Overnight – March rate cut calls fading with further strong Jobs data

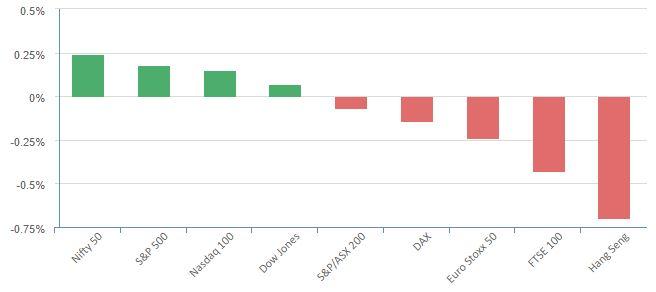

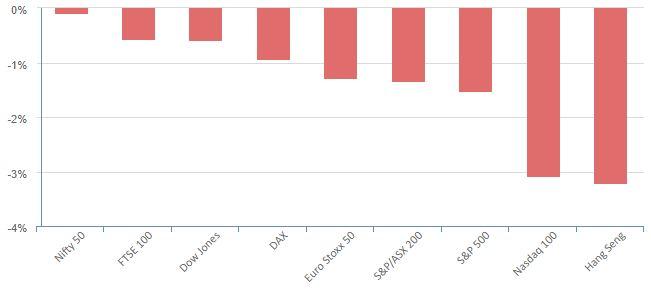

Equity markets finished slightly higher in choppy trade Friday after conflicting economic data.

Early in the session, US payrolls numbers showed employers hired some 46,000 more workers than expected last month, wages surged solidly, and the unemployment rate remained near historical lows at 3.7%. This led markets to initially dial back bets the Fed would start cutting interest rates in March.

The blistering rally for equity markets at the end of 2023 was based on expectations that the Fed, alongside significant easing by the European Central Bank, would cut rates six times this year, a premise that’s validity is very quickly evaporating.

But a weak report from the Institute for Supply Management (ISM) that showed service sector employment plunged to 43.3 in December to the lowest level since July 2020 lifted the rate cut outlook a bit, before settling little changed. The ISM non-manufacturing Purchasing Managers Index fell to 50.6 last month from 52.7 in November. A reading above 50 indicates expansion and one below that number shows contraction.

While leading indicators like the ISM Manufacturing are slowing, businesses are still hiring at an electric pace, which is putting further pressure on employers to increase wages, an inflationary pressure the Fed will want to stamp out.

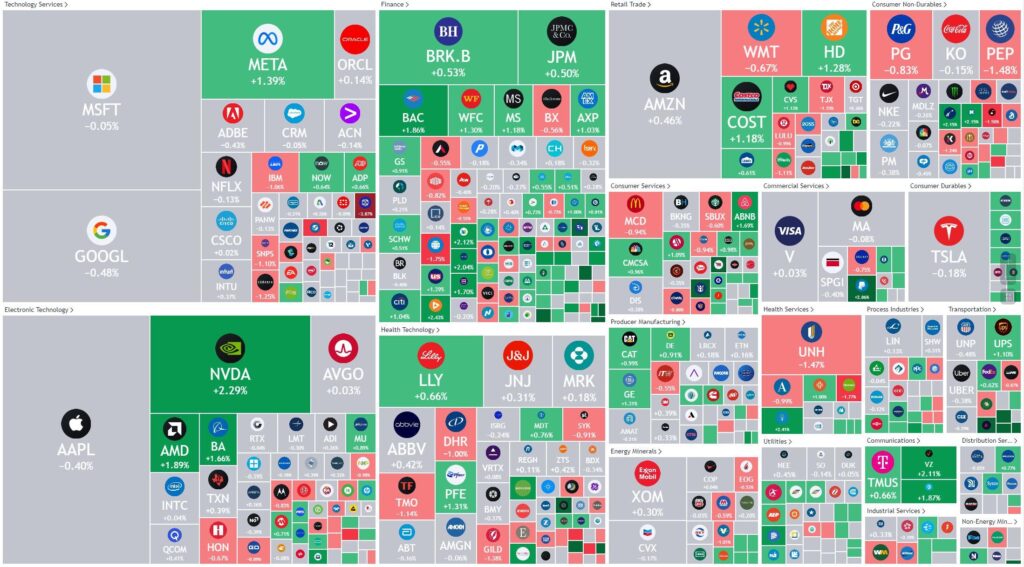

S&P 500 - Heatmap

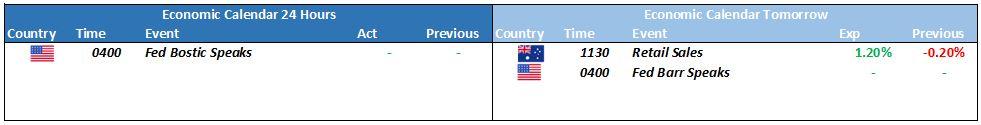

The Day Ahead

ASX SPI 7462 (-0.01%)

We should start to see trading volumes increase as more people come back to work this week. The uneventful payrolls numbers gave few clues to forward interest rate movements, the topic markets and investors seems to be obsessing about currently. Likely to be a quiet one