Overnight – Tech rallies as the AI golden child Nvidia delivers

Equities were buoyed by tech as optimism on the “golden child” of the AI rally, Nvidia results in the post market (later justified) and falling treasury yields leading into the Jackson Hole Symposium.

Treasury yields fell sharply from recent highs as investors trimmed their bearish bets on bonds with just days to go until Federal Reserve Jerome Powell takes center stage at the Jackson Hole symposium on Friday.

Chair Powell is also likely to reiterate the possibility of a soft landing, Stifel says, and likely to address the scenario of an uptick in inflation.

Investors will likely be on the lookout for clues as to “how will Fed officials respond or alter their policy pathway in the face of an upturn or a meaningful upturn in inflation

Nvidia reported Wednesday better-than-expected second-quarter results and upbeat guidance as the race to adopt generative artificial intelligence continues to bolster demand for its chips. NVIDIA was up more than 9% in afterhours trade. The high-margin data center business jumped 171% to a record $10.32B in Q2 from a year ago as businesses transition to accelerated computing and generative AI from general-purpose computing. As demand for AI ramps up, Nvidia’s suite of AI-related products including chips and a cloud service to train generative AI models have become the dominant option for startups, or businesses looking to expand into AI.

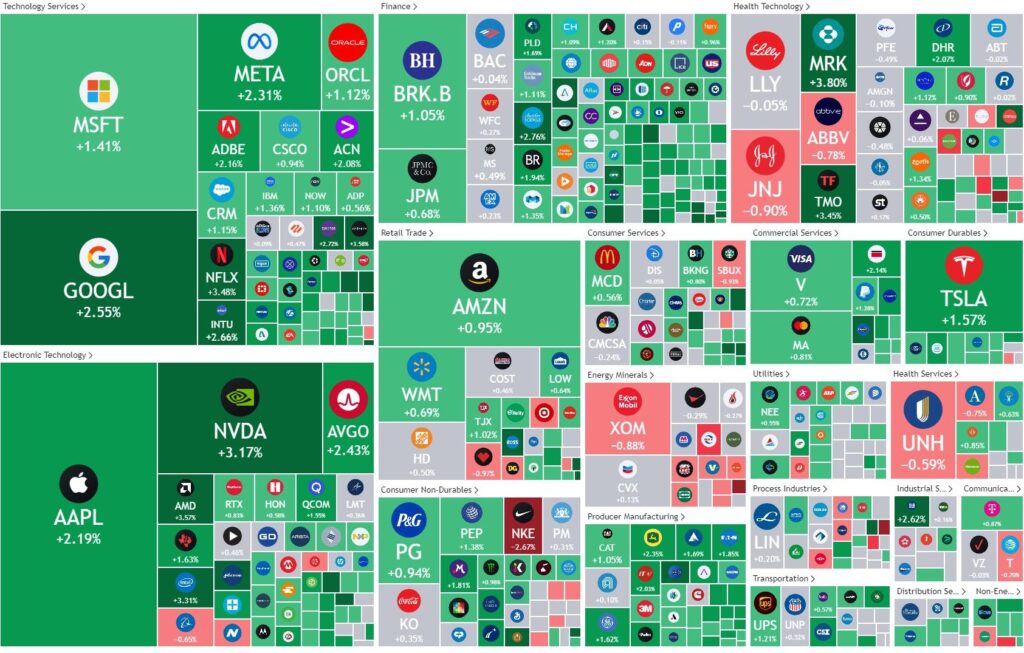

S&P 500 - Heatmap

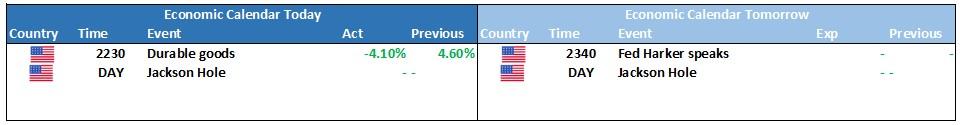

The Day Ahead

SPI Futures 7128 (+0.50%)

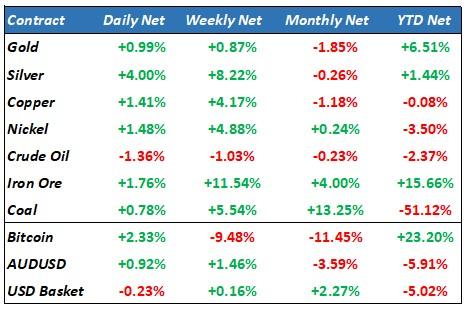

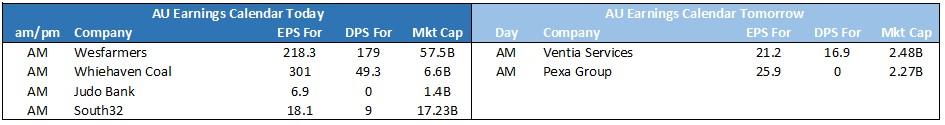

The ASX is in for a solid day as global yields take a breather from recent highs driving offshore equities higher and commodities banking a few solid days in a row. We will see company earnings from around 9% of the ASX200 this morning with WHC, TAH, S32, JDO, NEC, RHC scheduled to deliver results.