Overnight – Investors remain upbeat despite looming inflation data & Fed meeting

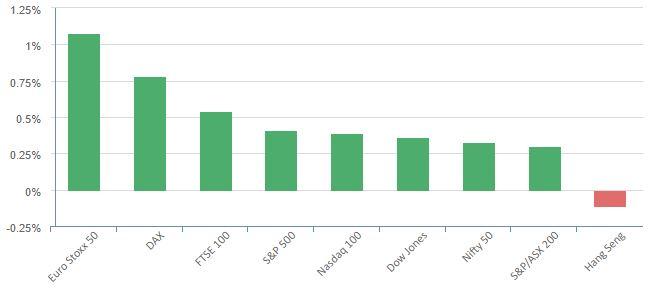

Stocks finished higher overnight as investors continued their bullish bets on risk assets, a day ahead of fresh inflation data and the Federal Reserve’s final two-day policy meeting this year.

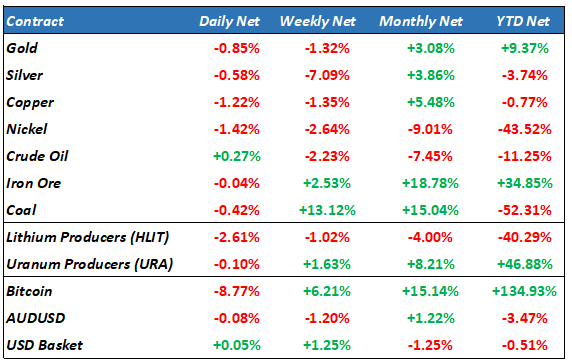

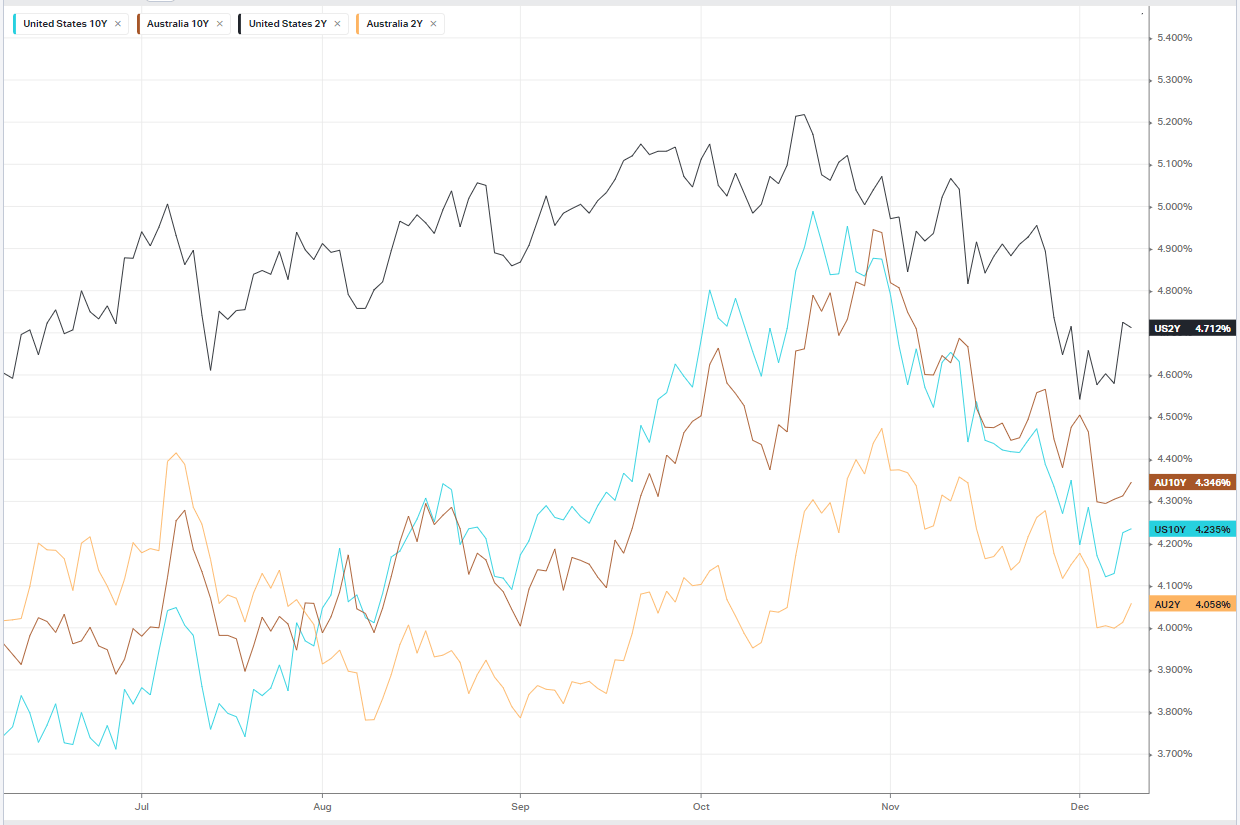

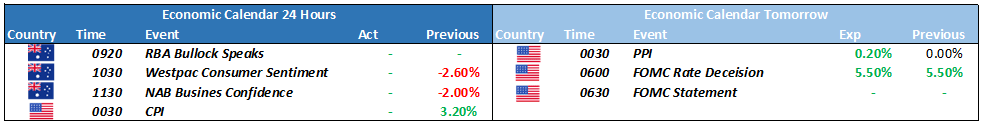

The FOMC is tipped to hold rates at 5.50% on Wednesday. Much of the focus will likely be the Fed’s projections for the economy, inflation, and the number of cuts expected next year. The meeting will arrive on the heels on fresh inflation data expected to show ongoing slowing in price pressures. Comments from Fed chair Jerome Powell will also be garnered for a potential push back on market expectations for a sooner rather than later rate cut. In the wake of last week’s jobs data and separate numbers showing the slowest annual rise in underlying price gains in two years in October, markets are now pricing in a nearly 50% chance of a quarter-point rate decrease in borrowing costs as soon as May, an unlikely scenario at best as it would require more than 3 month data to change the cycle.

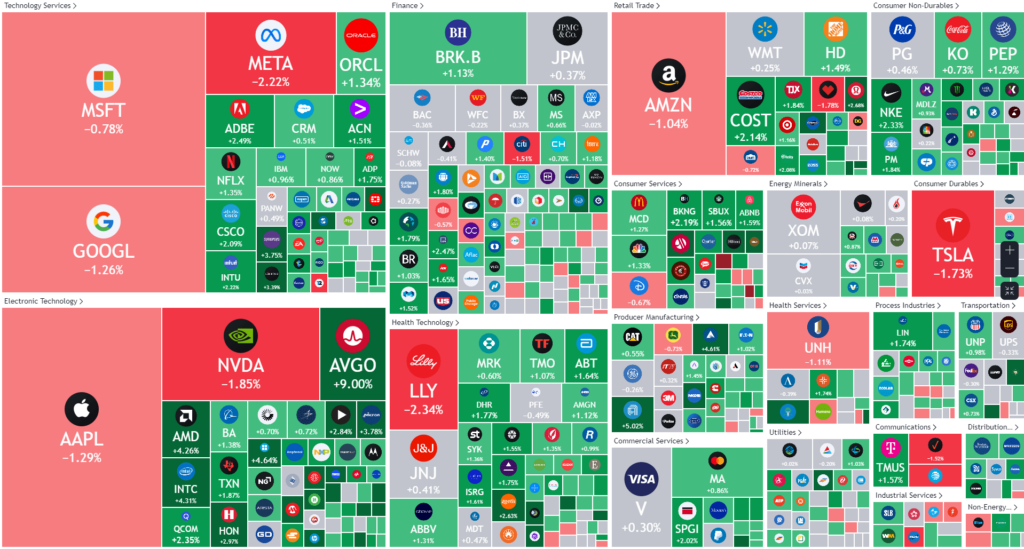

