Overnight – The AI Bulls are back as Google and AMD spark rally

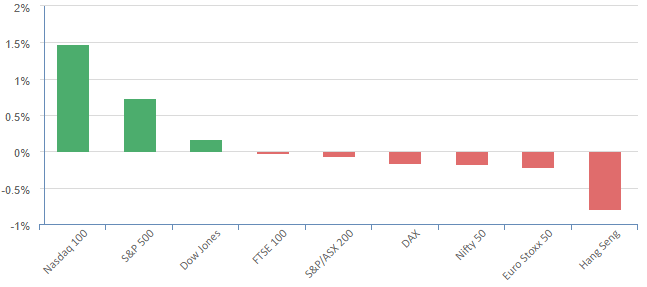

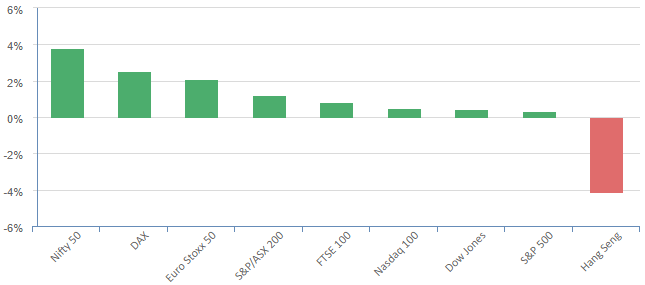

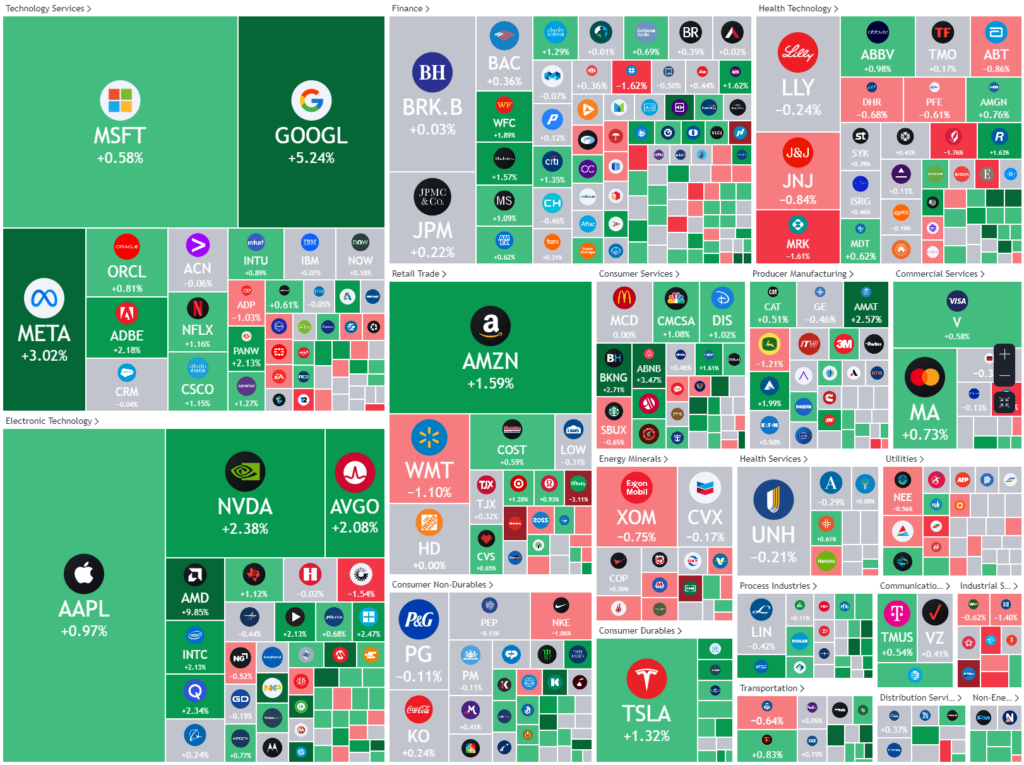

Equities finished higher as a tech-led rally underpinned by Alphabet and AMD offset losses in energy stocks ahead of the monthly jobs report due Friday.

Alphabet (Google) rose more than 5% a day after the company unveiled its latest AI model Gemini. The new multi-model AI system, which understands audio, photos and video, comes as tech giant looks to take the fight to rivals OpenAI, Microsoft and Meta.

Chip stocks also supported the broader tech sector, racking up a nearly 3% gain, underpinned by a surge in Advanced Micro Devices.

Advanced Micro Devices rose more than 9% after launching its new AI chip MI300X as the chipmaker takes the fight to Nvidia. AMD’s management sees MI300X performance surpassing NVDA H100 for AI workloads

