Overnight – Equities lock in solid November as inflation declines

Equities closed higher overnight as investors digested an ongoing slowdown in the pace of inflation and mostly better than expected corporate earnings

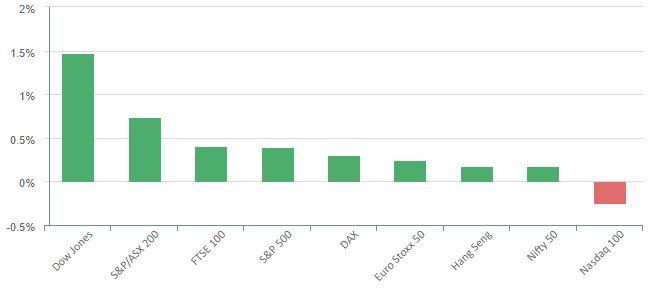

The US indices locked in hefty gains this November. The value based DOW gained 7.2%, (best month since October 2022) the SPX gained 8.5%, while the tech-based Nasdaq has advanced nearly 11% – both set for their best monthly performances since July 2022.

The October personal consumption expenditures price index, the Fed’s preferred measure of inflation, slowed to a 0% pace, compared with forecasts for a 0.1%, from a 0.4% last month, taking the annualized figure to 3.4%, down from 3.7% the prior month.

Core PCE inflation, which the Fed believes is a more accurate gauge of underlying inflation slowed to a 3.5% pace from 3.7% the prior month. The slowing pace of inflation comes even as the labor market appears strong than expected as initial jobless claims climbed by less than expected. Treasury yields shrugged off the signs of slowing inflation, with the yield on the 10-year Treasury up 7 basis points to 4.339%.

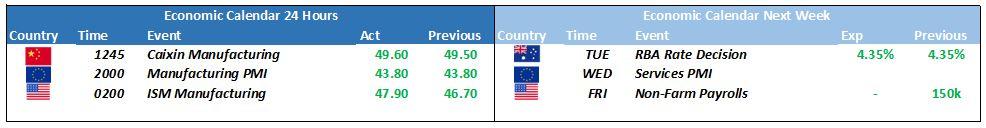

In a confusing reversal of early in the weeks Fed speak, NY Fed Williams said that the Fed’s rate-hike cycle has likely come to end, though warned that if disinflation doesn’t continue, then the central bank could resume hikes. “Based on what I know now, my assessment is that we are at, or near, the peak level of the target range of the federal funds rate,” Williams said, though added that “if price pressures and imbalances persist more than I expect, additional policy firming may be needed.” These comments completely flying in the face of remarks from earlier in the week

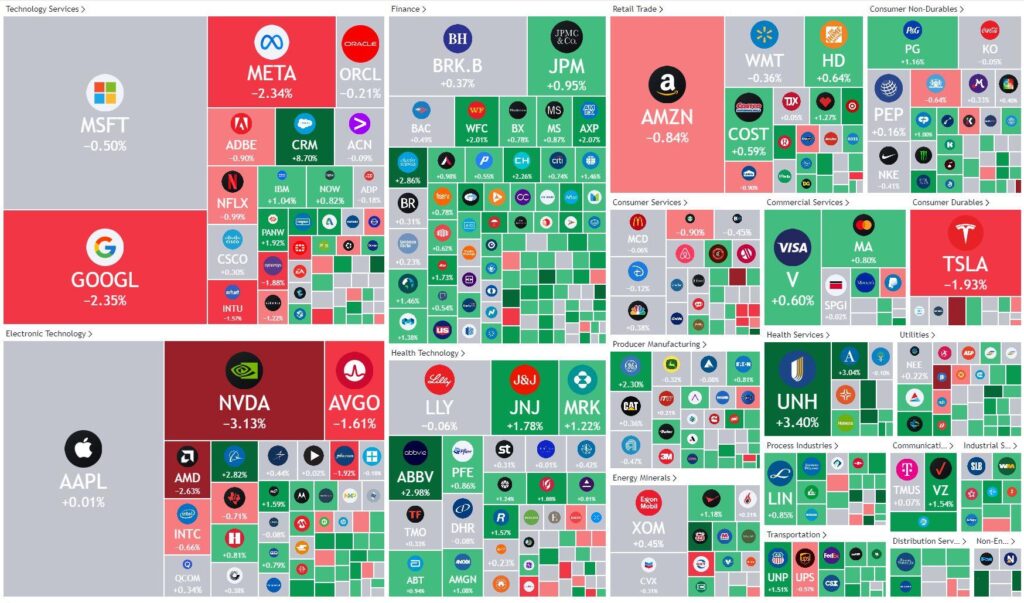

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7085 (-0.11%)

The consistently strong offshore lead may lead to a Friday rally today, as value stocks drove the rally in the US, usually a good indicator for the ASX200. Leading into OPEC+ oil stocks are likely to hold firm and looking ahead to next week, the RBA rate decision next Tuesday may hold back the REITs sector

Premier Investments hosts its annual meeting today