Overnight – Stocks rally as Payrolls figures shows US economy remains firm

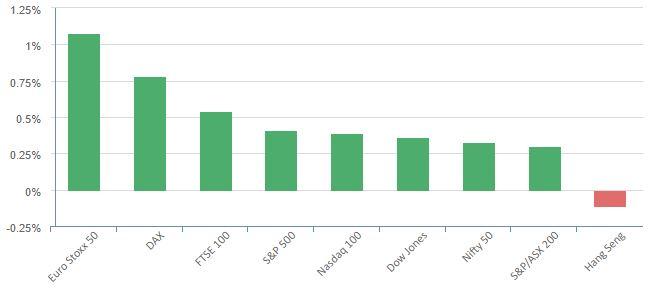

Equities continued their dream run with the major indices locking in 7 weeks in a row of gains, a feat not accomplished since 2019. This was sparked by a stronger-than-expected jobs report added to optimism that the U.S. economy will avoid a recession amid ongoing bets for a rate cut early next year.

Nonfarm payrolls increased by 199,000 jobs last month after rising by 150,000 in October, according to data from the Labor Department’s Bureau of Labor Statistics (BLS). Economists had estimated that payrolls would climb by 180,000 roles.

Average hourly earnings, a key gauge of wage growth, rose at a monthly pace of 0.4% versus October, accelerating from a previous reading of 0.2% and faster than predictions of 0.3%. The unemployment rate in the world’s largest economy, meanwhile, unexpectedly ticked down to 3.7%.

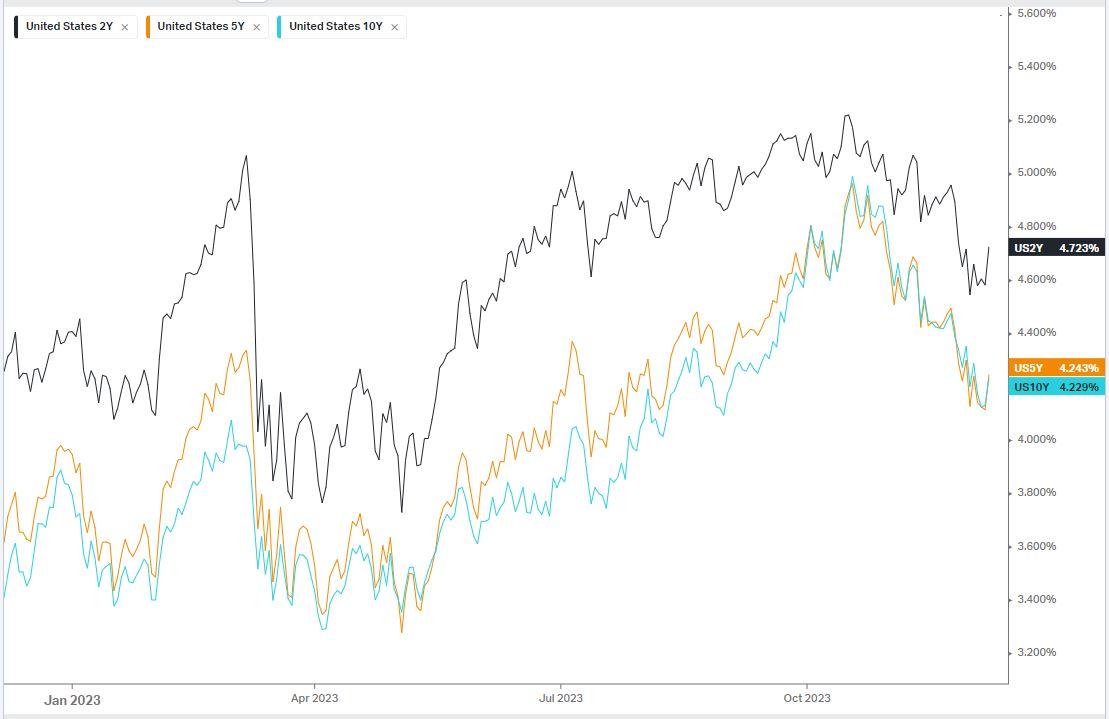

The uptick in wage growth, which risks boosting inflation, muddied the optimism for rate cuts, pushing Treasury yields higher, though some economists were quick to downplay the strength of report attributed to the return of employers that were on strike.

Investors sentiment is now firmly in the “Santa Rally” and “rate cuts next year” camps which is unlikely to be rattles until economic figures throw doubt. The current scenario is based on very selective cherry picking of convenient truths, when the reality is that a slowdown in the economy has never triggered a stock market rally. While we believe the rally will continue for the coming weeks, we remain cautious of a rally built on a foundation of sand.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7225 (+0.22%)

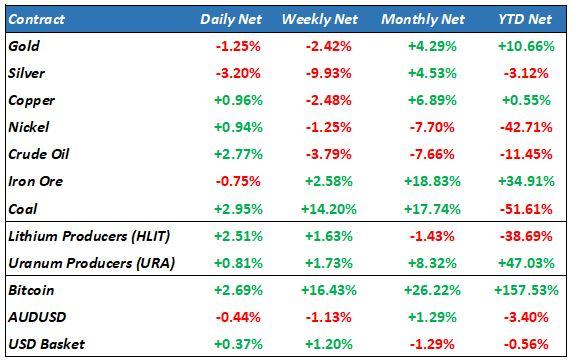

The ASX is likely to push higher with the soft landing and “Santa rally” thesis now firmly etched in investors minds. Lithium and uranium stocks are likely to continue their recent rallies with more global commitments to clean energy.

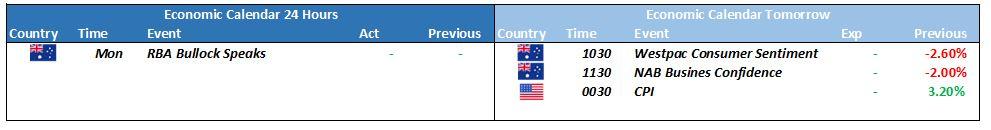

Clues around AU monetary policy could come from Gov Bullock today, while an announcement from the Albanese Govt to increase tax on foreign investment in housing and a reduction in immigration may hurt the RIETs sector