Overnight – Equities end higher as investors buy dip in tech

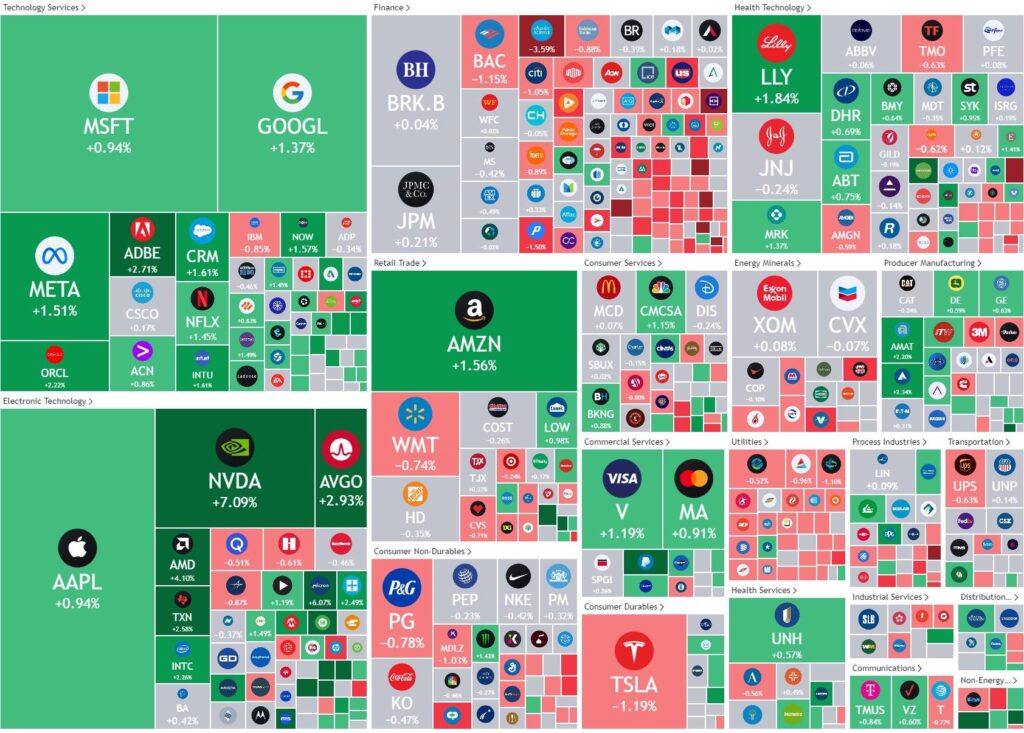

Weakness in banks was offset by renewed demand for tech amid a surge in Nvidia ahead of a slew of incoming economic data set to provide further insight on the consumer. The recent dip in tech attracted dip buyers, particularly in semiconductor stocks, with Nvidia soaring more than 7% after Morgan Stanley said the recent dip in the chipmaker was a buying opportunity. The vote of confidence from Morgan Stanley comes even as concerns linger about bloated inventory and waning demand for chips amid an economic stumble in China. But rising demand for AI is likely to boost data center spending, Morgan Stanley adds, bolstering Nvidia’s growth. Apple, Meta, Google and Microsoft, meanwhile, were also in demand following their recent weakness.

This was despite The U.S. 10-year Treasury yield jumping to its highest level since Nov 22 at 4.204%. The gains were short-lived as investors looked ahead to the latest consumer data due tonight.

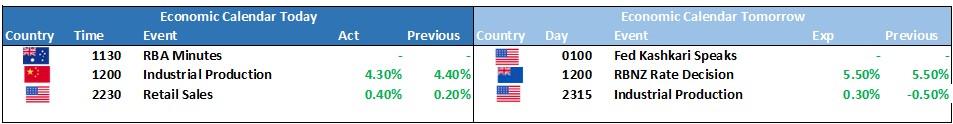

Retail sales data for July is expected to show that the consumer remains resilient. Fresh signs of a strong U.S. consumer, which makes up about 70% of economic of growth, would further dent bets that the Federal Reserve is unlikely to resume rate hikes later this year.

Regional bank stocks including Citizens Financial, Fifth Third Bancorp and KeyCorp pressured the broader financials as Moody’s recent downgrade of several banks continued to weigh on sentiment.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7220 (-0.45%)

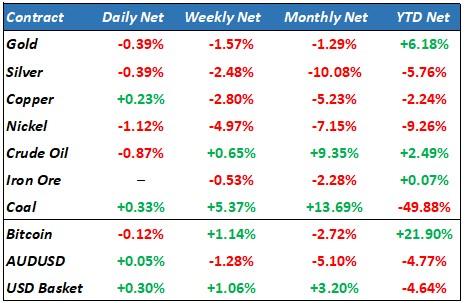

Concerns over China and the potential fall of Country Garden spreading to other financial institutions is bubbling under the surface putting pressure on commodities and helping the USD gain ground. Country Garden has the largest pool of outstanding bonds in the market and has failed to pay 2 coupon payments, which could spread to unit trusts if the non-payment continues. Any default would impact China’s housing market more than Evergrande’s collapse as Country Garden has four times as many projects and severely dampen commodity demand.

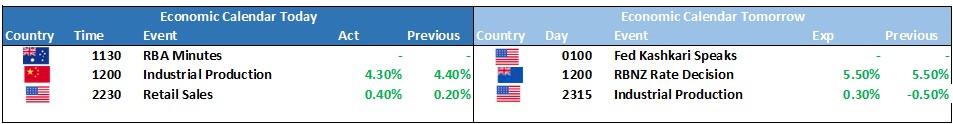

On the economic front, we have the minutes of the July RBA meeting which could give insight into the central banks thinking on future rates, critical to the AUD holding 9-month lows

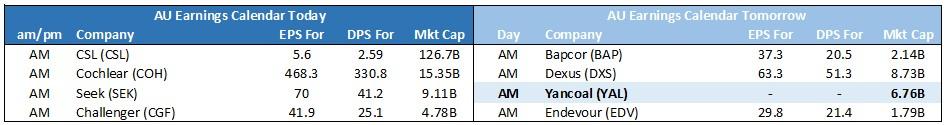

(Earnings calendar click here)

Corporate Earnings

CSL (CSL) – Balanced portfolio Blood products giant CSL has lifted full year underlying profit 10 per cent to $US2.61 billion ($4 billion) after a surge in sales of its core immunoglobulin division led by blockbuster therapies Privigen and Hizentra. Despite the warning from the company last quarter, it was a strong result with revenues up 31%, Net profit up 20% and Net profit after tax (NPAT) up 8%. CSL had a strong outlook for all business divisions and a reduction in CAPEX of 30% next year.

Challenger (CGF) – Retirement products provider Challenger says its normalised net profit before tax increased 10 per cent to $521 million while statutory profit gained 13 per cent to $288 million. The profit lift was on the back of record annuity sales, which increased 8 per cent. Domestic retail annuity sales rose 53 per cent to $3.6 billion

Cohlear (COH) – Cochlear says its sales revenue increased 19 per cent to $1.96 billion in financial year 2023. The company declared a final dividend of $1.75 a share. Implant units increased 16 per cent. Cochlear said it was driven by a combination of market growth, improved clinical capacity, market share gains and COVID-19 catch-up surgeries