Overnight Equities – Rising Yields keep lid on Equities as Apple and Amazon Beat

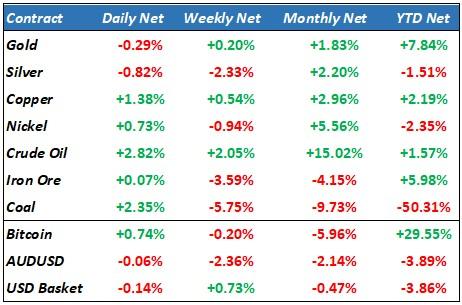

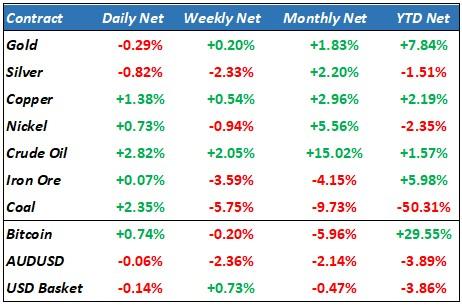

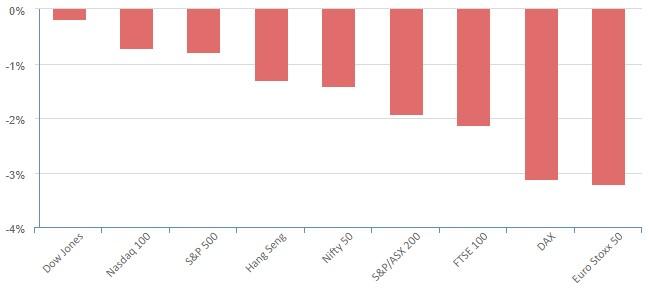

Gains in equities were capped as 10-year Treasury yields raced to 4.17%, nearing the 16-year high from last November as data showed a strong labour market and easing wage inflation. U.S. worker productivity rebounded sharply in the second quarter, while labour costs slowed, stoking further optimism that the easing in inflation seen recently is likely to continue. Ahead of the monthly jobs report due Friday, investors digested data showing the labour market still remains robust as weekly jobless claims for the week ended July 29 were fewer than expected. Tech cut some early-day losses as investors bought the dip in chips from a day earlier, pushing AMD and NVIDIA higher to offset losses in Qualcomm. Qualcomm fell more than 8% after the chipmaker’s gloomy update on guidance for the current quarter and third-quarter revenue that fell short of Wall Street estimates weighed on sentiment. While Qualcomm’s guidance was in line with estimates, investors were spooked by management’s soft commentary around its Dec quarter and incremental headwinds in 2024.

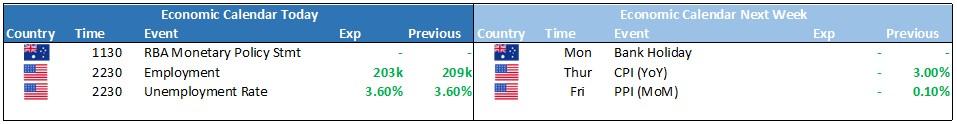

Tonight’s US non-farm payrolls numbers are expected to show the economy added yet another 200k jobs and the unemployment rate to remain near record lows at 3.6% which raises concerns about wage inflation in the future.

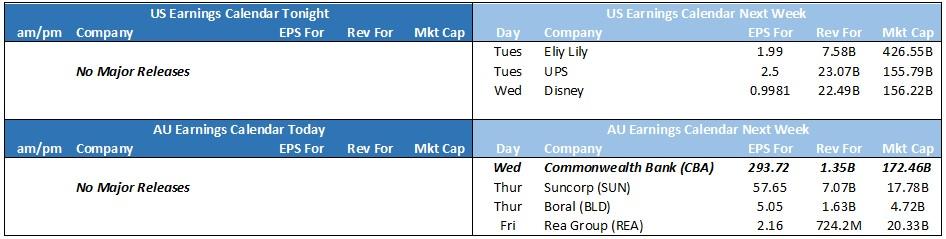

Corporate Earnings

Apple – The world’s biggest company, delivered fiscal third-quarter results that topped estimates as strength in its services business helped offset iPhone sales that fell short of estimates. Shares were down 1% in afterhours trading following the report. Apple reported EPS $1.26 on revenue of $81.80B, beating estimates for $1.19 and $81.73B, respectively. iPhone revenue, which makes up nearly half of total revenue, fell to $39.67B from $40.67B a year earlier, missing estimates of $39.91B. “We had an all-time revenue record in Services during the June quarter, driven by over 1 billion paid subscriptions, and we saw continued strength in emerging markets thanks to robust sales of iPhone,” Apple CEO Tim Cook said.

Amazon – Online retailer and cloud services provider, Amazon delivered second-quarter results that topped analysts’ estimates and delivered upbeat guidance for Q3 as growth in its cloud business topped estimates. Shares rose more than 8% in afterhours following the report. Net sales in North America rose 11% to $82.5B year-on-year in Q2. Amazon Web Services, its fast-growing cloud revenue segment, grew 12% to $22.1B, ahead of estimates of 10.2%. “Our AWS growth stabilized as customers started shifting from cost optimization to new workload deployment,” the company said. For the third quarter, the company expects revenue of $138B to $143B, beating Wall Street estimates of $138.28B. Operating income for Q3 was guided in a range of $5.5B to $8.5B.

PayPal – reported better-than-expected quarterly results, but underwhelming guidance and doubts about how quickly management can improve margins weighed on the stock. It fell 12%.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7238 (-0.01%)

We are looking at a quiet start to the day as all eyes will be on the RBA monetary policy statement at 1130. The significant paring back of rate hike expectations after the board at the monthly meeting on Tuesday will be confirmed or reversed by the statement, which will mean volatility. If the central bank says it will continue to hike, it will not be favourable for equities which will compound investor nerves around rising long-term yields into the key US employment numbers tonight.

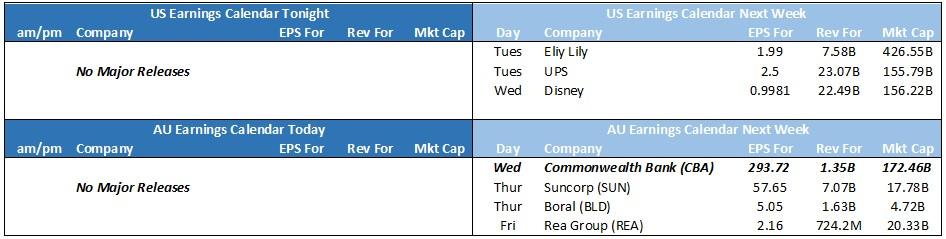

Next week sees AU reporting season kick off with CBA, SUN, BLD the notable releases. Click here to see the ASX Earnings Calendar