Overnight – Stocks stumble as Investor optimism reaches saturation point

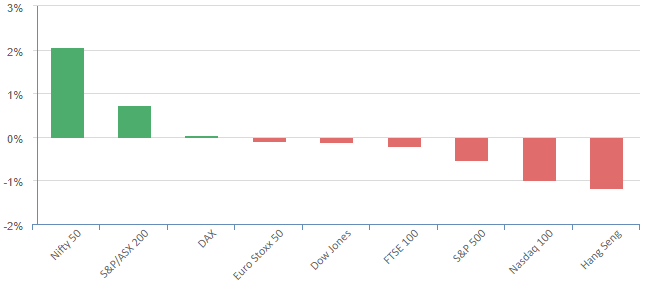

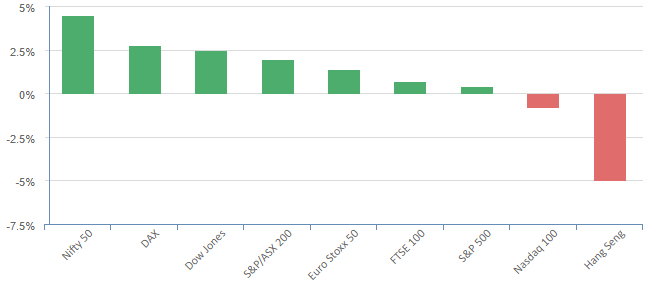

Investors paused their bullish bets on tech as Treasury yields rose ahead of key Payrolls data that will likely shape the Federal Reserve thinking on monetary policy. To put things in context, the S&P500 hit its year high on Friday, and the major indices have rallied for 5 weeks straight, which presents a risk, as statistically, equity markets rarely rally for 7-8 weeks straight without a major catalyst.

The difference with this rally is that it’s broad based with the value-based companies and small caps recovering from being beaten down for most of 2023. The Russell 2000 has outperformed the major indices for 3 weeks straight, the anomaly in 2023 as 90%+ of this year’s gains in the “Magnificent 7”

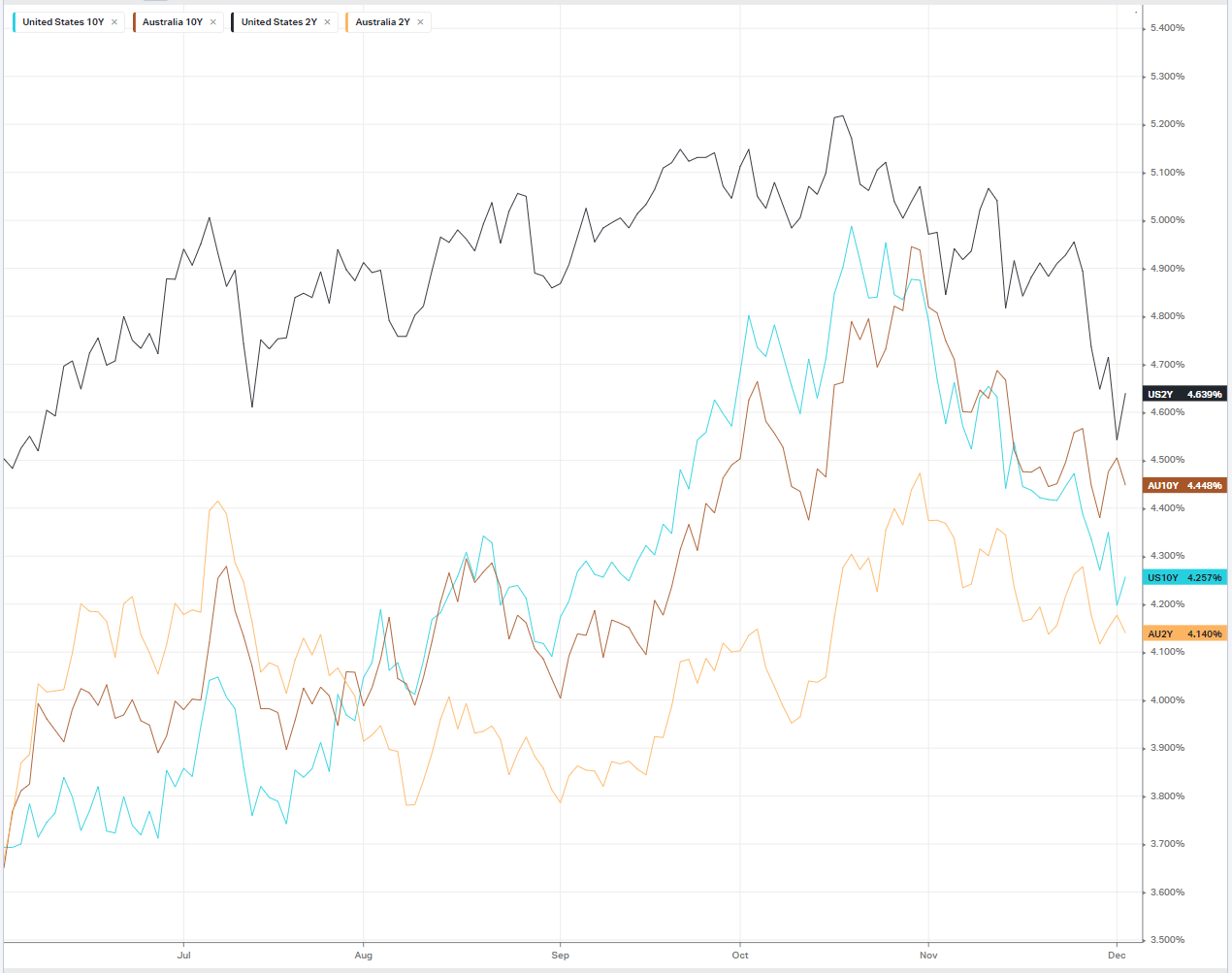

The yield on the 10-year Treasury rose 7 basis points to 4.296%, with the recent plunge in yields on Fed cut bets a little too optimistic. The average time between the last move of a rate cycle, into the first is around 500 days Any urgent need to cut rates in H1 2024 will

