Overnight – Dovish Fed Drives Down Bond Yields

Equities closed higher Tuesday, underpinned by a fall in Treasury yields as dovish remarks from some Federal Reserve officials boosted bets on rate cuts.

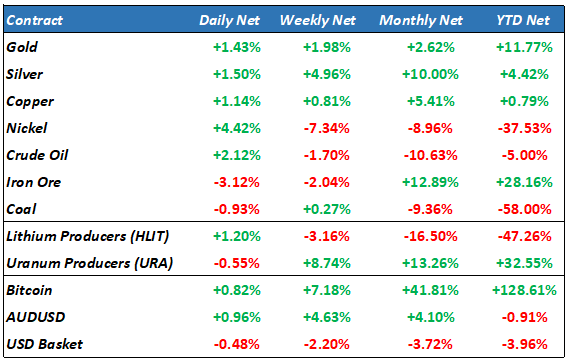

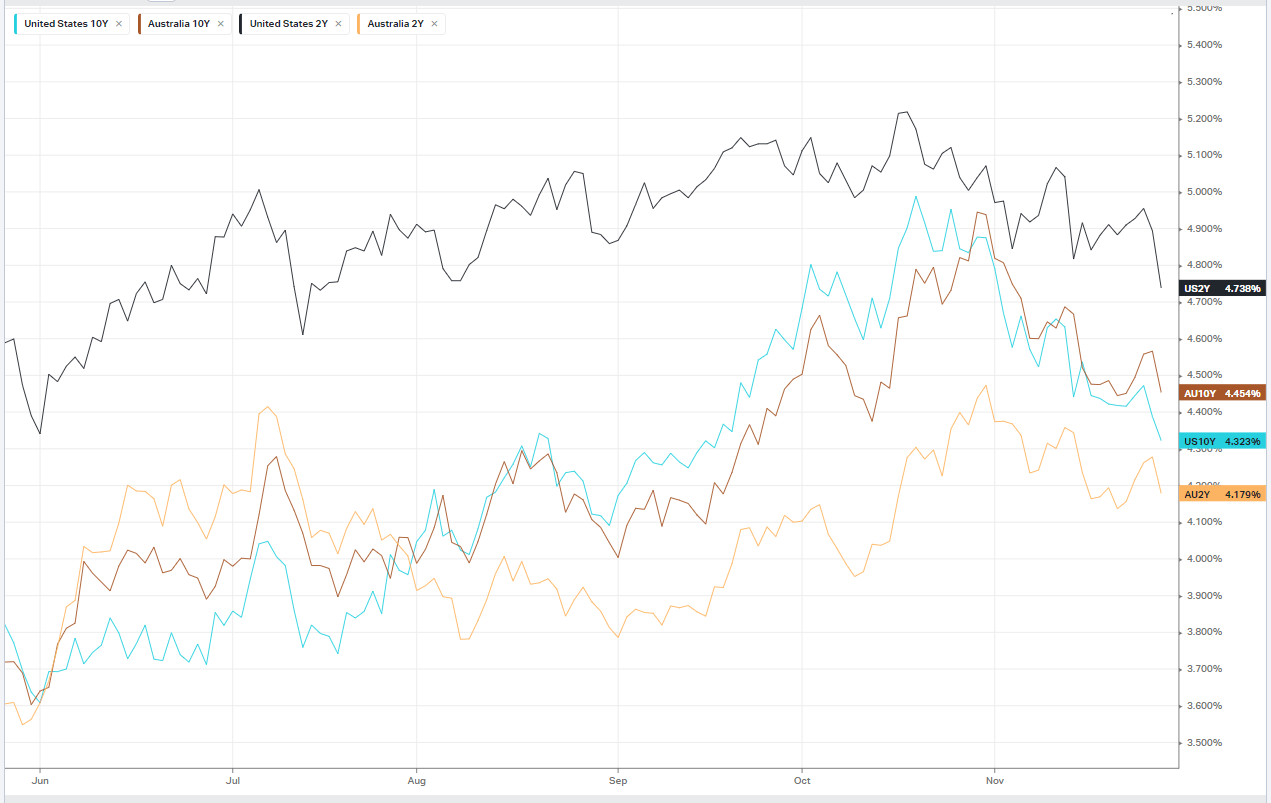

Federal Reserve Board Governor Christopher Waller said he was “increasingly confident” that policy is currently well positioned to slow the economy and get inflation back to 2% target. Adding to clout to bets of a Fed rate cut early next year, Waller added that should data show disinflation continuing for several more months, the Fed “could then start lowering the policy rate just because inflation’s lower.” Treasury yields fell on the remarks, with the yield on United States 2-Year falling nearly 12 basis points to about 4.74%, while the yield on the United States 10-Year fell 6 basis points to 4.330%.

