Overnight – Investor optimism fuels rate cut bets, despite stronger growth

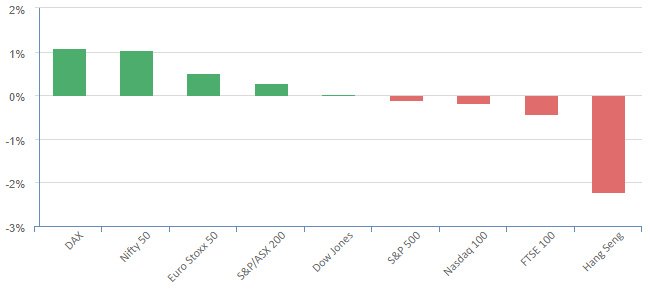

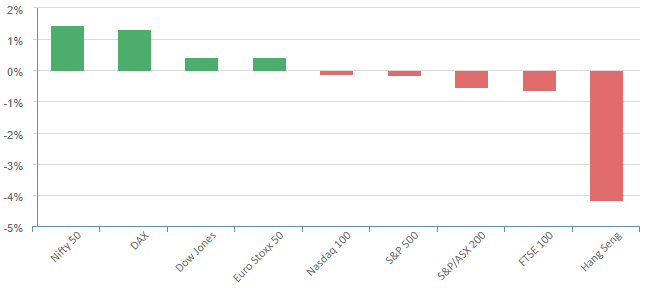

Equities closed mixed overnight to remain on course to post big November gains amid fresh optimism that the economy will avoid recession and ongoing optimism of Fed rate cuts of early next year, despite stronger GDP numbers

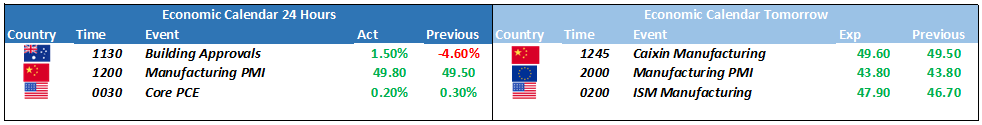

The US economy grew faster than initially thought in the third quarter, as gross domestic product increased at a 5.2% annualized rate last quarter, revised up from the previously reported 4.9% pace. The stronger growth spurred optimism that the economy likely to avoid recession and comes a day ahead of fresh inflation data tonight with PCE, the Feds preferred inflation gauge.

