Overnight – AI shine not enough to outweigh high bond yields

Equities ignored yesterday’s post-market move higher on better-than-expected Nvidia results and sold from the open as investors remain wary of making bullish bets a day ahead of potential clues on monetary policy from Federal Reserve chairman Jerome Powell at the upcoming Jackson Hole symposium.

Nvidia rallied to an all-time high before giving back some gains even as Wall Street cheered the chipmaker’s blowout results and guidance.

The chipmaker’s third-quarter revenue guidance of $16 billion was well ahead of expectations for $12B as the growth was bolstered by AI-led chip demand.

But the rally in Nvidia failed to lift big tech as investor appetite for bullish bets on the stock was kept in check by rising Treasury yields ahead of a speech from Powell on Friday

Adding to the speculation of a hawkish Fed was continued resilience in the US jobs market as jobless claims fell more than expected last week, stoking ongoing fears about a tight labor market and a threat to wage inflation.

Jobless claims fell to 230,000, a three-week low and more than forecasts of 240,000.

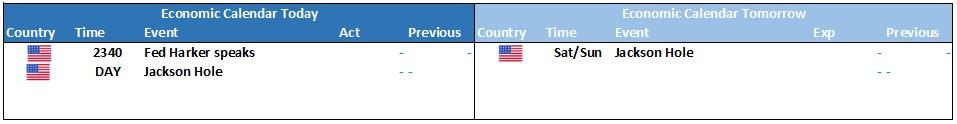

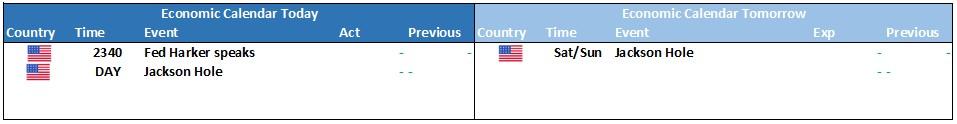

The focus will not be firmly on the Jackson Hole symposium this weekend as investors look for clues on whether the Fed has finished its fight against inflation

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7039 (-1.27%)

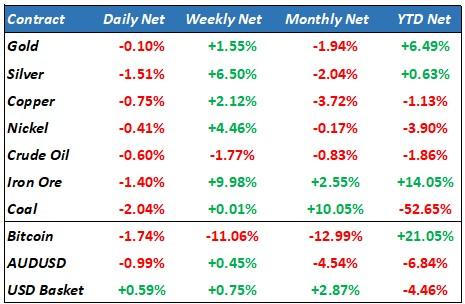

16-year highs in bond yields seem to have finally eaten into the “goldilocks” optimism of a soft landing with even the golden child of the AI rally Nvidia being sold from the open overnight. This could spell trouble broadly for equities as the rest of the market outside the “magnificent 7” have been mixed at best. Couple this with China worries and the risk is firmly to the downside

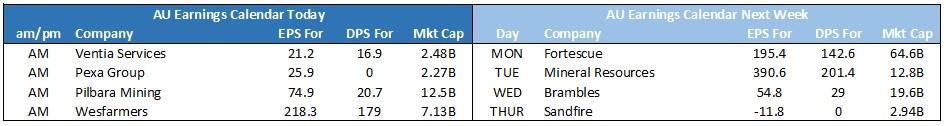

ASX earnings so far have been extraordinarily volatile with moves both up and down far larger than the company results warrant, leading us to believe that a major re-positioning is happening from the institutional side. We remain cautious and are looking forward to any market weakness with record holdings in cash and bonds for our portfolio