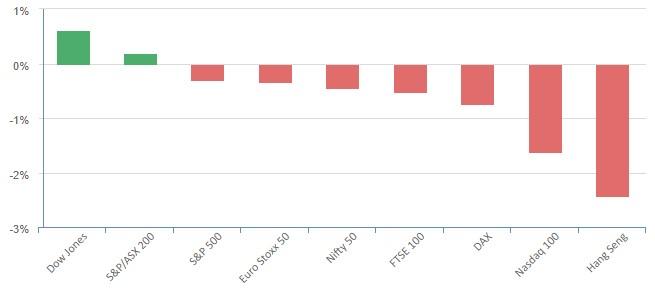

Overnight – Wholesale inflation data pushes yields higher, capping gains in equities

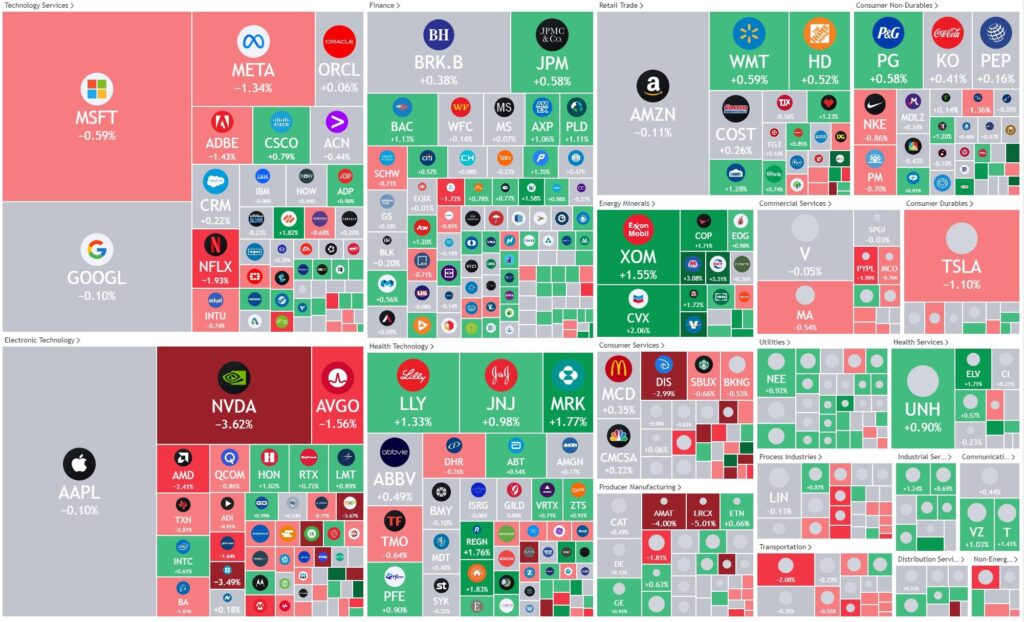

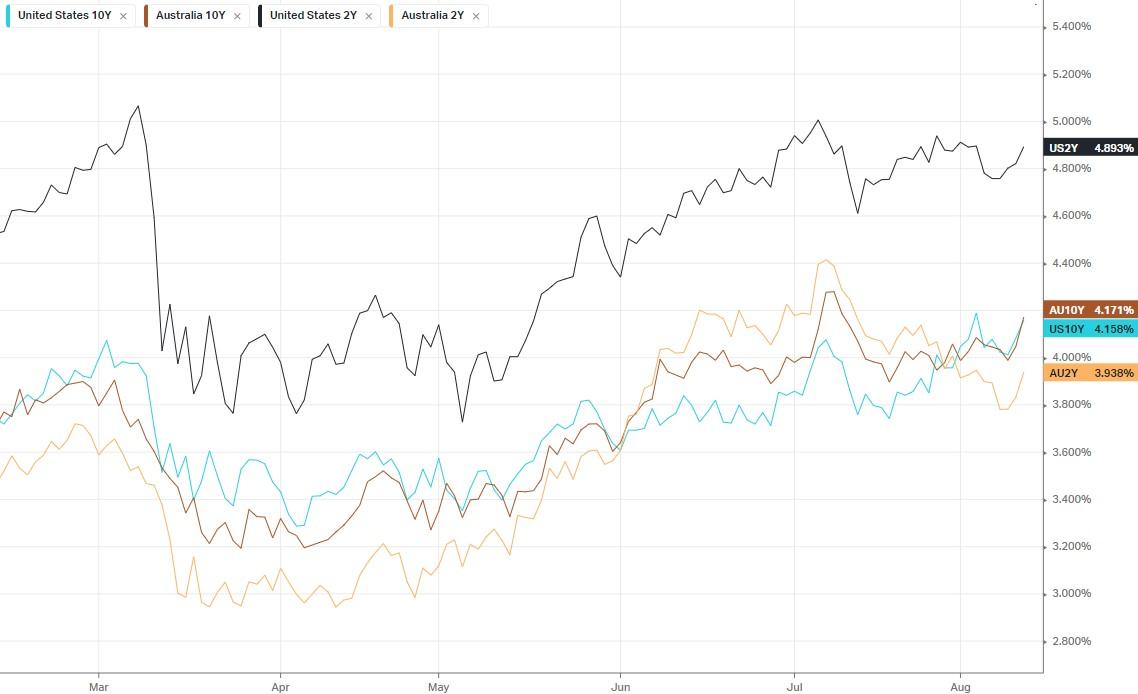

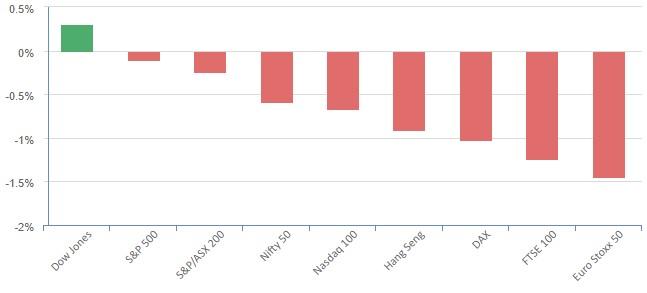

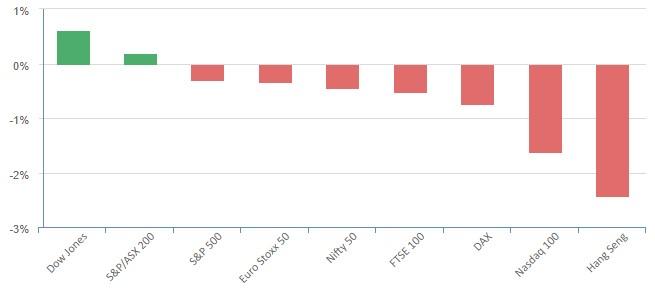

The upside was capped in equities on Friday night as renewed inflation fears pushing Treasury yields higher and deflating investor bets that the Fed is unlikely to resume rate hikes later this year. PPI increased 0.3% in July, above economists’ forecasts of 0.2%, and pick up from the 0.1% pace seen in June. In the 12 months through July, the PPI rose 2.4%, just above estimates of 2.3%. Coupled with yesterday’s headline rise in the CPI, this morning’s hotter-than-expected PPI data threw a wet blanket over the market’s earlier optimism the Committee will move back to the sidelines in September. Big tech, with the exception of Apple, struggled to turn positive as Meta led to the downside falling more than 1%. Chip stocks continued to add pressure on tech, with NVIDIA Corporation slipping 3% as the chipmaker fights to keep its extraordinarily optimistic $1 trillion valuation.