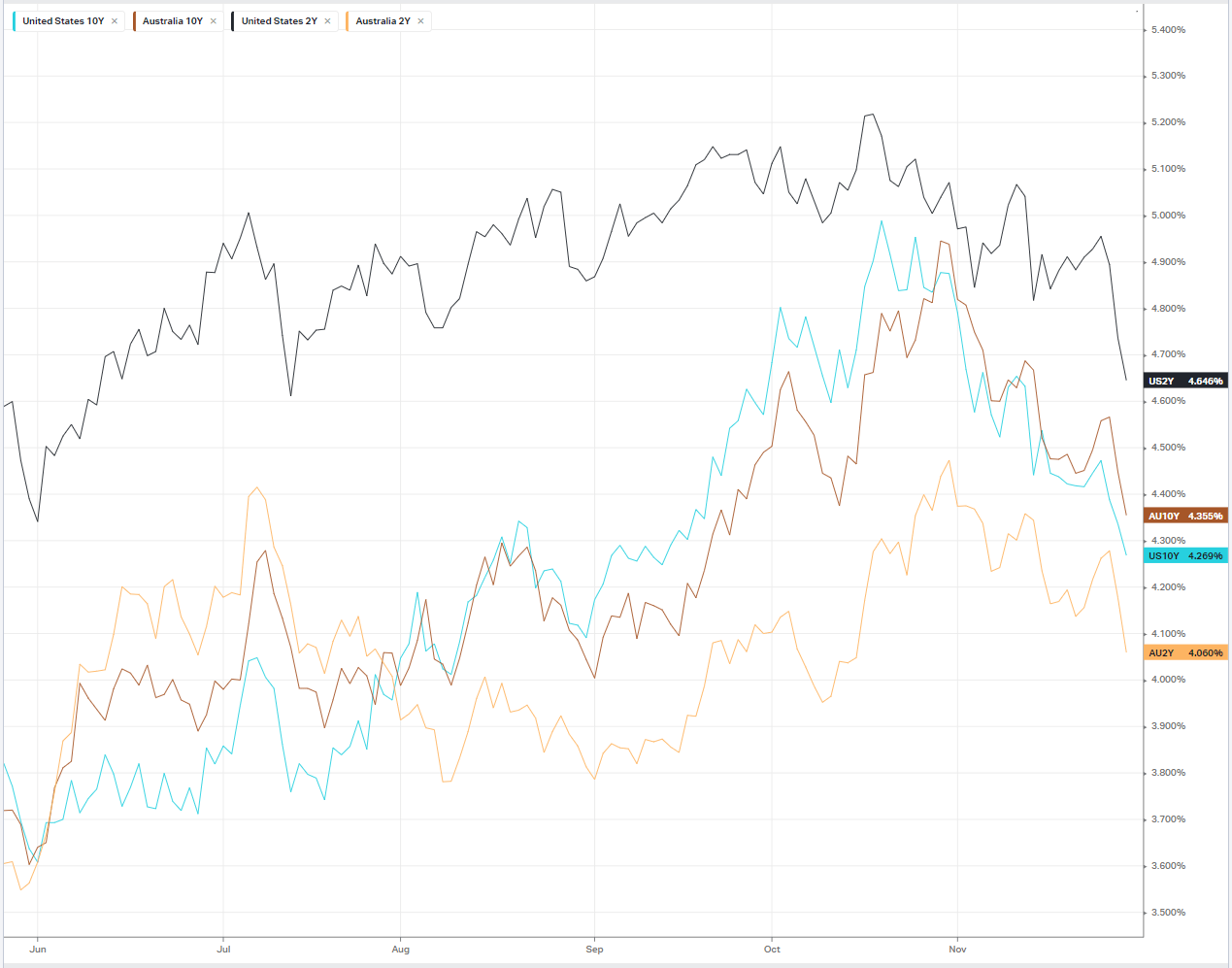

Bond yields added to losses from a day earlier amid ongoing rate cut bets following comments from Federal Reserve Governor Christopher Waller, who suggested on Tuesday that the U.S. central bank’s monetary policy is “well-positioned” to cool inflation. Waller, normally known as a hawkish voice at the Fed, added that should inflation continue to ease back down to the Fed’s 2% target for “several more months,” there is a chance that officials “could start lowering” interest rates. The remarks were taken as another sign that the Fed were done hiking rates, driving investor sentiment to price in a noticeably more dovish path for rates over the year ahead.

The market reaction to Waller and GDP are at odds with each other as economic fundamentals dictate that hotter than expected growth, will almost certainly curtail any chance of rate cuts, but the equity markets has chosen the “glass half full” for both scenarios. This is likely to be due to thin, post-Thanksgiving trade conditions and month end.

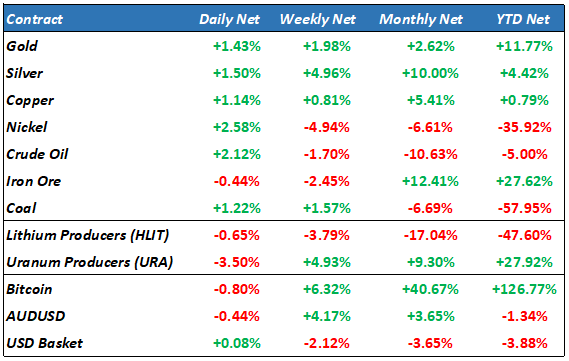

Oil surged higher as investors weighed up an unexpected rise in U.S. crude production and a Black Sea supply disruptions ahead of crucial OPEC+ meeting to discuss future production levels. On the supply side, meanwhile, a severe storm in the Black Sea region has disrupted up to 2 million barrels per day of oil exports from Kazakhstan and Russia.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7059 (+0.07%)

The continuing lethargic price action in the ASX200 is concerningly at odds with the data and global markets, as Australian investors are clearly more pessimistic than our global peers. Yesterdays unexpected drop in inflation was largely ignored along with the rise in commodity and energy prices, leaving the index underperforming for the last few weeks in a row. The bid tone in banking stocks and further drop in the USD likely to buoy commodity prices, may combine soon to spark a rally. We are of the view that the AU market will have a positive December, at which point we will lighten positions across the portfolios in January, looking for a weak H1 of 2024

- Mesoblast is poised to report earnings.

- Hosting annual meetings on Thursday: Imugene, Lake Resources, Link Administration, Liontown Resources, Mayne Pharma, Sayona Mining and Wotso Property.

- Aristocrat Leisure and Technology trades ex-dividend