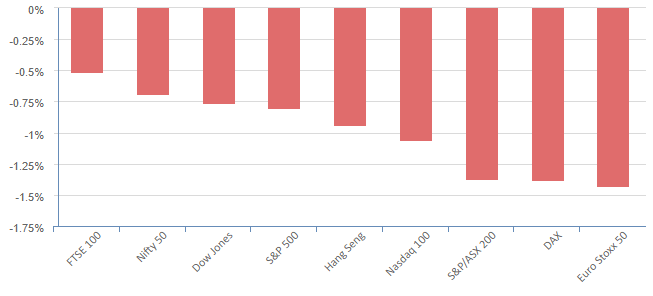

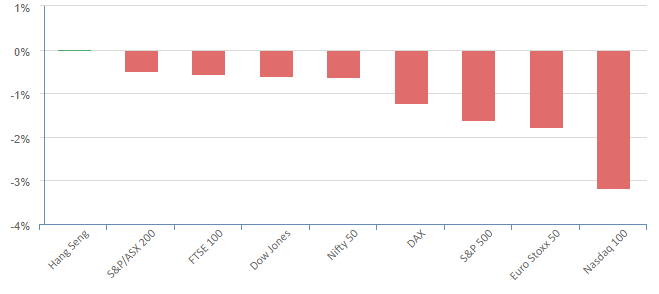

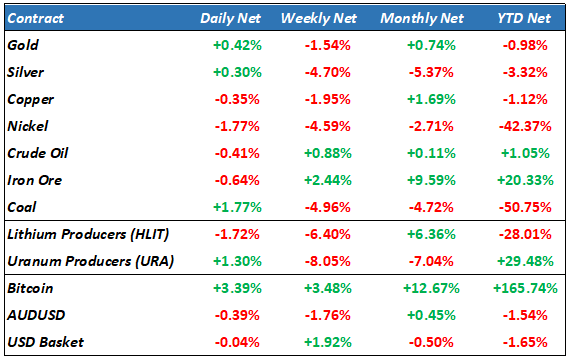

Overnight – Strong Jobs data contradictory of early rat cut calls

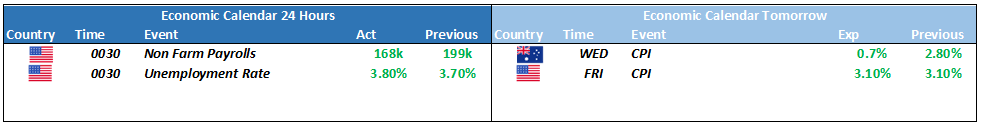

Equity markets tried to shake off New Year blues on Thursday after overnight employment data indicated a still resilient U.S. labor market, throwing cold water on the expectations of Federal Reserve interest rate cuts in 2024.

