Overnight – Equities drift higher into Thanksgiving Holiday

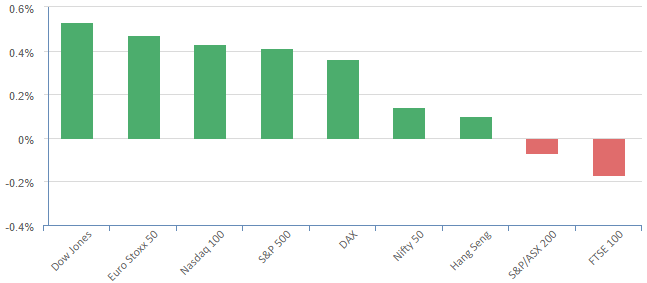

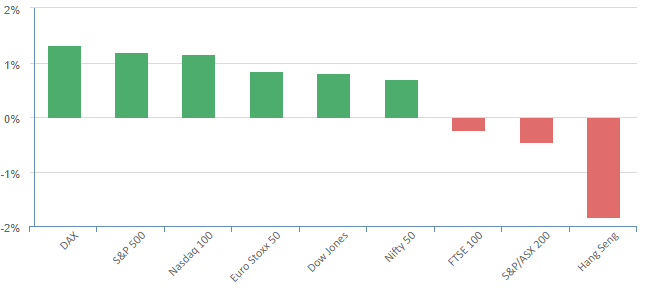

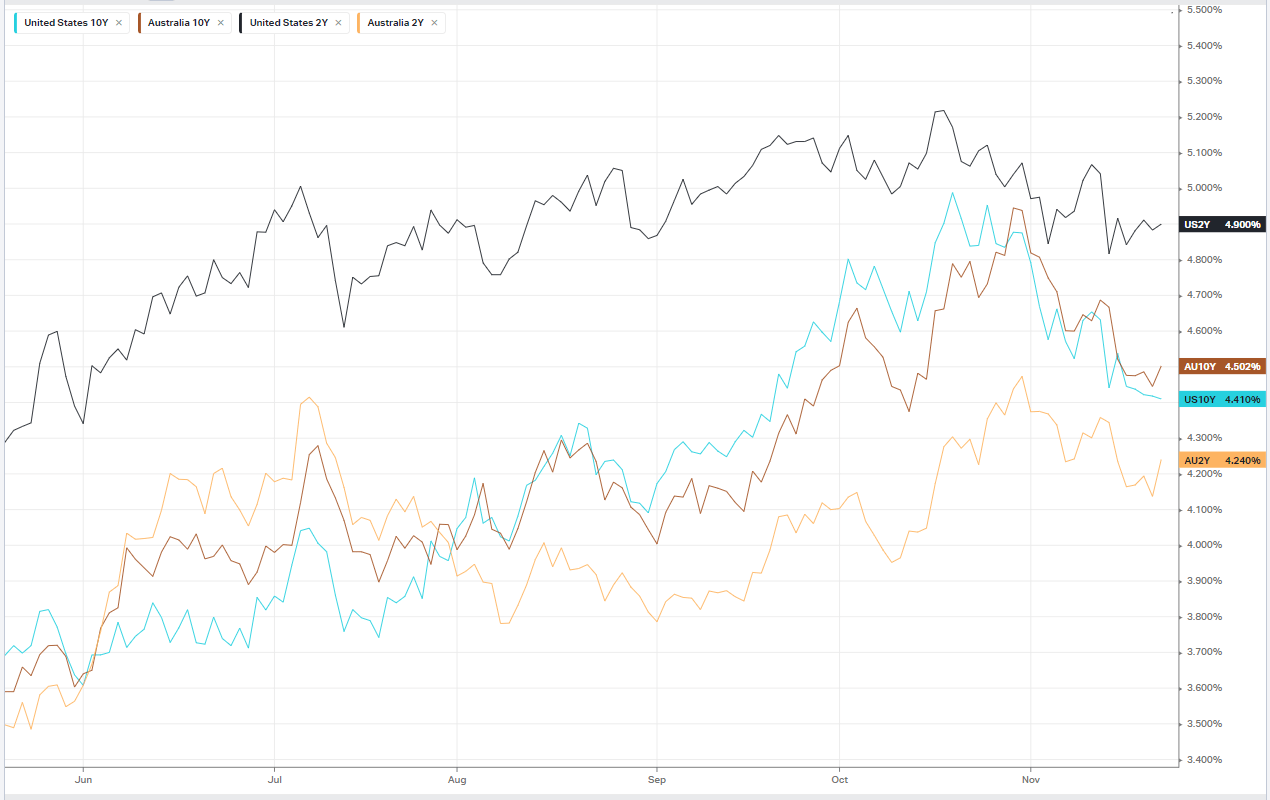

Equities resumed the rally overnight despite Nvidia disappointing investors with their results. The move was driven by optimism that the Federal Reserve may be done raising interest rates and that the economy is still resilient.

