Overnight – Stocks end lower on banking sector downgrade and rise in yields

Equities closed lower Tuesday, as bank stocks fell after credit rating agency Moody’s downgraded the debt ratings on a slew of U.S. banks on concerns about pressures on profit. Moody’s downgraded the ratings of 10 banks by one notch and placed six banks including US Bancorp, and State Street on review for downgrades. The ratings agency said second-quarter results from the banks showed “growing profitability pressures that will reduce their ability to generate internal capital.”

Big tech including Meta and Microsoft were a drag on tech as recent concerns about valuation and a rise in Treasury yields persist. As well as weakness in big tech, a more than 1% fall in semiconductor stocks was paced by declines in Advanced Micro Devices Inc

Corporate news

Eli Lily – gained 14% after the pharma giant reported much better-than-expected Q2 results, paving the way for the full-year forecast to be lifted. Lilly reported EPS of $2.11 on revenue of $8.31 billion, crushing the consensus for earnings of $1.98 per share on revenue of $7.58B. Mounjaro, the company’s flagship antidiabetic medication used for the treatment of type 2 diabetes, generated $979.7 million in Q2 sales, easily ahead of the expected $740.8M.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7246 (-0.01%)

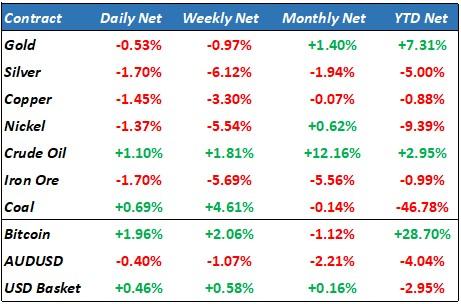

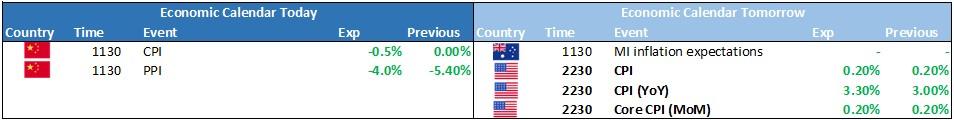

Today will likely be quiet again ahead of key inflation data out of China and the US. The banking sector will be mixed as the market digests a slightly better than expected result from CBA and the Moodys downgrade of the banking sector. The big miners will weigh on the market due to the continued fall in Iron ore prices.

Inflation data over the next 2 days is a huge risk to a market that is currently pricing in a “soft landing” or “goldilocks” scenario. Any signs of a second wave of inflation will see heavy selling in equity markets and caution is highly recommended

Corporate news

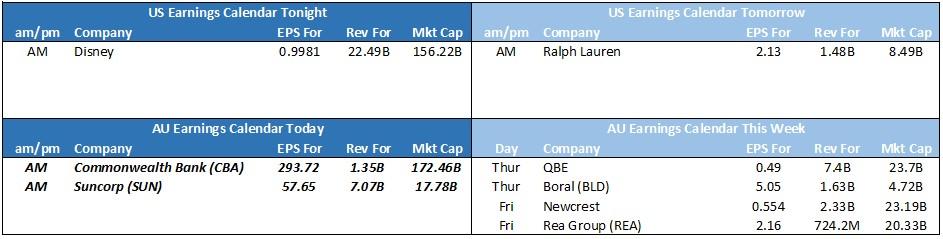

Commonwealth Bank – Commonwealth Bank’s annual cash profits rose 6% to a record $10.16 billion, driven by higher interest rates. However, net interest margins decreased in the second half due to increasing loan competition and funding costs. CEO Matt Comyn highlighted the bank’s resilience during challenging times and announced a dividend increase and a $1 billion share buyback in 2024. Although net interest margins rose year-on-year, there were pressures in the latter half, with competition and funding challenges predicted for 2024. The bank’s business division posted the highest profit growth at 32%.

Suncorp – Suncorp’s annual net profit soared 69% to A$1.15 billion, with cash earnings at A$1.25 billion, up from A$673 million. Premiums in its Australian and New Zealand units grew by 11% and 14%, respectively. The banking unit’s profit reached A$470 million. The proposed A$4.9 billion sale of Suncorp’s bank to ANZ faces regulatory challenges. The final dividend stands at A$0.27/share with a 60% payout ratio.

.