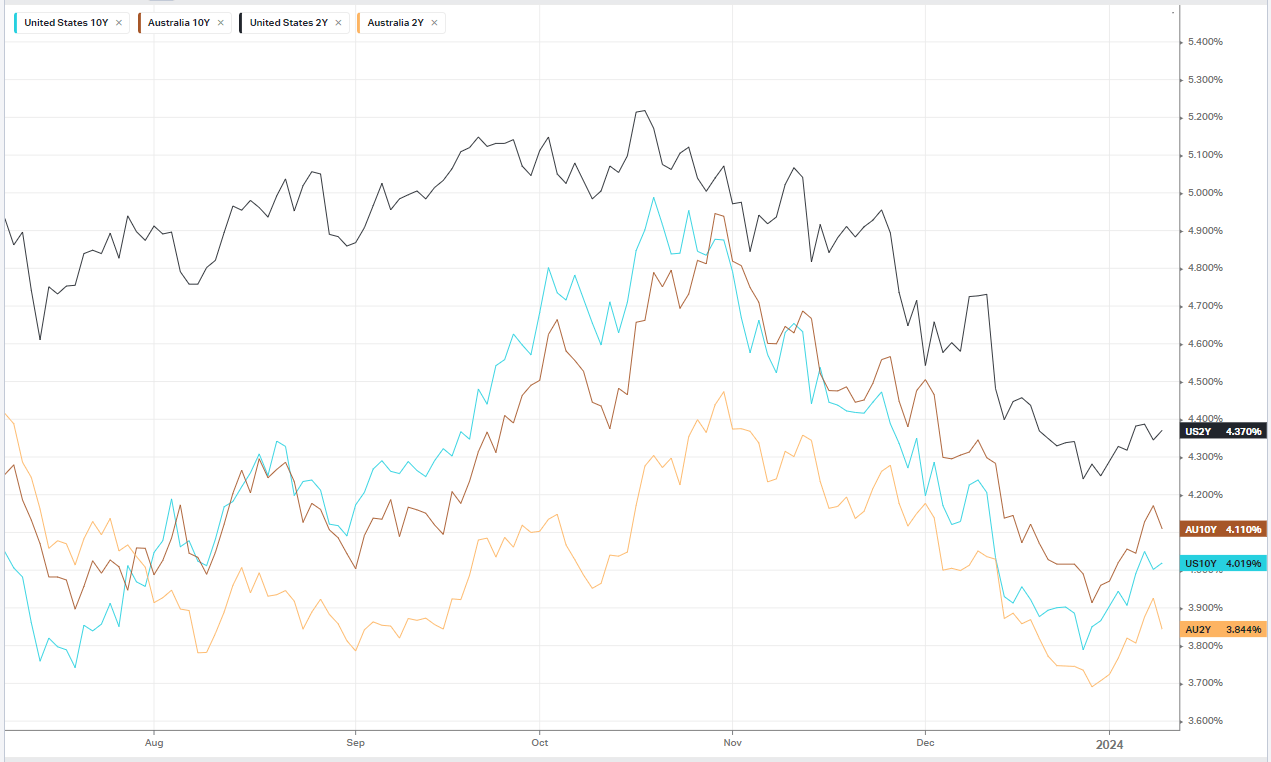

Expectations the central bank could begin cutting rates as soon as March have been slowly decreasing, with CME’s FedWatch Tool showing a 65.7% chance for a cut of at least 25 basis points (bps) for the month, down from 79% a week ago. That has helped keep U.S. Treasury yields hovering near the 4% mark, with the benchmark 10-year yield last up slightly at 4.01% after reaching a high of 4.053% earlier in the session.

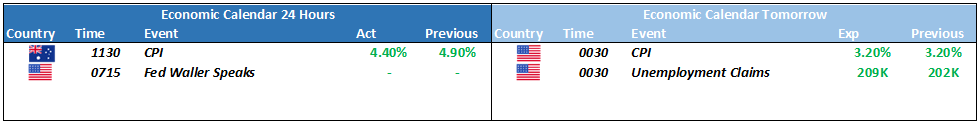

Investors are bracing this week for more Treasury supply and inflation data through the consumer price index (CPI) and producer price index (PPI). Earnings season unofficially begins on Friday, with reports from banks such as JPMorgan.

Atlanta Fed President Raphael Bostic on Monday stressed the need to keep monetary policy tight, while Fed Governor Michelle Bowman retreated from her persistently hawkish view and signaled a willingness to support eventual rate cuts as inflation eases.

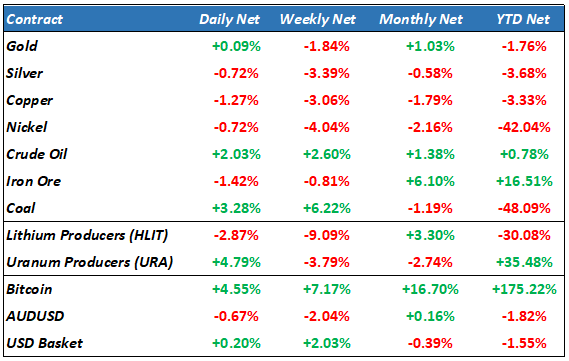

Energy prices bounced with oil recovering 2% while Uranium hit a fresh 16 year high.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7481 (-0.12%)

The focus for today will be the AU CPI numbers at 1130, key to future monetary policy. There was little movement in commodities and the US market outside of the Tech sector, which will provide little help for the ASX200.

Uranium and Coal stocks should be in for a positive day with the underlying commodities posting impressive overnight gains