Overnight – Equities Big tech struggles ahead of inflation data, Natural Gas spikes 40%

Equities fell overnight as the slide in tech continued, paced by weakness in chip stocks as investors remained wary of making bullish bets ahead of Thursday inflation report. Big tech including Apple, Microsoft, Google, and Meta struggled, keeping tech on the backfoot as investors remain wary of the lofty valuations into key inflation data. CPI is likely to point to another sign that deflationary pressure in the goods sector persists, driven by a fall in used car prices, with market consensus estimating headline CPI increased by 0.20% in July and 3.3% in the 12 months through July. Further signs that inflation is cooling will likely stoke optimism that the Federal Reserve may not resume rate hikes later this year.

A downgrade of Qualcomm from Daiwa capital triggered selling in the chip sector putting pressure on NVIDIA and Broadcom citing worries about weaker demand. Daiwa Capital flagged several issues that were evident in the third quarter including weak consumer demand, particularly in China, and high inventory levels.

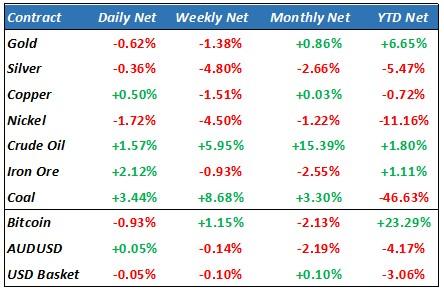

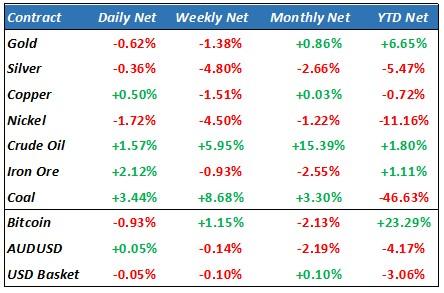

Natural gas spiked 40% overnight, building on gains in the previous two sessions, amid the possibility of worker strikes in Australia, highlighting market jitters over potential supply disruptions. These are the highest prices since March 2022, as traders are concerned about a long-lasting strike. Analysts at Citigroup predicting it could cause European and Asian LNG contracts for January to double, putting upward pressure on inflation

Corporate news

Disney – despite missing Wall St estimates, Disney rose 4% in aftermarket trade as the company reported Wednesday mixed fiscal third-quarter results as revenue missed Wall Street estimates as momentum in its streaming business slowed, but the company detailed plans to hike prices for its streaming business to boost growth. Disney’s parks business saw revenue climb 13% to $8.33 billion in Q3 from the year-ago period. Disney+ subscribers fell to 146.1 million, missing estimates of 151.1 million, pressured by a 24% fall in Disney+ Hotstar subscribers. Disney said that it would be raising the prices of its streaming streaming services including Disney+ and Hulu, but will keep prices of its ad-supported tiers of streaming unchanged.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7279 (+0.01%)

Today is likely to be another day of waiting for the key US inflation data, with investors likely to show nerves around the current “soft-landing” pricing of equity markets. In China, the opposite issue has emerged with yesterdays inflation data showing deflation, which has put more pressure on the PBoC to provide stimulus. This saw oil and iron ore prices edge higher, a positive for energy and materials sectors. Tech will be the major drag on the index, but more in terms of sentiment than the index as tech represents so little of the ASX200

Inflation data tonight is a huge risk to a market that is currently pricing in a “soft landing” or “goldilocks” scenario. Any signs of a second wave of inflation will see heavy selling in equity markets and caution is highly recommended