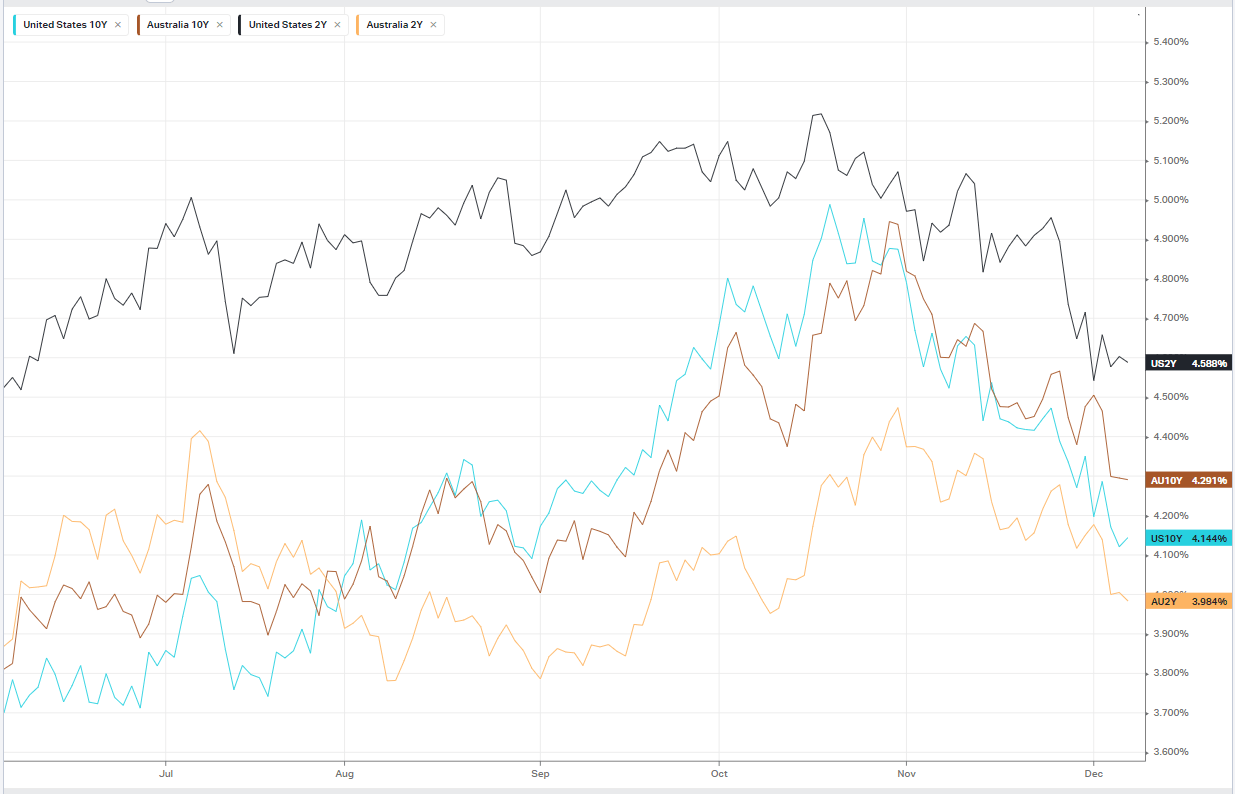

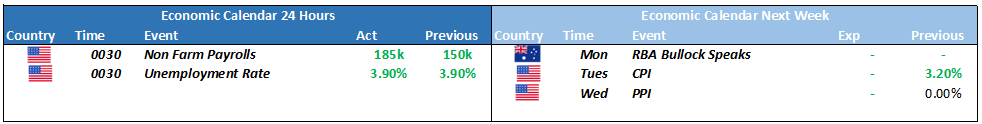

Data on Thursday showed that the number of Americans who filed for first-time unemployment aid came in at 220,000 last week, slightly higher than last week, but in line with expectation. The latest figures added to string of recent data pointing to soft labor market, though the nonfarm payrolls report for November will take center stage tonight.

Economists expect that the economy created 180,000 new jobs last month, with the unemployment rate likely steady at 3.9%. Average hourly earnings, however, are expected to have increased by 0.1%. This key figure could set the tone for the rest of 2023 if the figure comes out significantly higher or lower than expectation as the majority of investors sit in starkly different camps on the direction of the economy

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7170 (-0.20%)

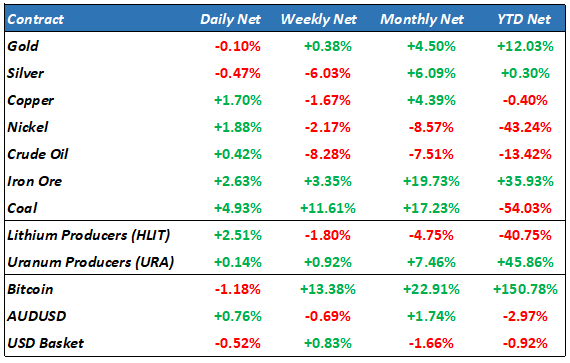

We are likely in for a relatively quiet day on the ASX with the lions share of gains overnight in tech, a minor contributor to the index. There could be some action in the materials sector as Iron ore hit its highest point since July 2021, spot lithium prices bounced 7% and coal prices continued to rally, up 15% this week. the spot lithium market was halted at +7%, “limit up” an exchange volatility mechanism limiting the maximum daily move. This would have hedge funds who have accumulated a huge 20% short position in Pilbara (PLS) very worried, which is likely to see the stock well supported.

- Woodside Energy and Santos are in talks on a potential merger of their businesses. The combination of the country’s two biggest listed oil and gas producers would create a company with a market value of almost $80 billion and bring together assets that two years ago were split across four companies, including Oil Search and BHP Petroleum.

- Sky City Entertainment Group lowered revenue guidance for fiscal 2024 due to weaker gaming gains in New Zealand and a softer performance in Adelaide.

- Lake Resources named Don Miller as chief financial officer.

- Washington H Soul Pattinson hosts its annual meeting.