Tech stocks were the biggest laggard on the day, paced by a more than 1% decline in Microsoft and Alphabet, though a sharp jump in semiconductor stocks kept a lid on losses.

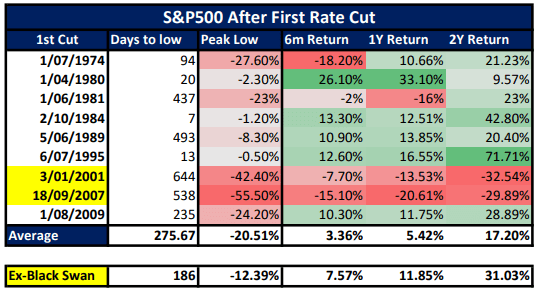

Investors seem to be overly optimistic on what rate cuts mean for the stock market. A rate cut from central banks would mean a significant slowdown in the economy and rise in the unemployment rate, neither a positive thing for Wall St and Main St.

Since 1974, investors have been bullish at the end of each tightening cycle, however, the first rate cut in the cycle has seen an average 20.51% fall in the S&P500 (-12.39% excluding Tech bubble and GFC) See table below

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7227 (+0.18%)

The focus today will be on the RBA Gov speaking at 920 AEDST this morning and also consumer and business sentiment data from 1030. We don’t expect a major reaction on volume with the recent thin trading conditions a feature of the lethargic ASX, seemingly asleep at the wheel for the last 6 weeks. These thin conditions are a double-edged sword, with both opportunity and potential pain in some stocks.

Sigma Healthcare shares are set to come out of a trading halt at the start of trade. The company said it would merge with Chemist Warehouse in an $8.8 billion deal.