Overnight – Markets Stumble on Inflation Concerns and Tech Pullback

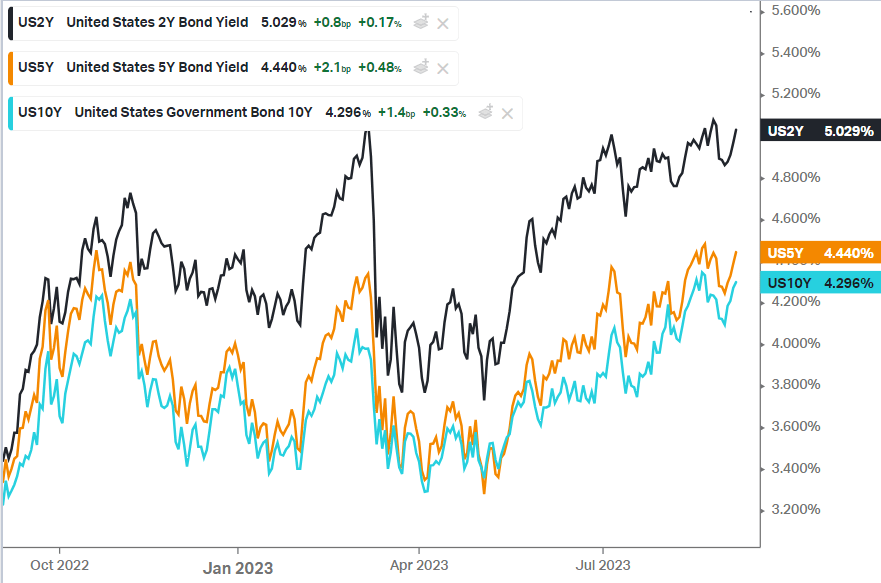

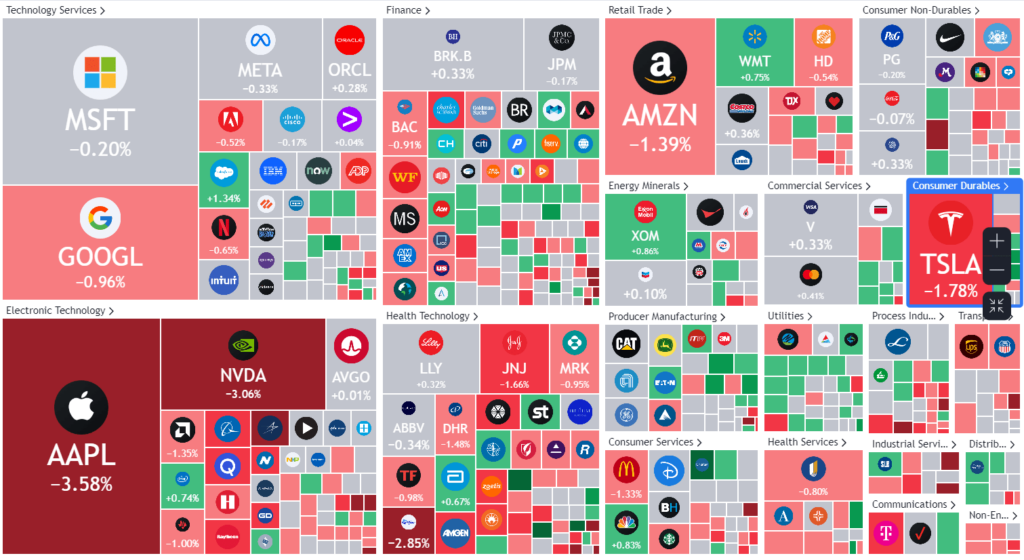

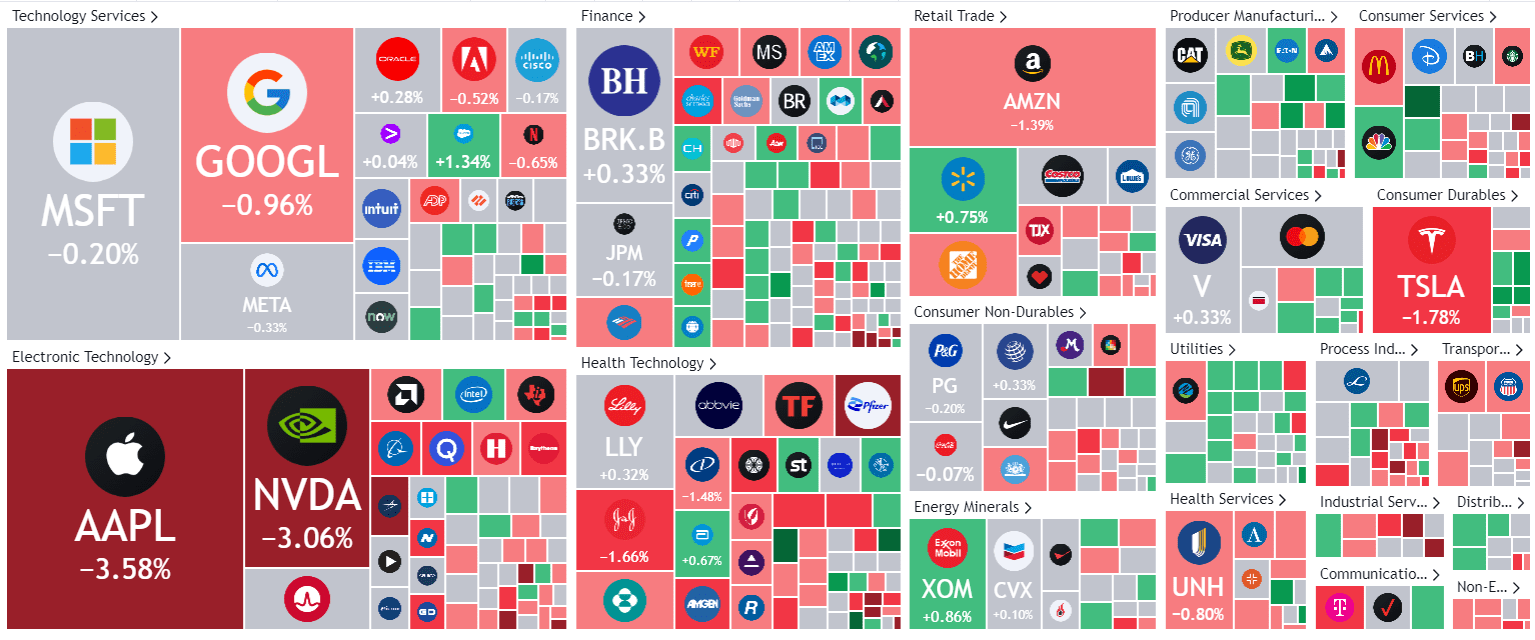

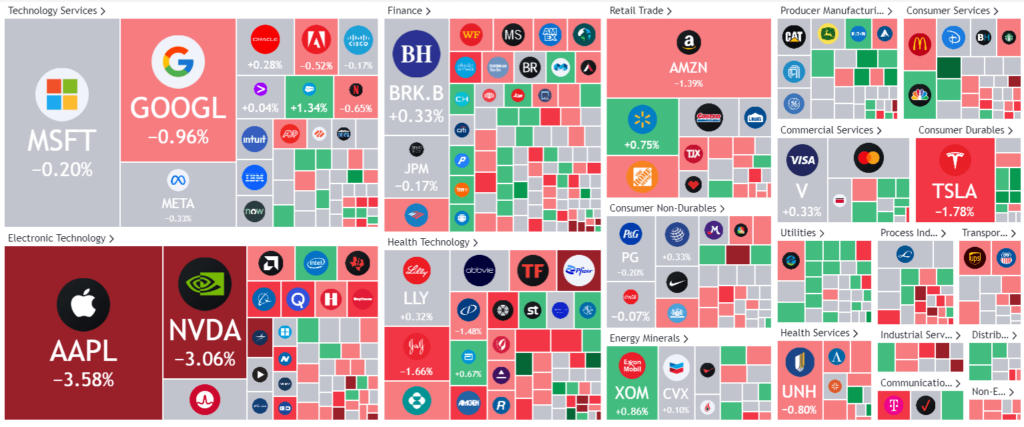

Markets faced turbulence on Wednesday with major indices closing in the red, driven by renewed inflation concerns and a significant drop in Apple’s stock. The Dow Jones, Nasdaq, and the S&P 500 fell by 0.6%, 1.1%, and 0.7% respectively. U.S. services activity for August exceeded expectations, intensifying inflation worries. The rise in the services activity to 54.5 from 52.7, coupled with a higher prices paid index, has increased the likelihood of a November rate hike to almost 50%. Apple’s stock took a hit, plummeting over 3% after China restricted iPhone usage in government agencies, signaling its intent to reduce dependence on foreign technology.

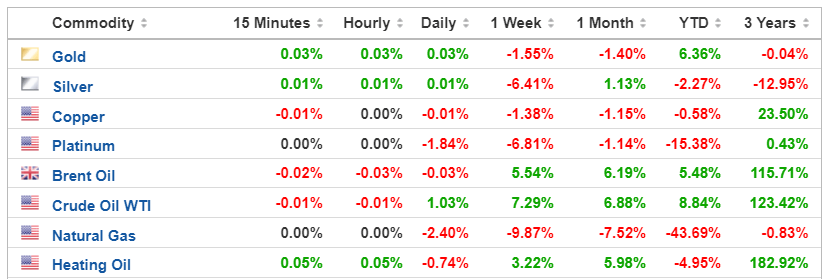

In the tech and services sector, Roku saw a nearly 3% surge in its stock after upgrading its Q3 guidance, highlighting cost-cutting measures and a revenue guidance increase to a range of $835 million to $875 million. Conversely, Block Inc faced a setback with a UBS downgrade, leading to a near 1% dip in its stock. The aviation