Overnight – Equities run out of steam after stellar run

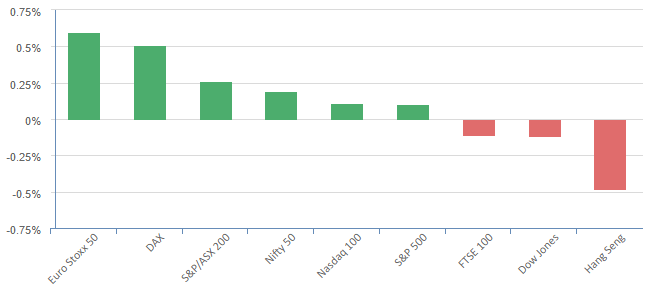

Equities took a breather Wednesday, a day after notching their longest winning streak in two years as investors continued to digest quarterly earnings and remarks from Federal Reserve officials.

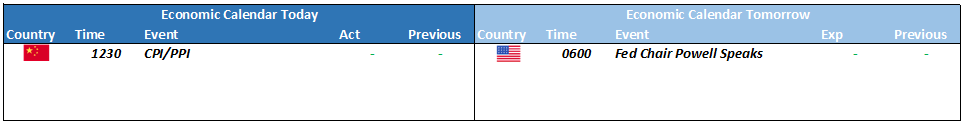

Fed chairman Jerome Powell didn’t offer clues on future monetary policy in opening remarks at the Fed’s statistics conference on Wednesday, but he is slated to speak as part of panel on Thursday.

