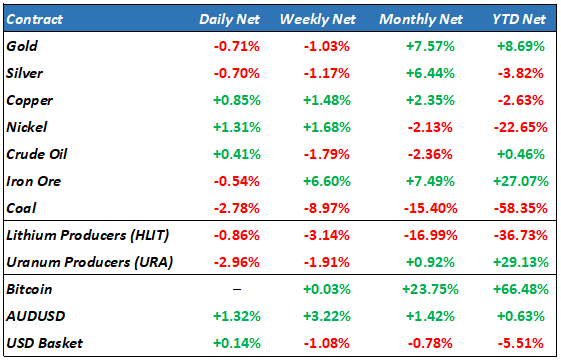

Overnight – Bulls take breather from breakneck rally as bond yields bounce

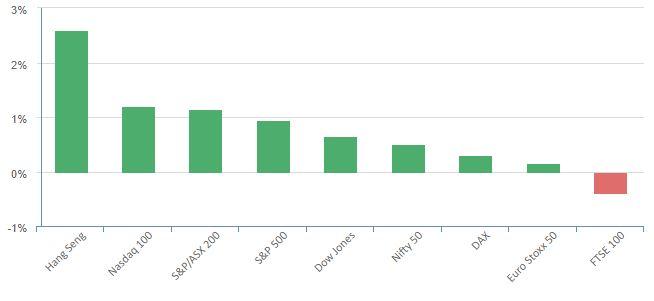

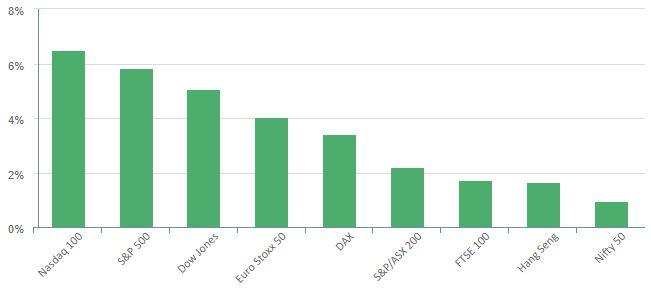

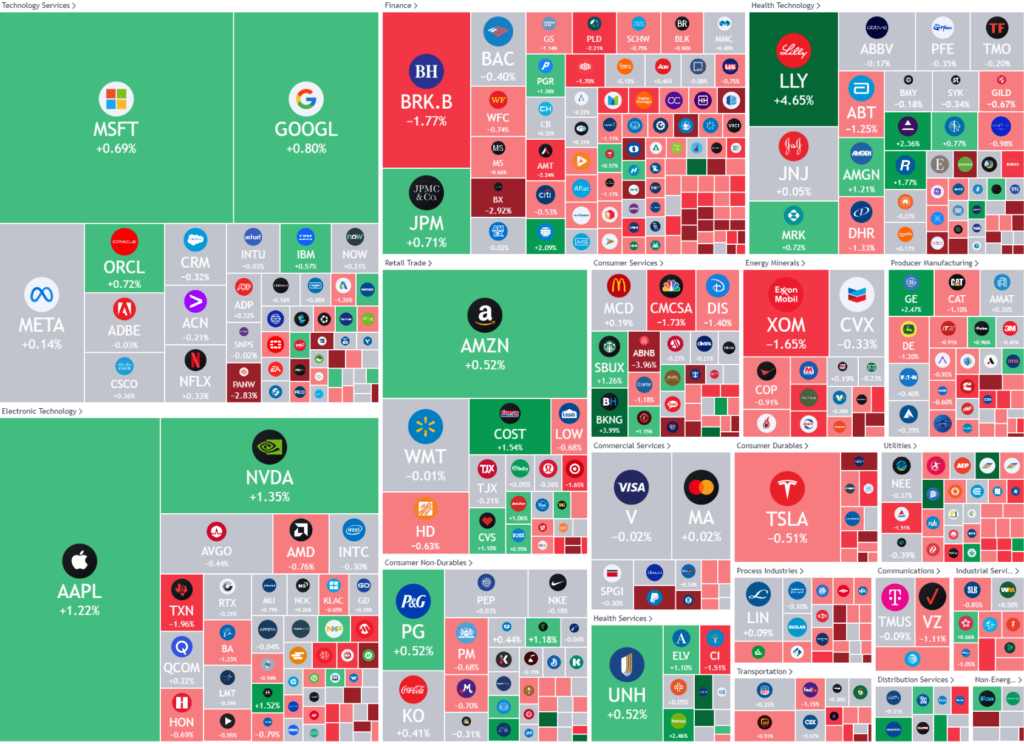

Equities finished relatively unchanged overnight, taking a breather from a weeklong rally not seen in 12 months. The “Magnificent 7” (AAPL, GOOG, MSFT, TSLA, NVDA, AMZN, META) did much of the heavy lifting, with energy and the banks struggling.

The upcoming week light is on economic data, although a number of Fed speakers are scheduled to give their opinions on rates and the economy this week, including two appearances by Chair Jerome Powell – the second of which on Thursday includes a Q&A session.