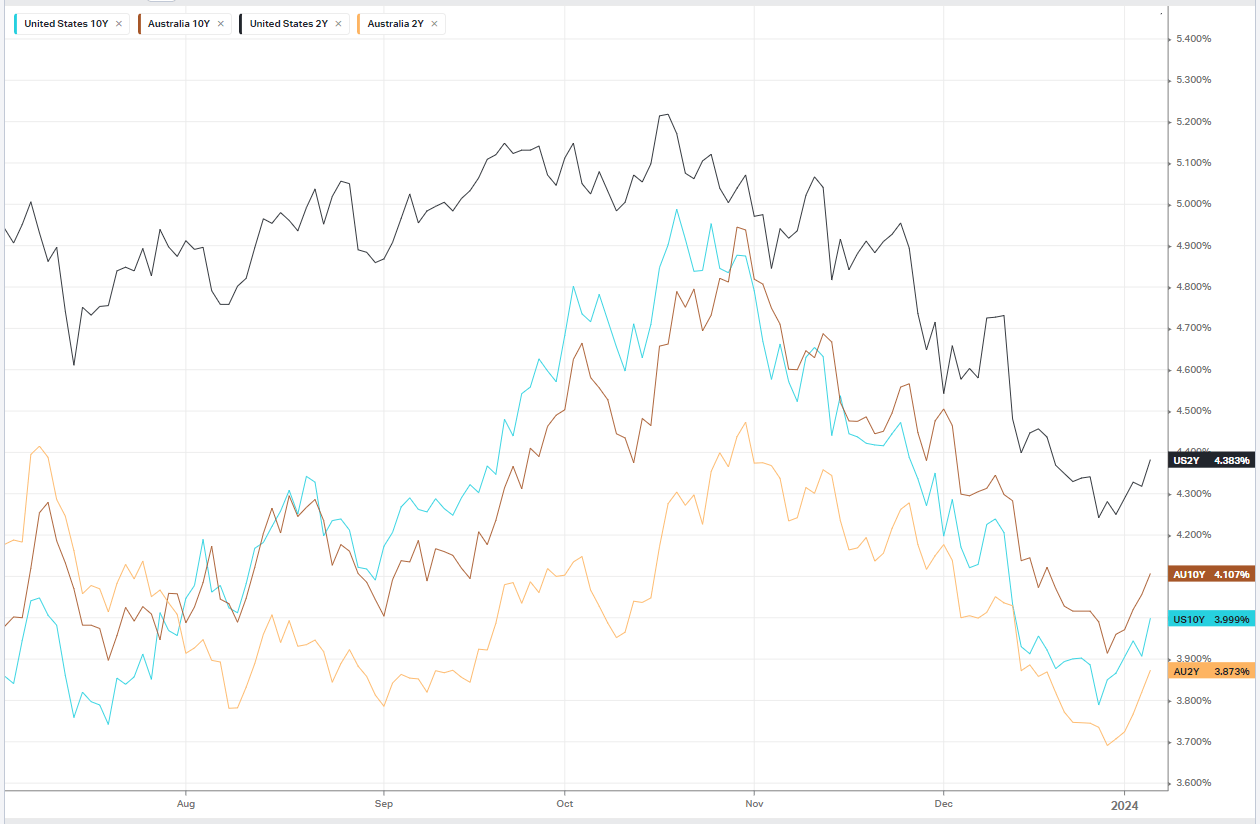

The yield on 10-year Treasuries jumped above 4% in a sharp reversal from last week, when the benchmark note slid to a five-month low of 3.783% when data showed inflation by some measures had declined close to the Fed’s 2% target.

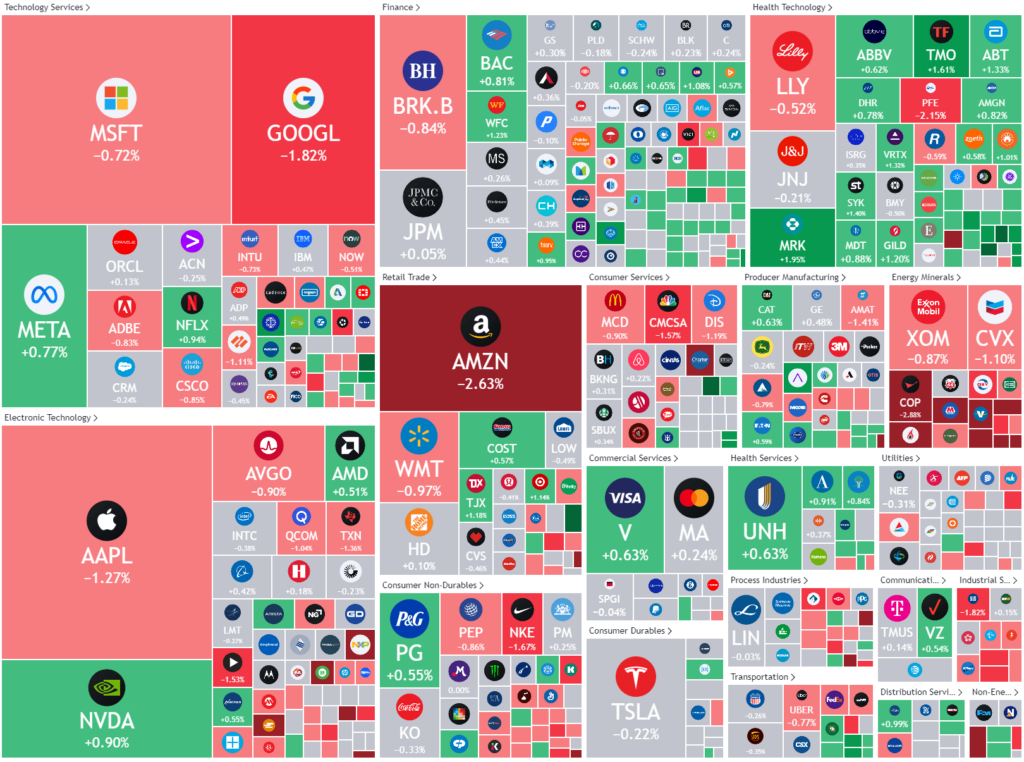

This rise in treasury yields led to a fall in growth/tech stocks and small caps, with non-cyclicals holding up the market

So far in 2024 investors have shifted their focus away from inflation, to speculating on the Fed’s ability to achieve a soft landing and what that landing might look like. This will make leading indicators, like tonights Payrolls (employment) data become more important.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7491 (+0.28%)

The ASX should recover into the weekend, as the market waits for the key US employment numbers tonight. Tech should continue to decline in line with rising yields. While a downgrade by Fitch to 4 Chinese funds could see some negativity around the Chinese economy which will affect the miners

- Core Lithium has paused mining from its Northern Territory mine, as the price of the battery metal continues to put pressure on the struggling company.

- Telix Pharmaceuticals is considering listing on the US-based Nasdaq exchange.

- Billions of dollars of hydrogen projects by Australian companies including Woodside and Fortescue may be in doubt after the US proposed rule changes that could exclude them from its Inflation Reduction Act cash.