Sentiment on retailers were boosted by ongoing signs that the consumer remains in good shape after consumer confidence in November surprised to the upside, while Cyber Monday sales hit a record high. Consumer spending on Cyber Monday, the biggest U.S. online shopping day, is expected to have surged to an all-time high of over $12 billion, according to preliminary estimates from Adobe Digital Insights cited by Reuters. Walmart and Foot Locker were among a slew of retailers in the ascendency, while payments platform Affirm jumped nearly 12% as record number of holiday shoppers likely used buy now, pay later services

In big tech, Amazon cloud business, Amazon Web Services, unveiled a new chip for customers to develop artificial intelligence applications and tech giant also said it would offer Nvidia’s latest chips. The move comes after Microsoft recently announced its own AI chip and also said customers of Azure cloud platform would have access to Nvidia’s GPUs.

Energy stocks were one of the biggest gainers on the day as oil prices rose on hopes that OPEC+ will agree to extend or even deepen its ongoing production cuts at a meeting later this week on Thursday.

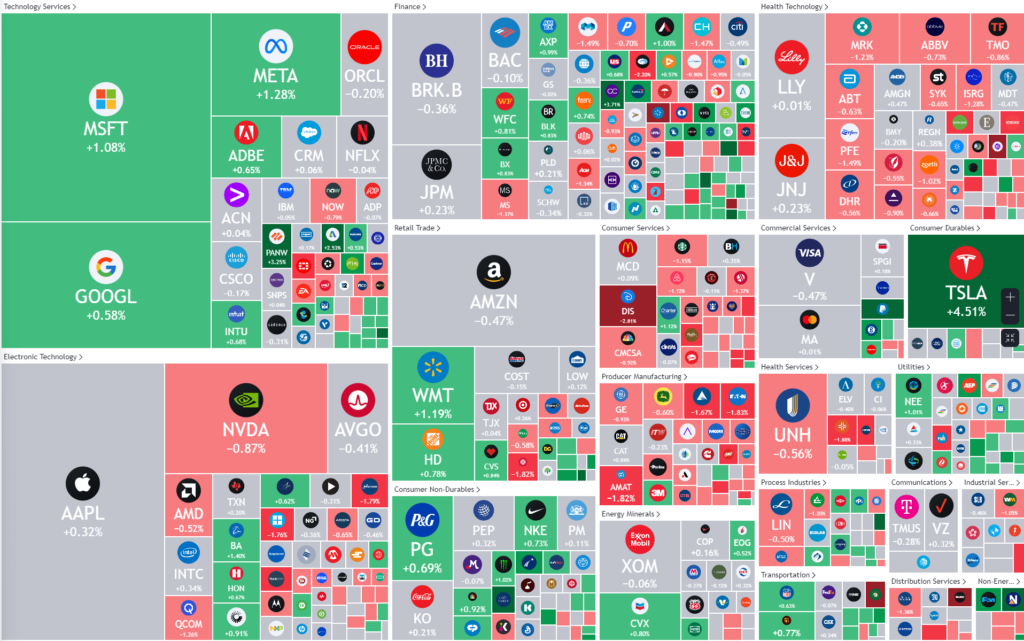

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7053 (+0.21%)

The ASX has a lot of catch up to play and with the broad rise in commodity prices overnight, we should see the materials and energy sector lead the market higher. Record spending from consumers in the US may buoy hopes for retail stocks.

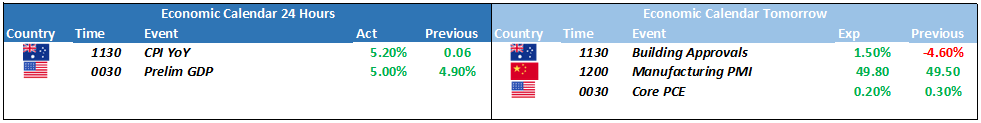

CPI will be in focus at 1130, however the monthly updates have proven to be less influential than the quarterly, so there could be a kneejerk reaction on a higher number. A lower number may trigger a “catch up” move as it will likely take a December hike out of investors minds

- Fisher & Paykel Healthcarereported increasing revenue and profit in its first half of 2024 as the respirator manufacturer re-adjusts to a pre-COVID trading environment.

- Annual meeting will be hosted by EML Payments, Emeco, Harvey Norman, Lynas Rare Earths, Sandfire Resources and Temple & Webster.

- Shares in GrainCorp, Infratil, Liberty Financialand Newmont will all trade ex-dividend.