Overnight – All

quiet on the western front for US Labor Day holiday

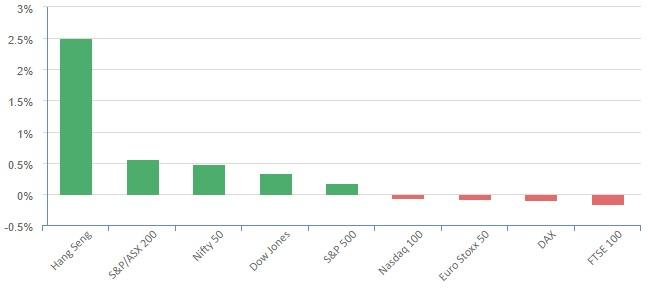

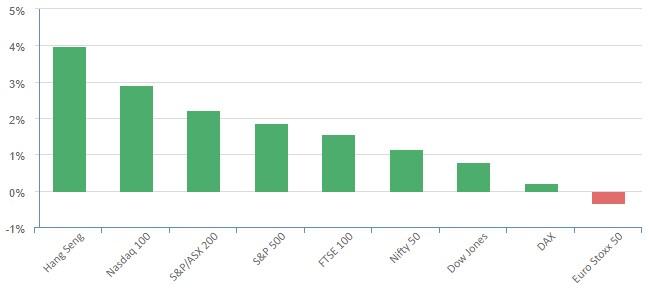

Equities were very quiet with the

US Labor Holiday.

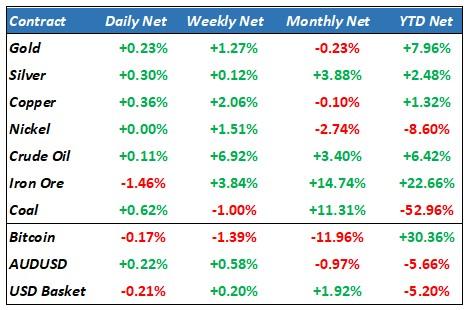

Oil prices held near three-week

highs in choppy trading amid optimism that top crude producers will agree to

further output cuts that could keep global supplies tight. Russia has said that

it will outline more reductions in supply this week. The statement added to

speculation that Saudi Arabia, the de facto leader of the Organization of the

Petroleum Exporting Countries and its allies, a group known as OPEC+, will also

extend a one million barrel per day cut into October. Bets that the Fed will

not hike rates further this month — and, by extension, not place extra

downward pressure on economic activity — also bolstered oil prices.

World leaders will convene in New

Delhi for the G20 summit later this week, with the group’s western members at

odds with developing nations like China and Russia over major issues like the

war in Ukraine and climate change.

The U.S. stock market was closed on

Monday for the Labor Day holiday.

S&P 500 - Heatmap

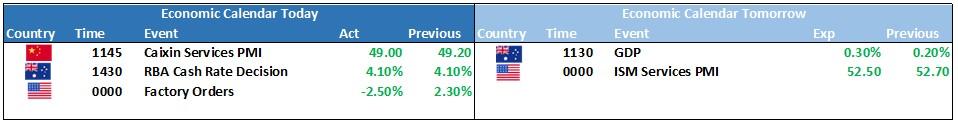

The Day Ahead

SPI Futures 7277 (-0.26%)

The ASX is likely to be quiet until the RBA at 1430 and tomorrow’s GDP numbers.

Ex-dividend today PLS 14c (3%) and YAL 37c (6.8%) both are fully franked