Overnight – Yields continue to rise despite muted inflation data

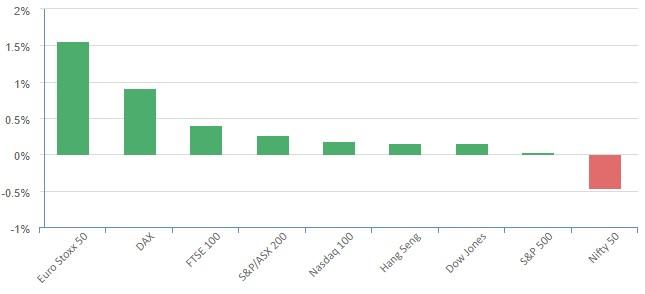

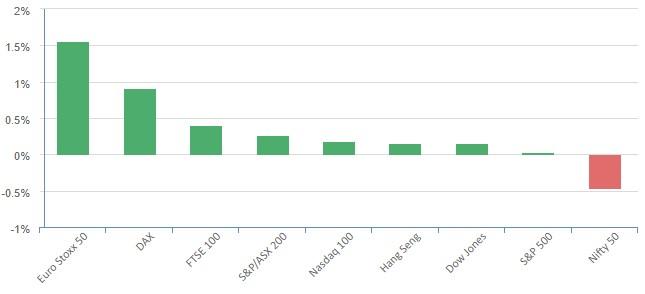

Equites closed slightly higher overnight, supported by a jump in Disney after giving up the bulk of its gains as a climb in Treasury yields weighed on sentiment even as data showed further signs of easing inflation. The U.S. consumer price index rose 0.2% in July, in line with economists’ forecasts and unchanged from the pace seen in June, while annual inflation through July rose 3.2%, which was slower than expectations for 3.3%.. CPI is gradually approaching a more comfortable level for the Federal Reserve, which will likely resume its interest rate pause. Treasury yields initially fell below the flatline before rebounding as a deeper look into the inflation report flagged a rise in core services ex-housing inflation, a closely watched measure for the Fed, which rose 0.2% after coming in flat in June.

S&P 500 - Heatmap

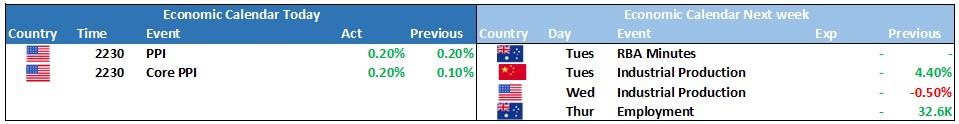

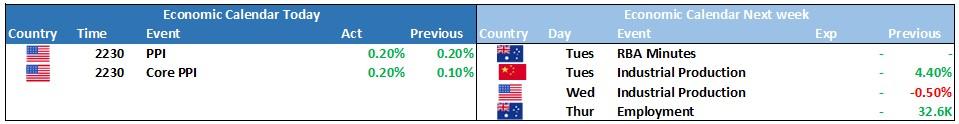

The Day Ahead

SPI Futures 7281 (-0.27%)

The ASX will be weighed down by worries over China and inflation data in the US that didn’t support the “goldilocks” pricing of the market. Corporate earnings will be the focus for the next two weeks as ASX companies show how good their management has been over the last 12 months of uncertainty. Economic data will be thin next week with AU employment the only significant figure on the calendar

Corporate Earnings

REA Group – cut full-year dividend by 4 per cent to $1.58 after reporting lower profit for FY 2023 and flagged higher losses ahead, due to challenging conditions and spending plans.

Nick Scali – posted a full-year record net profit after tax of $101.1 million and increased its full-year total dividend to 75¢, from 70¢ a year ago.

Baby Bunting – net profit after tax slumped 51 per cent to $14.5 million in FY 2023 from a year ago, resulting a similar decrease in the fully franked annual dividend to 7.5¢.