Overnight – Tech bulls drive equities to their best run in 2-years

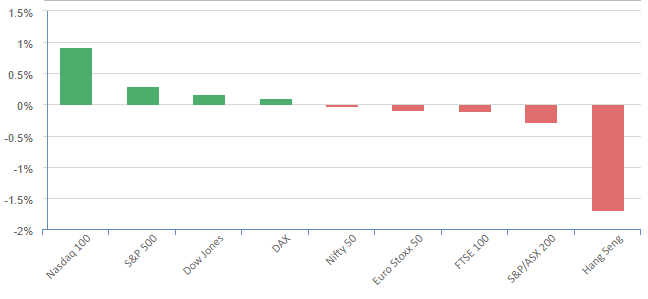

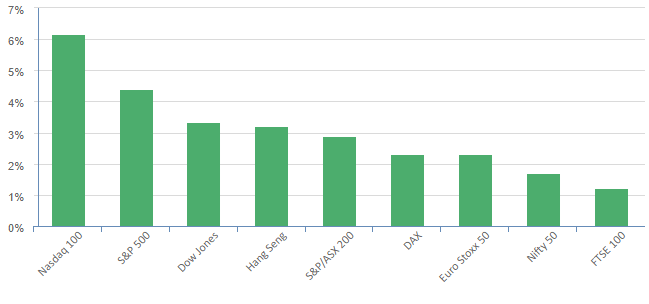

Equities with the S&P 500 and Nasdaq notching their longest streak of gains in two years, as a retreat in U.S. Treasury yields buoyed mega cap growth stocks, despite Fed board members signaling rate hikes aren’t off the table.

