Overnight – Santa rally profit taking continues as investors sober on rate outlook

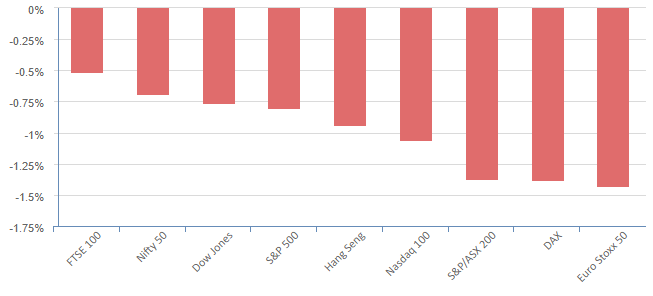

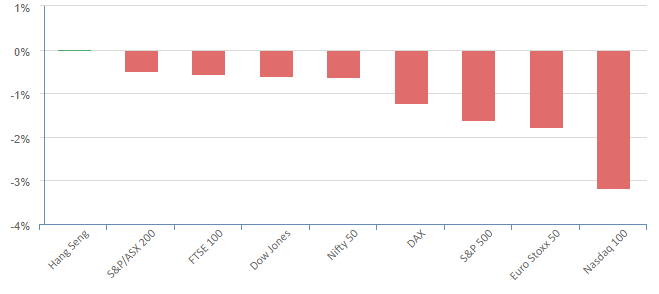

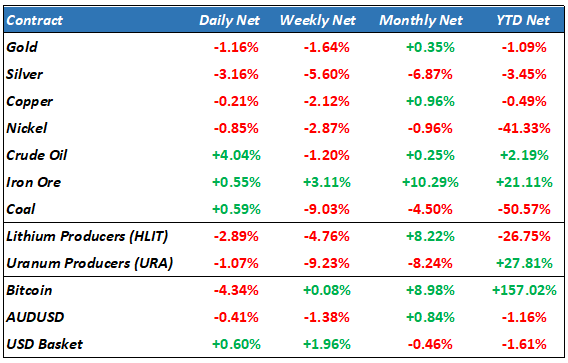

Profit-taking continued for a second day after a strong finish to 2023, where the S&P500 rallied 15% since Early November.

