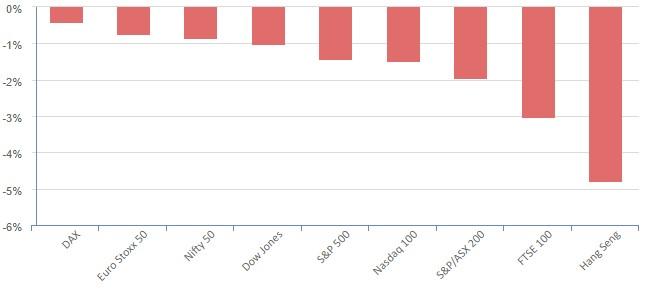

Overnight – Equities drop to 7-week lows on higher bond yields, Hawkish Fed

Equities closed at their lowest point in 7 weeks as a melt-up in Treasury yields continued after the Federal Reserve’s July meeting signaled that a further rate hike remains in play later this year.

In the FOMC Minutes, most Federal Reserve officials said “significant” upside risks to inflation keep further monetary policy tightening on the table for later this year, according to the minutes from the July 25-26 Federal Open Market Committee meeting published Wednesday.

The minutes also revealed a Fed U-turn on the outlook for the economy, with Fed staff no longer expecting a “mild” recession later this year. The hawkish overtones gave credence to bets for higher for longer rates, pushing Treasury yields to fresh October highs, dangerously close to a new 15 year peak for the US10Y

Tech led the broader market to the downside as chip stocks took a breather from the recent melt-up amid pressure from Intel Corporation, Coherent and AMD.

Intel fell more than 3% after walking away from plans to acquire Tower Semiconductor as the chipmaker failed to secure regulatory backing for the deal in time. Intel will pay a break-up fee of $353 million for backing out of the deal.

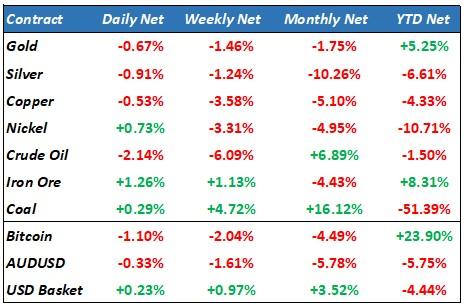

Commodities were dragged down on a rising USD due to the potential for higher rates and a sour sentiment on the Chinese economy.

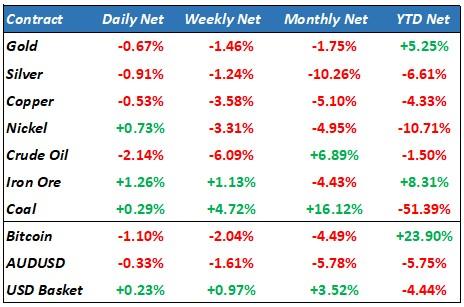

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7118 (-0.32%)

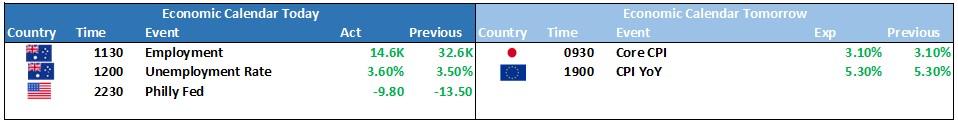

With commodities falling and the US banking sector on credit watch, the index will find it hard to rally today are the focus will be on Company earnings and AU employment numbers at 1130. Tech is likely to have another rough day as the frothy AI rally starts to hit a wall of reality with 15 year highs in US10Y treasury yields hitting 15 year highs.

Employment is expected to add a further 14k jobs today and the unemployment rate remain towards record lows at 3.6%. if we see another strong number, the RBA is likely to be forced into more rate hikes which will see equities heavy

(Earnings calendar click here)

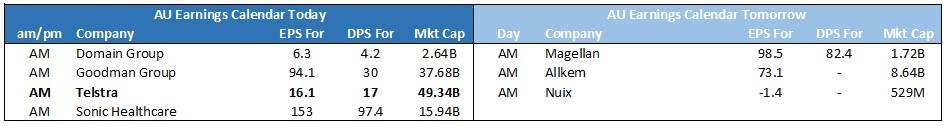

Corporate Earnings

Yancoal (YAL) Balanced portfolio – Yancoal delivered earnings overnight, banking a 973m net profit and declaring 37c dividend for the last 6 months, a total of 107c this year (21%) operating costs were higher and average sale price was weaker, however this was largely priced in. the intention for the company to maintaining a minimum payout ratio of 50% with no debt and $1B in cash, YAL is likely to have a strong day

Telstra (TLS) – Telstra has reported a jump in profit in its latest full-year report.

Total income came in at $23.2 billion, a jump of 5.4 per cent on the previous year. Net profit after tax rose 13.1 per cent to $2.1 billion.

HomeCo REIT (HDN) – Statutory profit fell 70 per cent at convenience mall landlord HomeCo Daily Needs REIT as the trust absorbed the impact of about an $87 million write down in the value of its $4.7 billion portfolio. This was driven by an 11-basis-points increase in capitalisation rates or yields to 5.46 per cent, partially offset by rental growth. Operationally, the trust which bedded down the acquisition of homemaker centre owner Aventus during the 2023 financial year, delivered funds from operations of $177.1 million or 8.6¢ per unit in-line with guidance.

On the economic front, we have the RBNZ rate decision today and AU employment numbers tomorrow, which could renew calls for more rate hikes if a strong number is delivered.