Overnight – Resilient consumer pushes bond yields higher

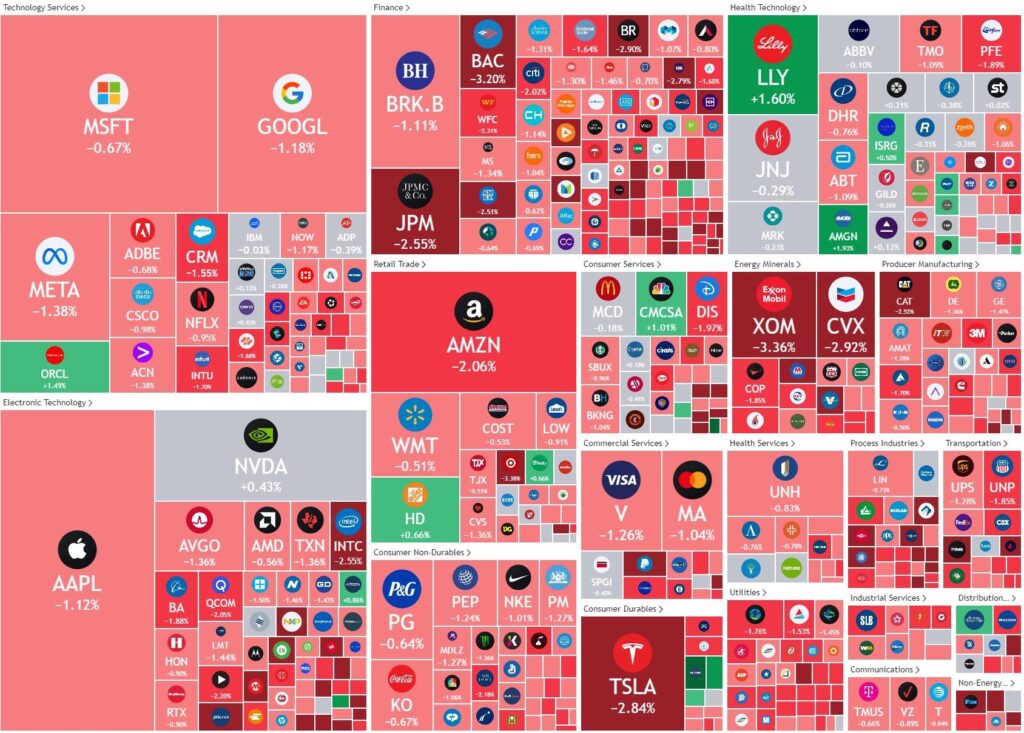

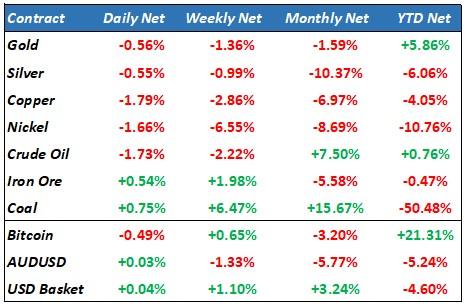

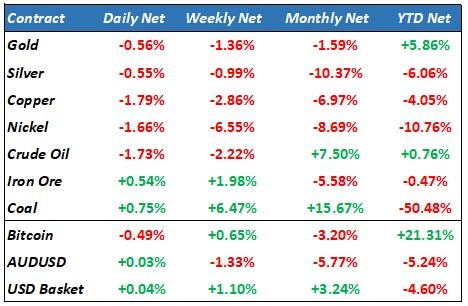

Equities closed lower overnight as an ongoing stumble in China’s economy raised fears about global growth as Treasury yields rose after stronger-than-expected consumer spending denting hopes that the Federal Reserve is finished raising rates.

Retail sales rose 0.7% last month, well above expectations for 0.4%, marking the biggest increase since January. The data pointing to signs of consumer strength cooled bets the Fed may not have to resume rate hikes later this year, and further pushed out expectations for rate cuts. Bets on a Fed November rate hike rose to 32.2% from 26.4% last week, according to the CME FedWatch Tool.

Banking stock woes continued as Fitch Ratings analyst Chris Wolfe told CNBC on Tuesday that the credit ratings agency may forced to downgrade a slew of U.S. banks including JPMorgan should the health of the banking sector deteriorate further. Another downgrade of the U.S. banking industry to A+ from AA-, would force it to reassess its ratings on each of the more than 70 U.S. banks it covers, Wolfe told CNBC. Regional banks led the selling in the sector, but major Wall Street banking including JPM and BAC were more than 2% lower on the day.

In the industrials, Caterpillar, a bellwether of economic conditions fell 2% on worries over the poor economic data

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7168 (-1.03%)

After some positivity around China stimulus yesterday, reality may come to bite the market today as concerns over the state of the Chinese economy may force investors to consider if the rate cuts will be enough to salvage the economy. The constant “glass half full” optimism of investors is being seriously tested in the AU market as weakness of our largest trading partner, coupled with rising bond yields which will thwart an overinflated AI rally may all cause a perfect storm of negativity. Add to this a possible default from Chinese property developer 4x the size of Evergrande, we certainly aren’t feeling a soft landing or “goldilocks” scenario is remotely likely

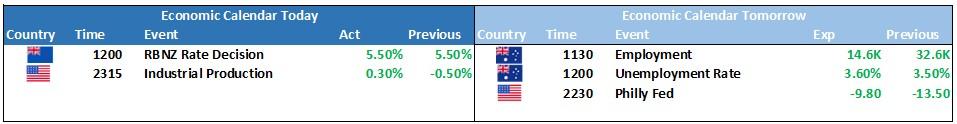

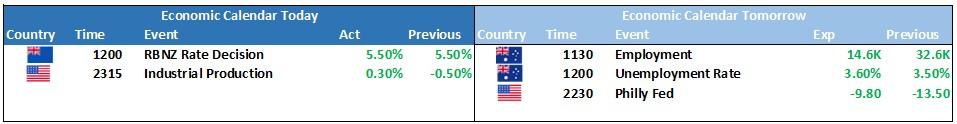

On the economic front, we have the RBNZ rate decision today and AU employment numbers tomorrow, which could renew calls for more rate hikes if a strong number is delivered.

(Earnings calendar click here)

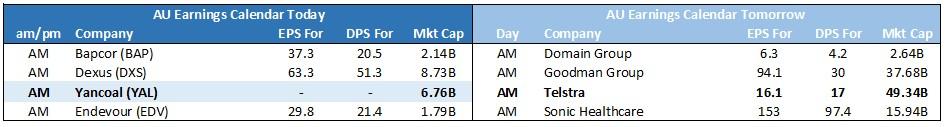

Corporate Earnings

Transurban (TCL) – Transurban’s annual net profit has risen five-fold to $92 million after income from toll fares jumped 26 per cent to more than $3 billion.

More updates to come BAP, DXS, YAL, EDV