industry sounded alarms over rising fuel costs. Southwest Airlines adjusted its Q3 outlook due to these concerns, and other airlines like United Airlines and Alaska Air echoed similar sentiments. Despite outperforming Wall Street’s expectations, cybersecurity firm Zscaler’s stock declined by close to 3%.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7196.5 (-1.20%)

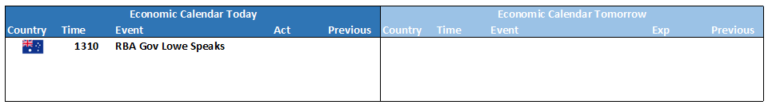

Australian shares are gearing up for a lower opening, echoing New York’s tech-led sell-off, with Apple at the forefront. Recent US service data has reignited inflation concerns, suggesting a potential rise in interest rates. Today’s local spotlight will be on the July trade balance and Lowe’s speech, while internationally, German industrial production and Eurozone’s Q2 GDP will be in focus.

RBA Governor Philip Lowe is slated to speak in Sydney today, ahead of Michele Bullock succeeding him on September 18. Wall Street’s downturn saw major indices like the Dow, S&P, and Nasdaq drop, with tech giants including Apple and Nvidia facing significant declines. The recent directive from China against the use of iPhones in government agencies has further dented Apple’s stock, especially given China’s substantial contribution to its revenue.