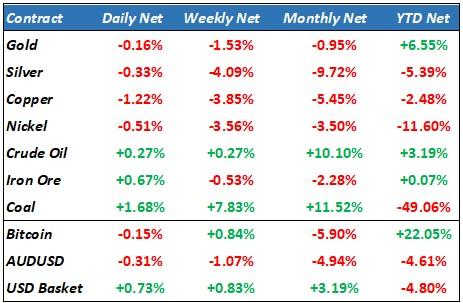

Commodities were quiet with oil starting to run out of steam after a 7 week rally as investors worry about China’s deteriorating economy

This week is relatively quiet on the data front, coupled with US summer holidays, we expect the market to be relatively quiet with all eyes on the US10Y yield, which finished at its highest weekly close in 15-years. Any further rally would be very negative for tech stocks

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7251 (-0.41%)

The weak offshore lead, rising yields and worsening Chinese data will set a poor tone to start the week, however the ASX will be focused on earnings for the next couple of weeks with the likes of CSL, CIP, TLS and AKE reporting results (for Earnings calendar click here) only Ansell had delivered earnings at the time of writing this report

Ansell (ANN) – Ansell’s sales declined 15.2 per cent in FY23 to $US1.65 billion, while its EBIT dropped 15.8 per cent to $US206.3 million. The company declared a final dividend of US25.80¢, taking its full-year dividend to US45.90¢.