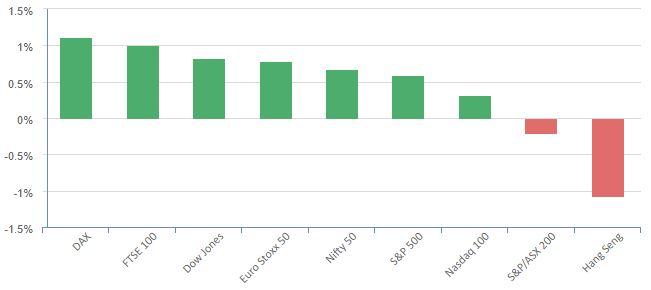

Overnight – Solid start to December led by Cyclicals and Small-caps

Stocks rallied and the S&P registered its highest close of the year on Friday, starting December on an upbeat note as remarks from Federal Reserve Chair Jerome Powell bolstered the view that key policy rates have peaked. All three major U.S. stock indexes advanced, with economically sensitive transports and small caps enjoying the most robust gains.

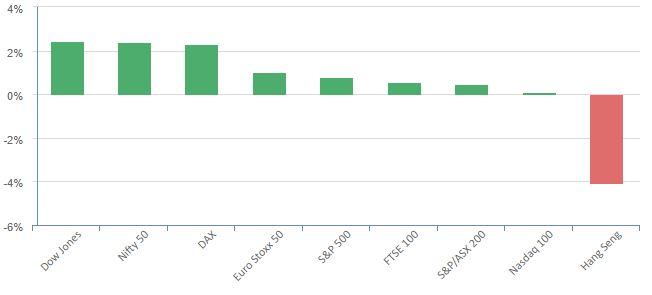

All three indexes notched their fifth consecutive weekly percentage gains. On Thursday, they wrapped up a banner month in which the S&P 500 and the Nasdaq registered their biggest one-month percentage gains since July 2022, and the Dow closed at its highest level since January 2022.

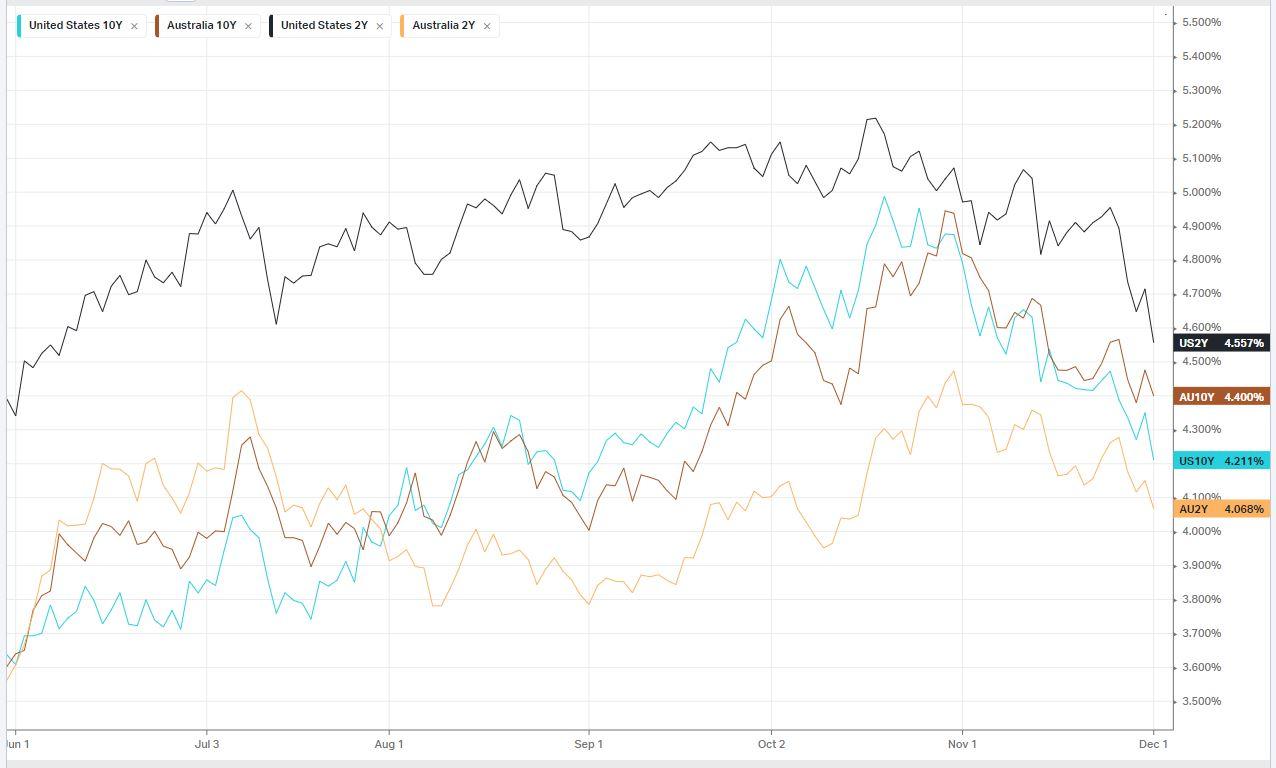

In prepared remarks, Powell acknowledged the central bank’s need to “move forward carefully” amid signs of economic softening, as the risks of over- and under-tightening its monetary policy are becoming more balanced. Treasury yields fells sharply, shrugging off Powell’s warning that it “would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease”