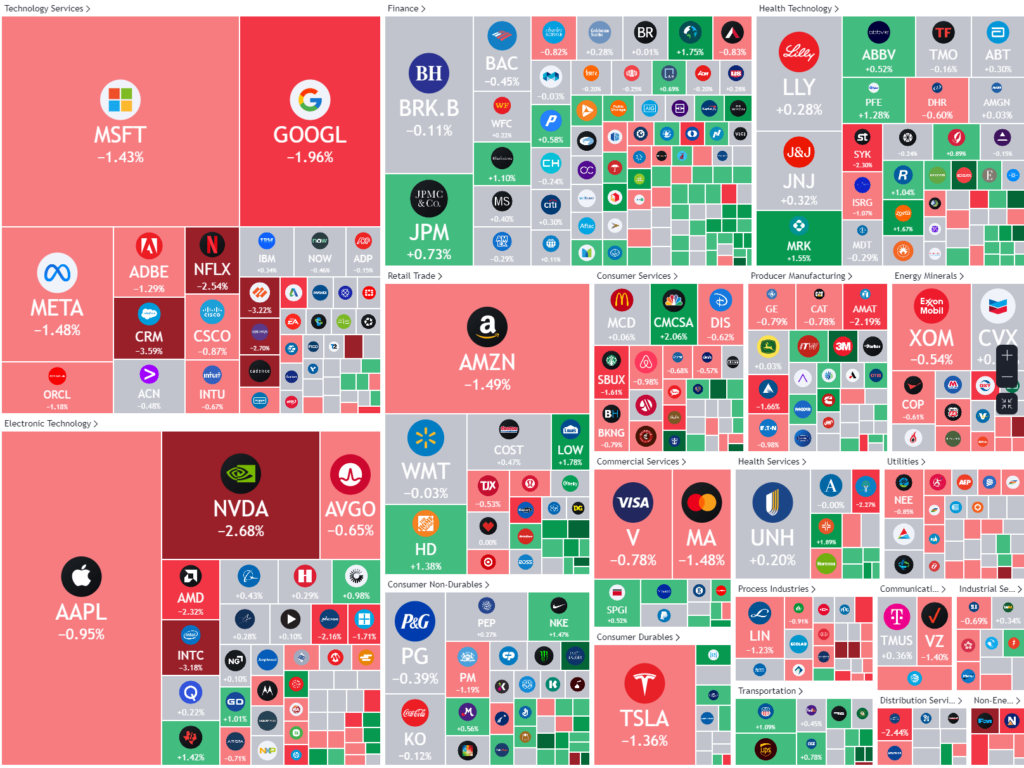

Big tech stumbled, paced by a decline in Alphabet and Apple Inc, with the latter also weighed by concerns about iPhone production disruptions. Apple is reportedly facing iPhone supply disruptions in India as suppliers Foxconn and Pegatron stopped iPhone production at facilities near Chennai, India owing to adverse weather Reuters reported Monday, citing sources. Meta Platforms, meanwhile, fell more than 2% after CEO Mark Zuckerberg sold 680,000 of his shares in the company in November, according to a US Securities and Exchange Commission filing.

Crypto-related stocks including Coinbase, MicroStrategy and Riot Platforms rallied sharply after bitcoin crossed $40,000 for the first time this year, topping out at $42,000

S&P 500 - Heatmap

The Day Ahead

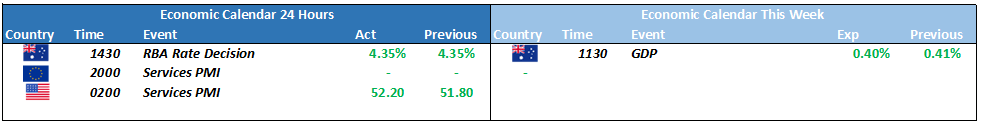

ASX SPI 7106 (-0.53%)

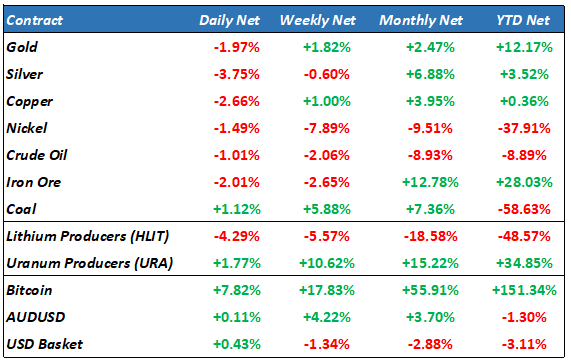

The ASX is likely to be cautious leading into today’s RBA meeting at 1430, despite the markets pricing in very little chance of a hike. This won’t be helped by a pull back from yesterday’s rally as commodity prices pulled back from highs, particularly in gold/silver as gold bugs belief is being tested at record highs

Origin Energy shares will resume trading after shareholders rejected a takeover proposal by Brookfield and EIG was rejected by shareholders. The Bank of Queensland hosts its annual meeting.