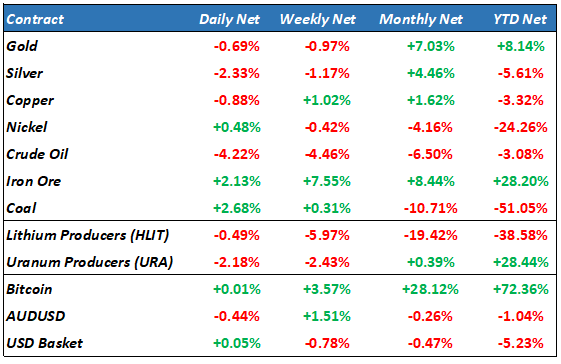

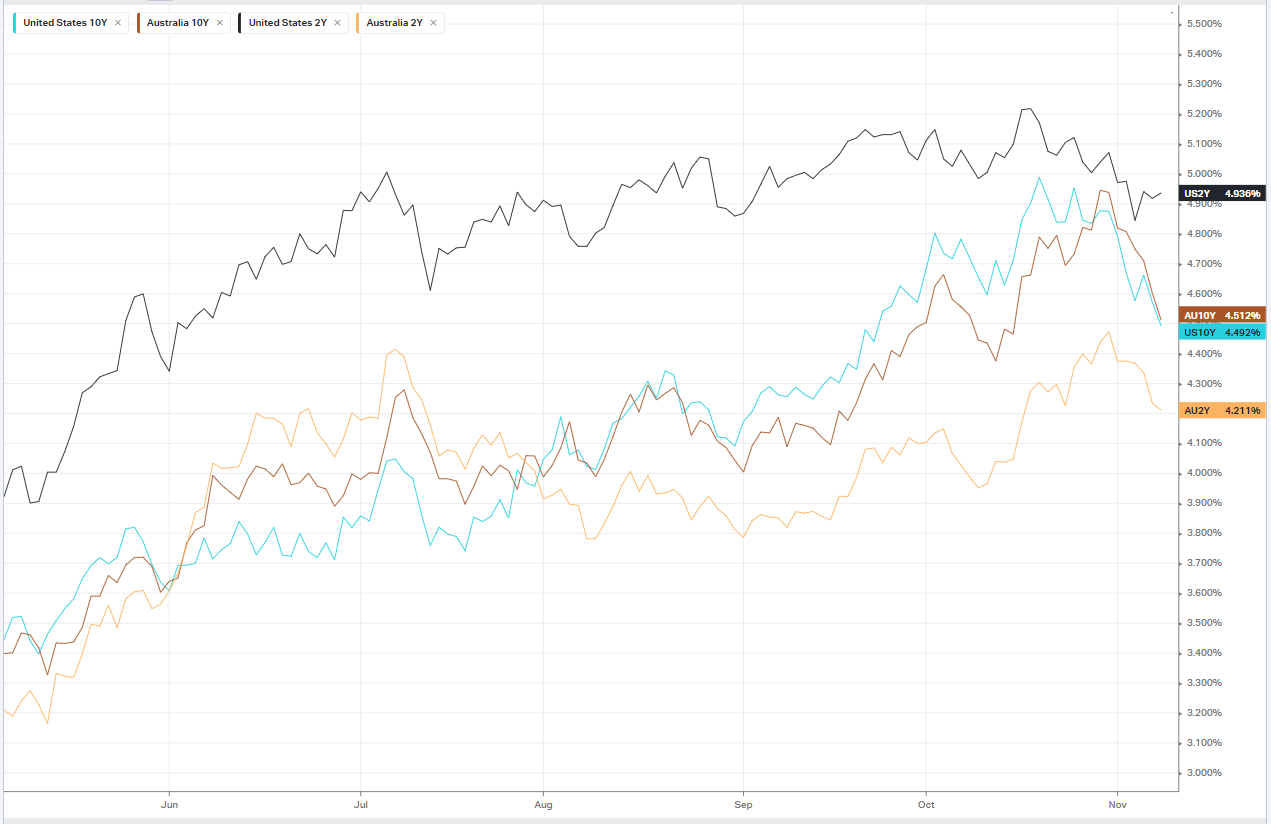

The yield on 10-year Treasury remained in the red after the U.S. Treasury auctioned $40 billion of 10-year notes at a high yield of 4.519%, lower than the prior auction’s 4.61% yield. Analysts viewed the drop as acceptable given the increased size.

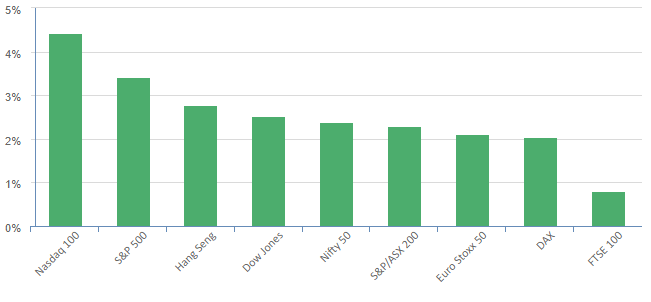

Utilities and energy stocks were the biggest decliners on the day, with the latter weighed pressured by falling oil prices on worries about softer global energy demand. As well as demand concerns, a surprise surge in U.S. crude inventories also added to concerns about slowing demand.

Eli Lilly shares climbed after the U.S. Food and Drug Administration approved the drugmaker’s weight loss treatment.

The gap between the broad Russell 2000 index and the large cap indices of the DOW, S&P500 and Nasdaq is the largest since 2007 suggesting the economy is slowing sharper than the “headline” indices suggest as the “Magnificent 7” disguise the effect of higher inflation and interest rates on

Earnings Results

Robinhood (HOOD) -fell more than 14% after reporting mixed quarterly results as revenue fell short of estimates following a decline trading activity amid a fall in users on the trading platform. The company said it expects weaker trading activity in November and December, given the timing of holidays, Goldman Sachs said, as it decrease its price target on Robinhood to $10 from $11 previously.

eBay (EBAY) -fell more than 2% after the e-commerce platform’s third-quarter results beat Wall Street estimates, but forecast softer-than-expected sales for the key holiday quarter.

Roblox (RBLX) – reported a narrower than expected loss in Q3 following stronger bookings in the quarter and the online gaming platform also said it would begin offering guidance next year.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7030 (+0.40%)

The ASX is likely to be dominated by company specific news today with a few “heavy hitters” releasing results. The rise in iron ore will help materials, the fall in oil will hurt energy stocks and tech should remain supported

National Australia Bank lifted its cash profit by 8.8 per cent to $7.7 billion for the 2023 financial year and boosted its final dividend to 84¢ a share. The big four bank also pointed to a “more challenging environment” over its second half which it expects will persist during 2024.

Challenger has expanded its business ties with an origination agreement with Apollo Global Management which will give the company access to origination flows, co-investment opportunities, and new investment strategies.

Zip says it expects to deliver positive cash earnings in fiscal 2024 from increased revenue margin from new products, according to an investor presentation.

Accounting software company Xero swung to net profit of $NZ54.1 million ($50 million) for the half year compared to a net loss of $16.1 million a year ago.

And Orica posted a net profit of $296 million for fiscal 2023, up nearly five times from a year ago. It also declared a 23 per cent increase in total dividends to 43¢.

Amcor, Cooper Energy, Myer, Nine Entertainment, Seven West Media and Star Entertainment all host annual general meetings, and Westpac trades ex-dividend.