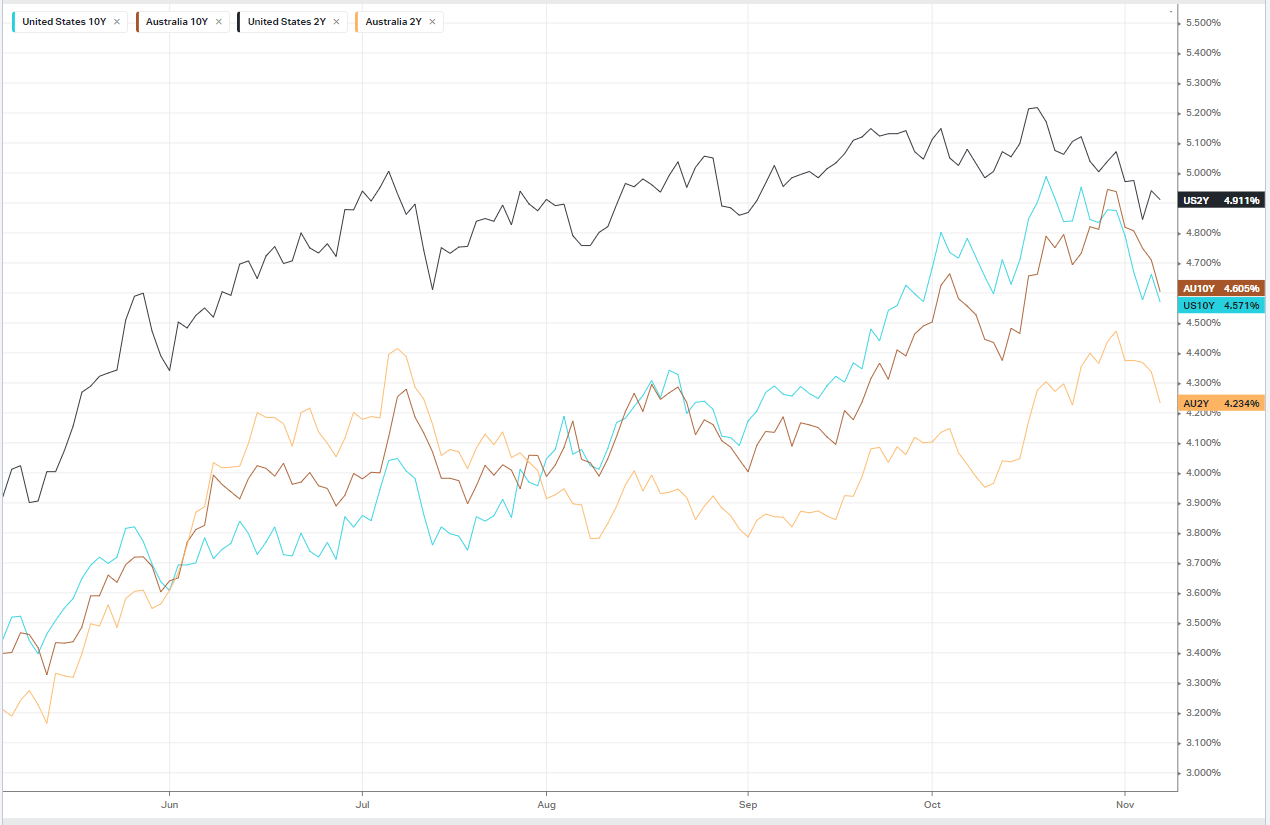

Expectations that the Fed’s rate hike cycle is at an end have increased in recent days, but the market remains sensitive to the possibility of more hikes, and central bank officials have been cautious in comments on the future rate path.

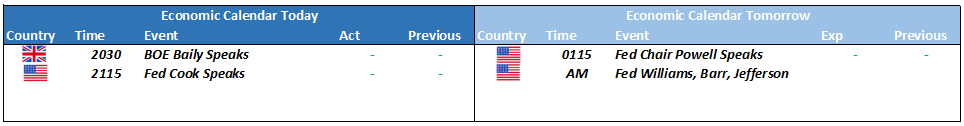

Markets are pricing in a 90.2% chance the Fed will once again hold rates steady at its December policy meeting, up from 68.9% a week ago, according to CME’s FedWatch Tool. Fed Chair Jerome Powell is set to speak on Wednesday and Thursday.

Work space provider WeWork, which was valued at $47B, has filed for bankruptcy in a New Jersey court, as it grapples with a post-pandemic downturn in office occupancy and expensive leases. Shares were halted.

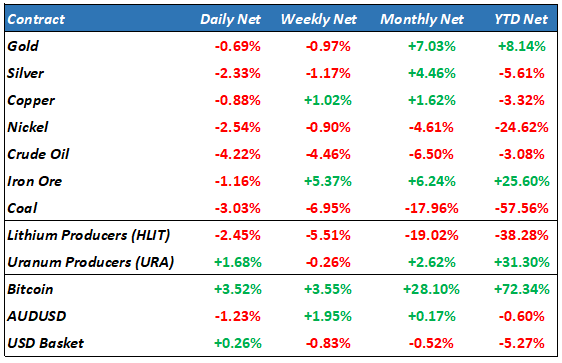

Oil prices fell sharply Tuesday, dropping to over two-month lows, after the disappointing trade data from China raised concerns over sluggish demand in the world’s largest oil importer.

Earnings Results

Uber Technologies (UBER) – weaker-than-expected quarterly earnings were overshadowed by stronger-than-expected gross bookings, the value of transactions on its app. Its shares rose nearly 4%.

Datadog (DDOG) – surged 28% after the cloud infrastructure lifted its annual guidance and reported third-quarter results that topped Wall Street estimates.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6992 (+0.02%)

A “dovish hike” was the description from analysts regarding yesterdays hike of 25bps from the RBA, prompting a market chorus of “the RBA is finished” from the financial press and analysts for the third time this year. While yesterdays hike was already priced in, we may see some small fallout for debt laden companies today.

The offshore lead from tech will help the index early, however, Chinese figures yesterday have seen a chunky sell off in energy and commodities which will cap any ground the index makes. The Chinese trade balance showed that imports were significantly higher than expected, while exports were significantly lower than expected, which in our minds is a positive for Australian commodity exporters and likely provide a buying opportunity

James Hardie Industries releases earnings today. ResMed trades ex-dividend.

Hosting annual meetings today: Allkem, Ardent Leisure Group, Breville, Chorus, Domain, Magellan Financial Group and Vulcan Steel.