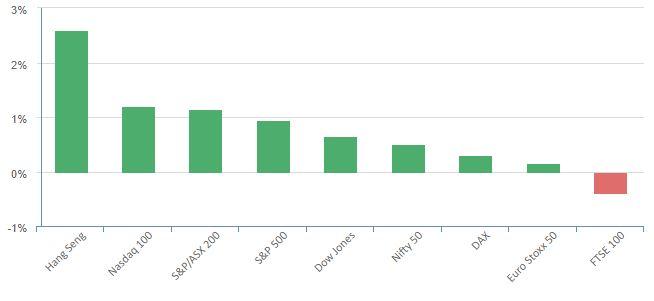

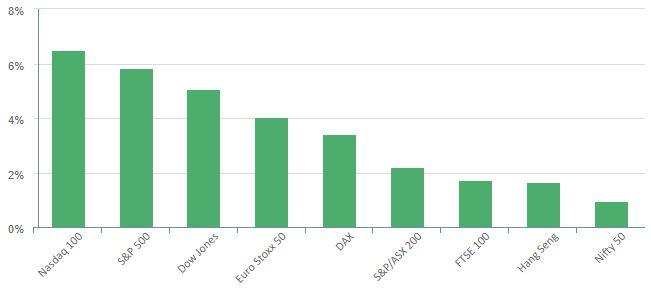

Overnight – Equities have best week this year as softer Jobs report bolsters “peak rates” speculation

Equities wrapped up the week with its biggest weekly gain this year as a weaker-than-expected jobs report stoked hopes that Federal Reserve rate hikes are now in the rearview mirror, pushing Treasury yields sharply lower.

The economy added 150,000 jobs in October, less than the 180,000 expected and down from 336,000 in September. The unemployment rate ticked higher to 3.9% from 3.8%, while average hourly earnings rose 0.2%, below expectations.

The fewer-than-expected jobs created in October and easing wage pressures stoked investor expectations the the Fed is unlikely to deliver another rate hike this year.

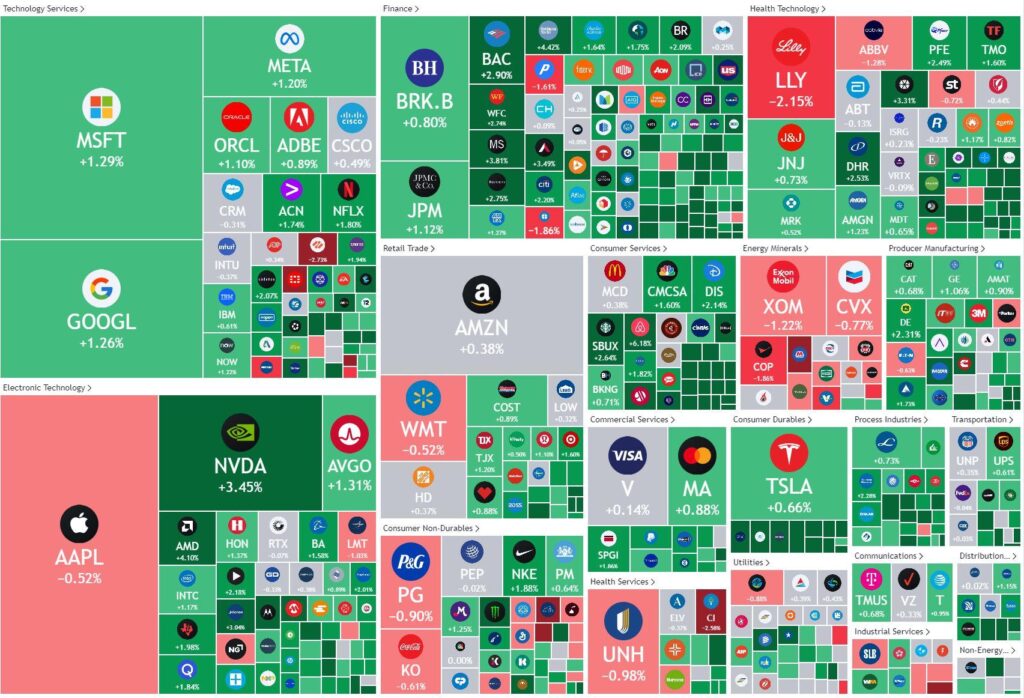

Apple cut the bulk of losses to end the day 0.5% lower after the tech giant forecast weaker-than-expected sales for the current key holiday quarter, blaming weak demand for iPads and wearables, especially in the key market of China. The California company flagged that revenue in its December quarter — typically one of its largest due to holiday shopping — would be in line with the corresponding time frame last year. However, the quarter will be one week shorter.

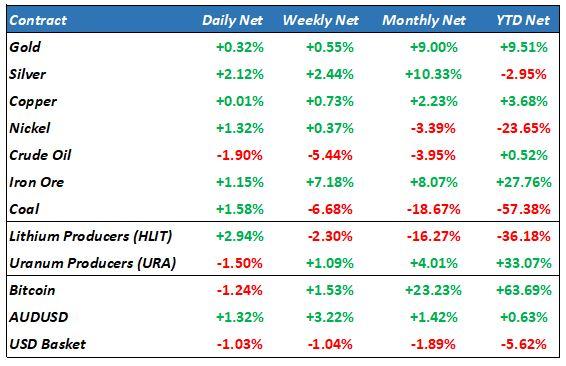

Oil prices fell Friday to second-straight weekly loss, pressured by easing fears of supply disruptions in the Middle East as concerns cooled about a wider conflict in the region amid a lack of escalation in the Israel-Hamas war.

Meanwhile, recent data out of China has underscored the uncertain demand outlook in the world’s top importer, adding further pressure on demand.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7000 (+0.20%)

The ASX should see a positive start to the week with a positive US lead. With the fall in the USD and bond yields gold and silver stocks should shine while fresh 15 month highs in iron ore will likely see the materials sector the best performer of Mondays session

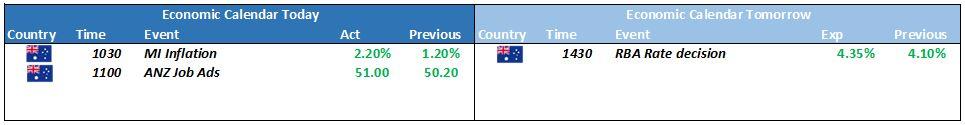

With the RBA & Melbourne cup tomorrow, some late afternoon selling may appear as investor take some risk off the table after a solid bounce over the last week