Overnight – Banks drive stocks higher, gold rallies on rates outlook

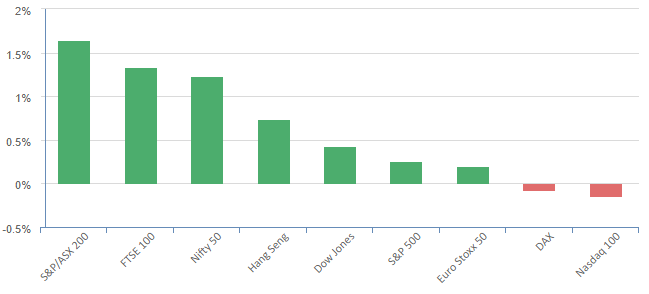

US stocks gave up some gains late in the session, as the post-Fed rally pushed stocks into overbought territory, triggering concerns that the surge may have been too much too soon.

The three key indexes including the Dow, S&P 500 and Nasdaq retreated from session highs after breaching technically “overbought” levels, or a level above 70 on the relative strength index, or RSI, a technical tool that indicates whether a security is overbought or oversold.

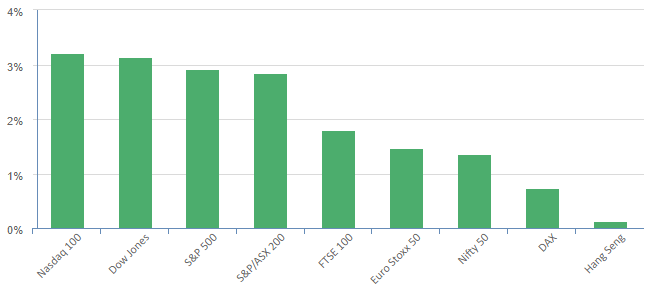

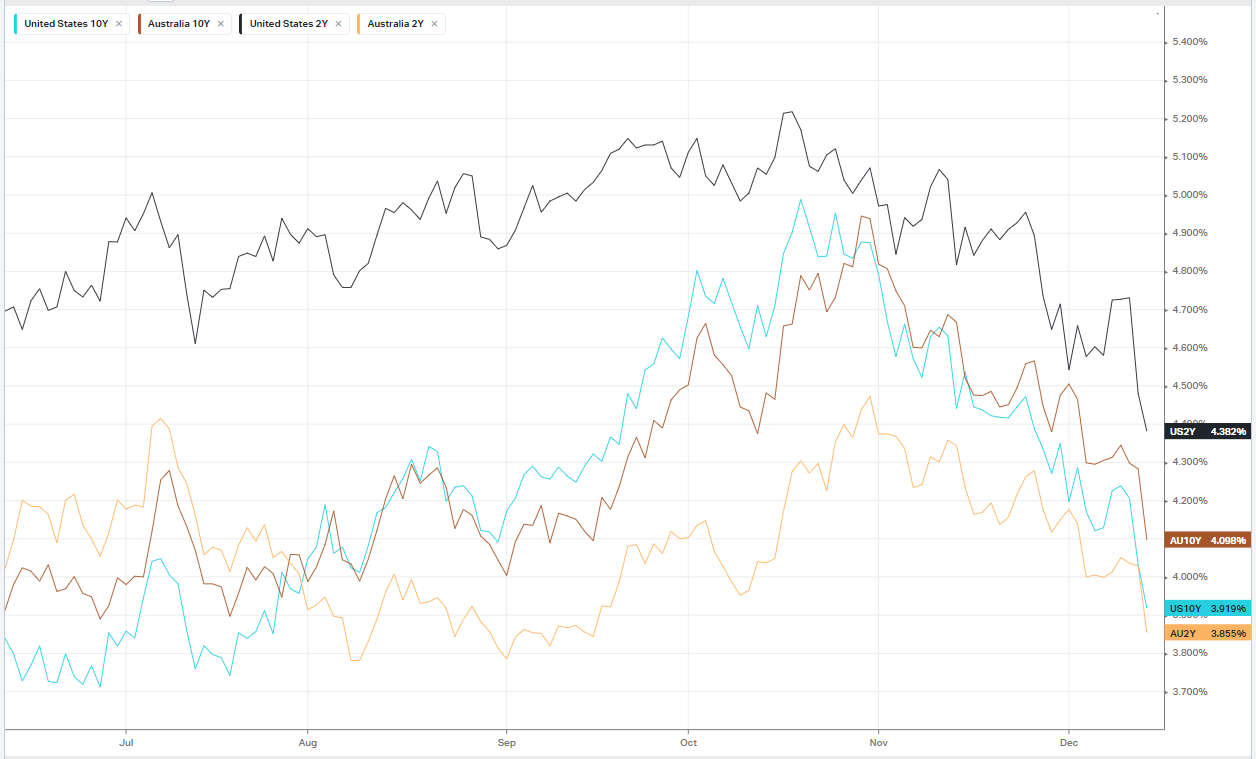

The earlier intraday surge in stocks came a day after the Federal Reserve forecast three rate hikes for next, with Fed chairman Jerome Powell announcing that it discussion of when to cut rates was now on the table.

Banking stocks and small caps continued their strong run with the financials rallying 3%+ for the second day in a row and the Russel2000 adding another 2.73%

Initial jobless claims dropped 19,000 to a seasonally adjusted 202,000 for the week ended Dec. 9, but while that was short of economists estimates, some continue to see a material weakening ahead. Small businesses, in particular, are facing pressure from higher interest that have hiked up monthly business, Jefferies said. Still, the consumer continued to show strength, with U.S. retail sales unexpectedly rising 0.3% on the month in November as the holiday shopping season got off to a brisk start.

