Overnight Equities – Investors Embrace “Goldilocks” Scenario

A resilient U.S. economy and expectations of a nearing peak in the Federal Reserve’s monetary policy tightening cycle are emboldening stock investors, even as worries persist over rising valuations and the potential for inflation to rebound. One key factor driving stocks higher has been the view that the economy is moving towards a so-called Goldilocks scenario of ebbing consumer prices and strong growth that many believe is a healthy backdrop for stocks. That view gained further traction in the past week, when Chair Jerome Powell said the central bank’s staff no longer forecasts a U.S. recession and that inflation had a shot of returning to its 2% target without high levels of job losses. A test of this “Goldilocks” scenario comes Friday when US employment numbers for July are released. While comparatively strong employment data has been a driver of this year’s stock rally, signs that the economy is growing at too rapid a pace could spark worries that the Fed will need to raise rates more than expected. Many are also assessing the durability of a rally in tech stocks, which has been fuelled in part by excitement over developments in artificial intelligence. The tech-heavy Nasdaq is up nearly 44% year-to-date, while the S&P 500 information technology sector has gained nearly 46%.

Optimistic forecasts from Meta Platforms and results from Google earlier this week bolstered the case for those who believe megacaps’ lofty valuations are justified. For megacap stocks, “the risk-reward is not as good as it was a quarter ago

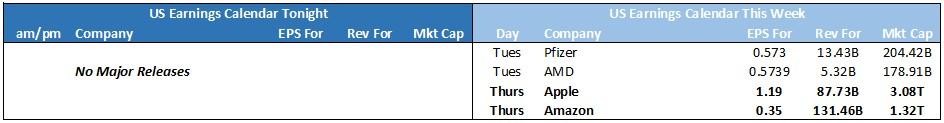

Corporate Earnings

Intel – Intel led rally in chip stocks also pushed broader tech higher as the chipmaker reported upbeat guidance and second-quarter surprise profit following better-than-expected revenue. Intel’s ongoing improvement in margins is expected to continue into 4Q, Deutsche Bank says, as a “wide array of headwinds abating tailwinds emerging” including revenue scale, cost cuts, and the selling PRQ’s products, which refers to early product stock of upcoming launches.

Ford – Ford Motors fell more than 3% after the automaker warned of a $4.5 billion in its electric vehicle business as take up of its EVs had been slower than expected. The dour EV commentary offset quarterly results that topped Wall Street estimates on both the top and bottom lines.

S&P 500 - Heatmap

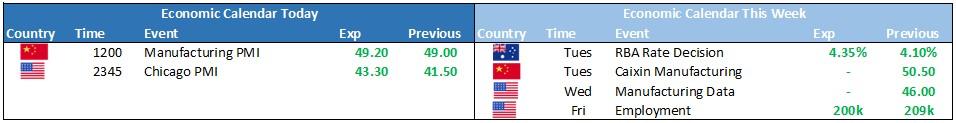

The Day Ahead

SPI Futures 7376 (+0.25%)

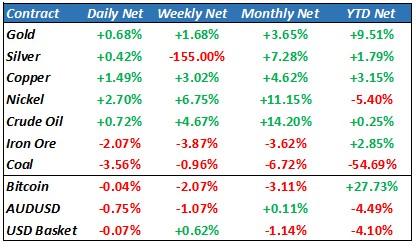

The tech driven rally in the US will have little effect on the ASX as the focus will likely be on the falling Iron ore price and the RBA meeting tomorrow which is split as to whether the central bank will raise by 25bps or leave rates unchanged. The recent fall in inflation numbers globally has investors giddy with optimism on central banks achieving a soft landing that is “just right”. it is likely for the next month that the battle between “goldilocks” and the “Bears” will continue with both sides cherry picking data to back their case. during these periods of uncertainty, we think its important to not get swept up in either side and stick to picking up high percentage opportunities when they appear.