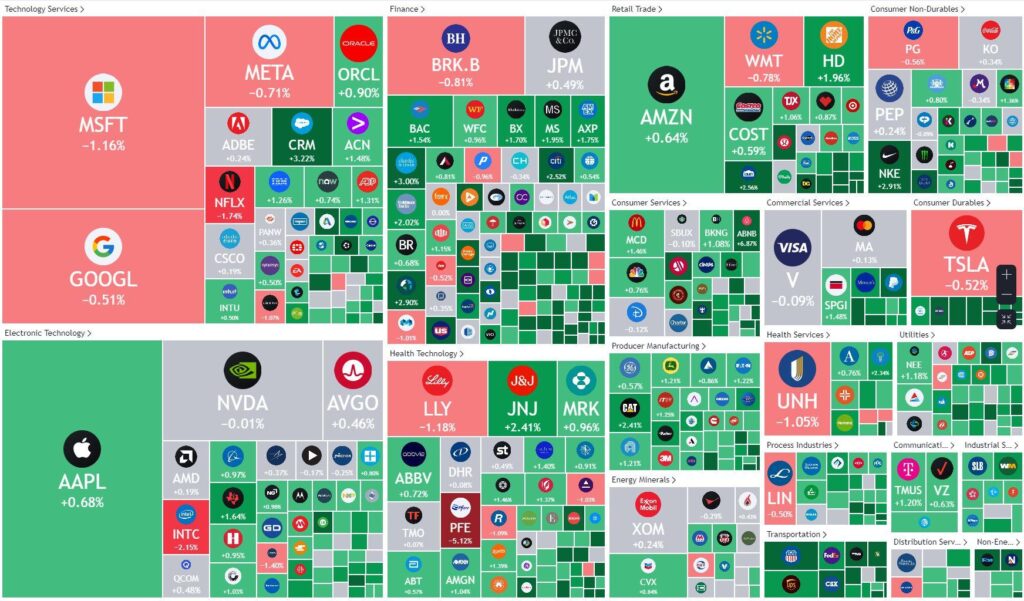

Tesla cut some losses to end the day around 0.5% lower after the electric-vehicle manufacturer revealed a starting price of nearly $61,000 for its highly-anticipated Cybertruck, about 56% higher than the starting price announced in 2019. Apple and Paramount are reportedly in early discussions to bundle their streaming services at a discounted rate, The Wall Street Journal reported Friday.

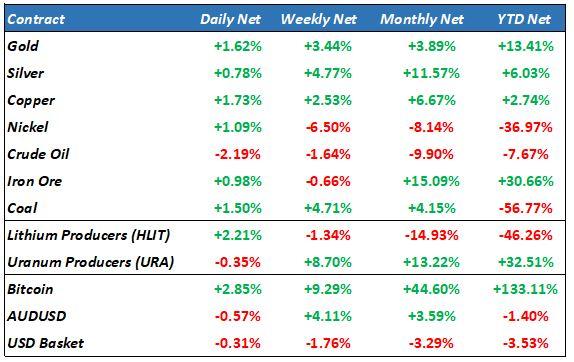

edged higher Friday, clawing back some losses from the previous session when the voluntary oil output cuts agreed by OPEC+ producers fell short of expectations.

S&P 500 - Heatmap

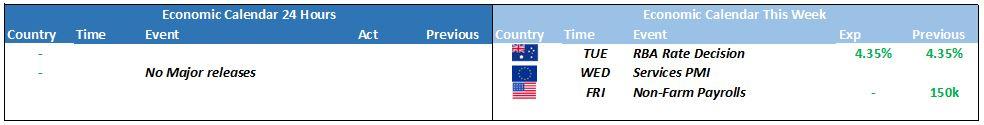

The Day Ahead

ASX SPI 7154 (+0.91%)

The shift in sentiment towards more cyclical stocks and small-caps will help the ASX200 finally find its groove today, with the rise in commodity prices likely to lead the market higher along with the banks. The RBA announcement tomorrow could cap the gains as investors worry about “one more hike” although the solid start to December is likely to flow through to an extended rally leading into Santas visit later in the month