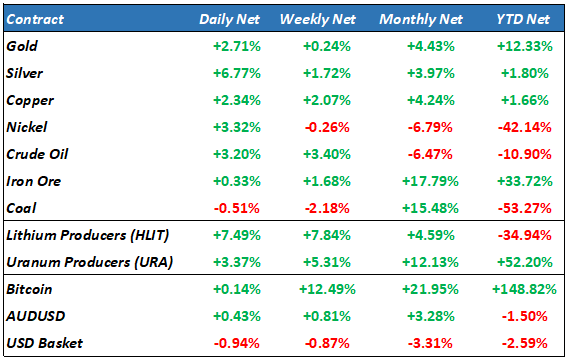

Gold and silver both extended their recent run, up 2.7% and 6.7% respectively, as the USD fell away on the end of the hiking cycle

S&P 500 - Heatmap

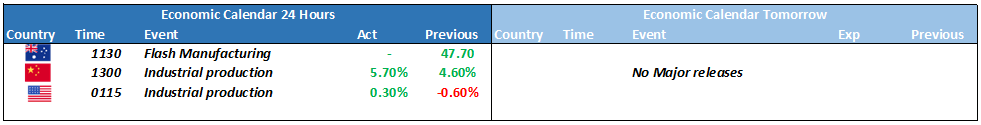

The Day Ahead

ASX SPI 7446 (+0.48%)

Further catch up should be played by the ASX again today, as commodities and energy stocks had a solid rally overnight, while the banking sector was the clear winner in offshore markets overnight. While yesterdays strong employment number may stoke rate hike fears, the US pivot will likely be the loudest voice in the room when it comes to interest rates

- Orora said on Thursday its newly acquired bottle-making business in France will deliver flat earnings in 2023-24 because of soft demand.

- Westpac boss Peter King has committed to visiting the Tiwi following concerns about consultation on Santos’ Barossa project.

- Elders had a big 63 per cent protest vote against its pay practices on Thursday after Mark Allison stayed on as CEO with higher pay.

- Alumina shares rose to an eight-week high on Thursday after the WA government approved the company’s five-year bauxite mining plans in the state’s Jarrah forests.

- National Australia Bank holds its AGM.