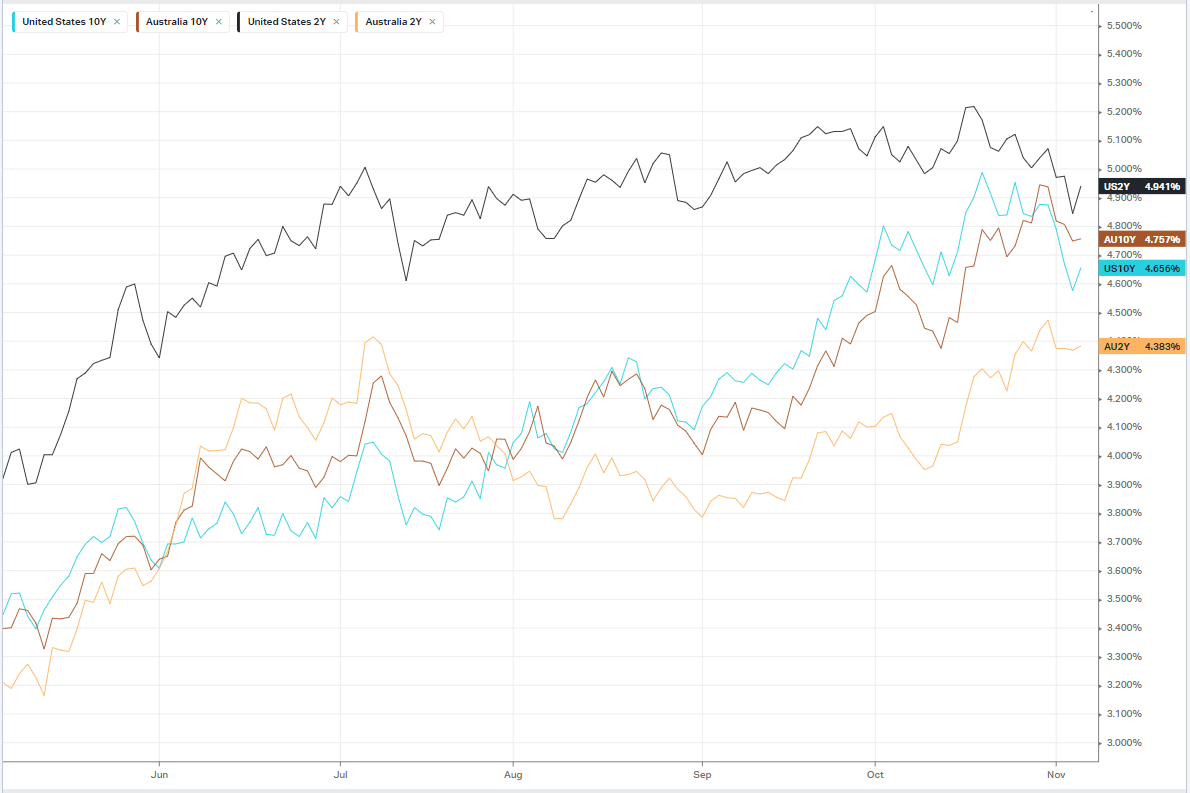

Overnight, Federal Reserve Governor Lisa Cook said on Monday that an expectation of higher for longer interest rates doesn’t “appear to be causing the increase in longer-term rates”. While this is, at first, a confusing statement, what Gov Cook is likely alluding to is the liquidity the Fed is draining from the system, reversing QE. Adding to the upside pressure on yields is the ballooning US Govt debt, forcing the treasury to issue trillions in further debt to fund their debt payments (always ends well), giving investors good reason to demand more interest to take the risk.

Regional banks included Zions, Comerica, and PacWest fell as bank lending conditions tightened in Q3, slowing demand for loans, the Fed’s Q3 senior loan officer survey showed Monday.

The earnings season is starting to wind down, with 80% of the S&P 500 companies having already reported their quarterly financial results, with few major companies left to deliver updates

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6993 (-0.15%)

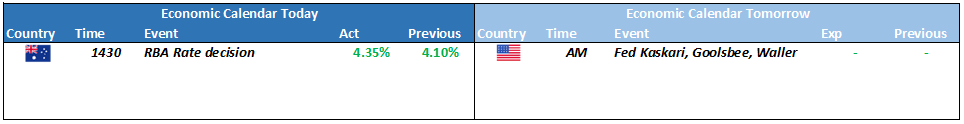

For the punters today, both in the investing and equine world, the focus will be firmly around 1 hour of the day, 2:30pm-3:30pm with the rates and race that stops the nation. The RBA is expected to deliver a 25bp hike and potentially point to another 25bps in December as a new Reserve Bank Governor taking the helm. We at MPC believe Michelle Bullock will take the opportunity to raise rates in a well-worn political path of new political and business leaders of making the “hard choice” with the flexibility to blame it on previous management if it is the wrong choice or take credit if it is the right choice.

The longer she leaves it, the more responsibility lands on her shoulders, something that public servants have a deep aversion to