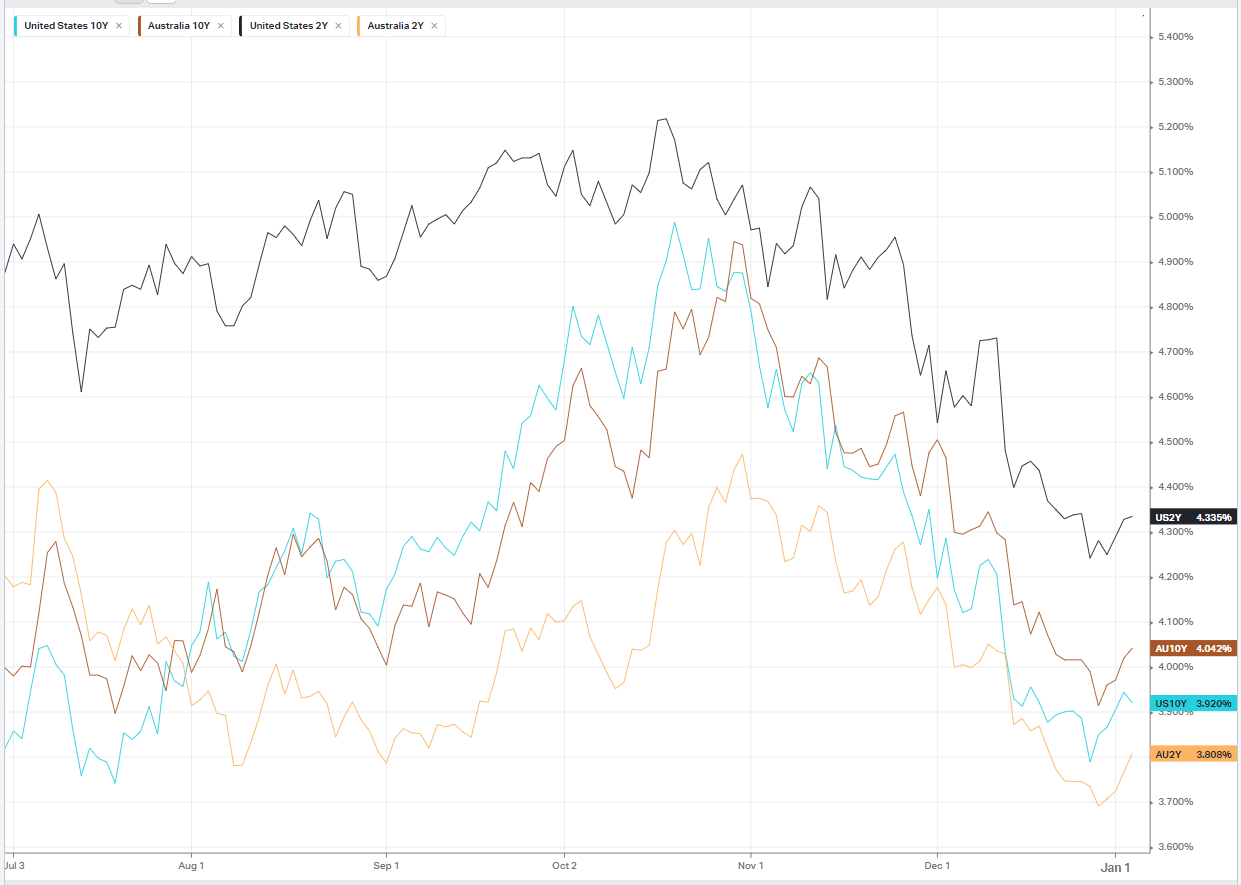

Minutes from the Federal Reserve’s December meeting failed to justify investors (ridiculous) expectations of rate cuts in the first quarter of 2024. Fed policymakers appeared increasingly convinced that inflation was coming under control, with “upside risks” diminished and growing concern about the damage that “overly restrictive” monetary policy might do to the economy, the minutes released on Wednesday showed. The minutes shed little light on when rate cuts might commence.

While the Fed is widely expected to keep rates on hold in January, traders have priced in a 67% chance of a 25 basis point rate cut in March, as per FedWatch. This expectation is wildly unrealistic as not enough economic data can be released to justify a pivot in policy by March.

Richmond Fed President Thomas Barkin said, prior to the release of the minutes, that the U.S. central bank is “making real progress” towards taming inflation without inflicting major damage on the job market, with a hoped-for soft landing “increasingly conceivable.”

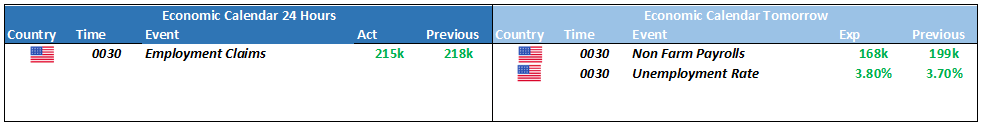

Data showed U.S. job openings fell for the third straight month in November as labor market conditions gradually ease. While the ISM Manufacturing survey showed activity contracted further in December, with a modest rebound in production and improvement in factory employment.

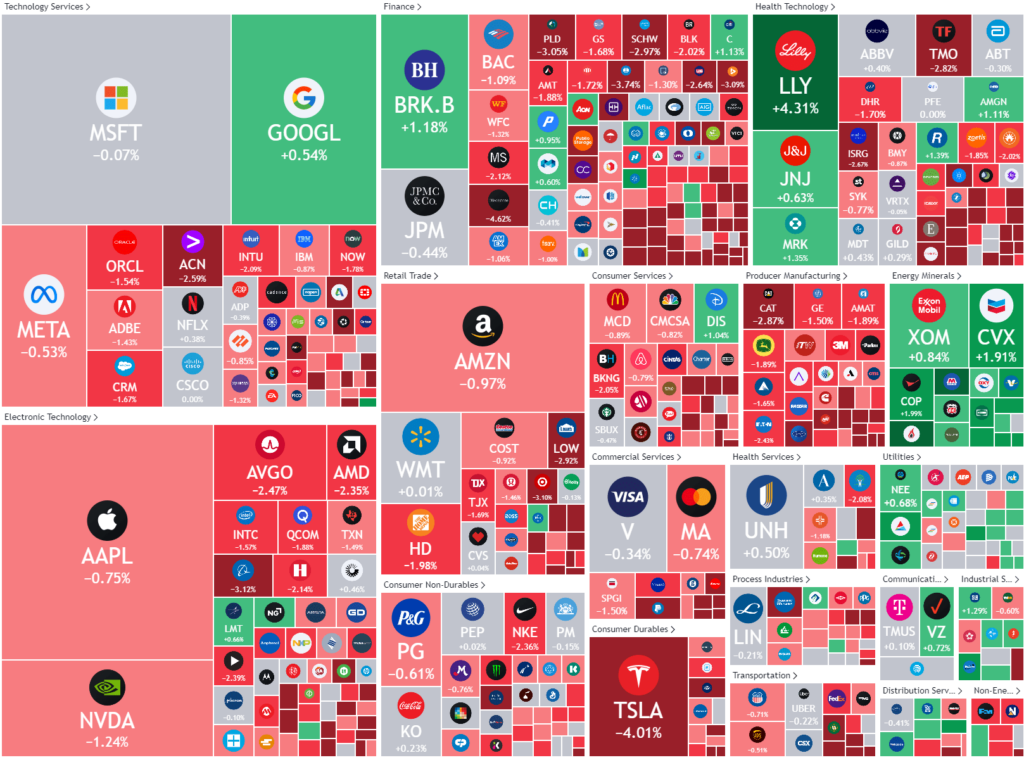

Shares of rate-sensitive megacap stocks extended the overnight drop, with Nvidia, Apple and Tesla down between 0.6% and 3.3%. Their fate was not helped by the US10Y initially climbing for a fourth straight session, although it had reverted to 3.91% by mid-afternoon.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7480 (-0.25%)

The domestic market is likely in for another low volume day, with the focus for global markets squarely on US employment data Friday night.

The bullishness in Financials, Iron ore and Healthcare stocks should see our index outperform the tech heavy US indices if the trend of the last 2 sessions continues