Economic data showed the number of Americans filing new claims for unemployment benefits fell more than expected last week. Separately, U.S. consumers’ inflation expectations rose in a survey for a second straight month in November.

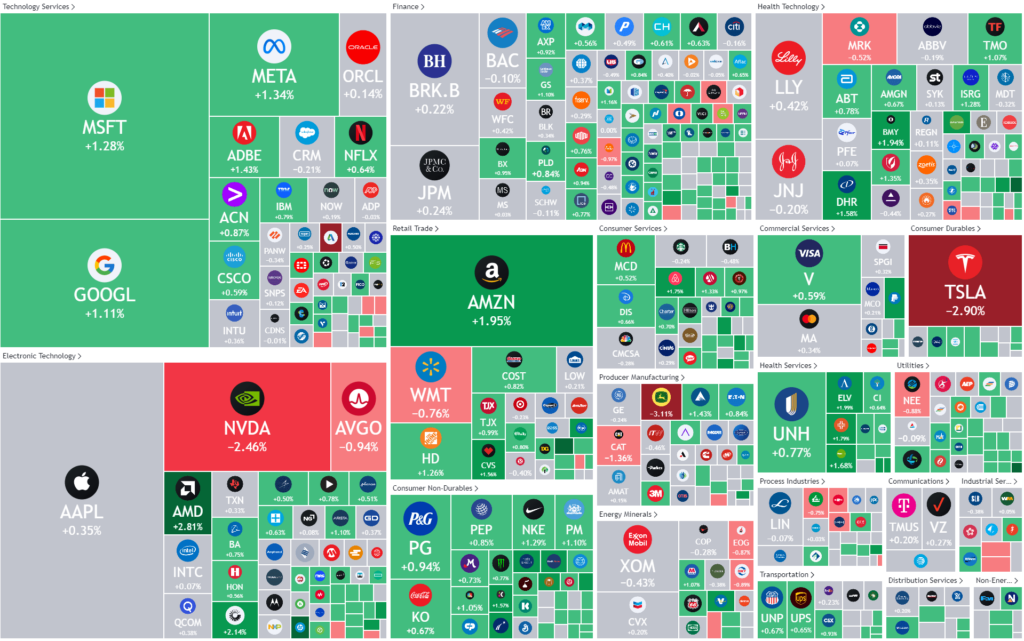

Among the day’s negatives, Nvidia’s shares fell after the chip designer forecast overall fourth-quarter revenue above Wall Street targets, but warned U.S. export curbs could lead to a steep drop in sales in China. Other major movers, Deere & Co shares were down after the farm equipment maker forecast 2024 profit below analysts’ estimates.

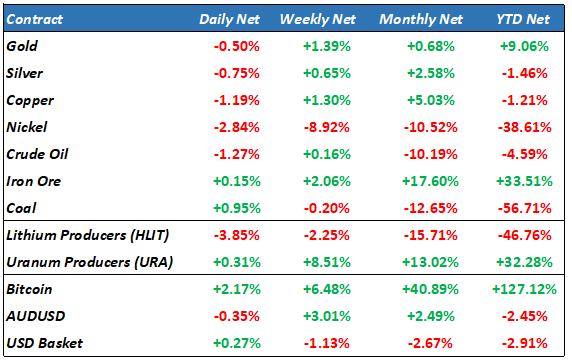

Energy stocks were pressure by a fall in oil prices after The Organization of the Petroleum Exporting Countries and and its allies, or OPEC+, postponed a scheduled meeting to Nov. 30 from Nov. 26, amid struggles to agree on production levels, stoking uncertain over potential output cuts.

S&P 500 - Heatmap

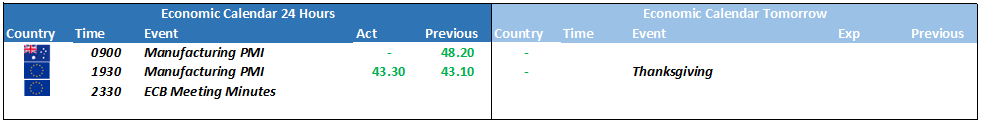

The Day Ahead

ASX SPI 7084 (-0.02%)

Hawkish comments from the RBA Governor overnight are likely to weigh on the market today in an otherwise quiet day with little economic or company specific data to spark a significant move. Michele Bullock spoke at a dinner last night saying inflation is now largely a “homegrown” problem, hitting back at claims price rises are mainly driven by global factors outside the central bank’s control.“ An important implication of this homegrown and demand-driven component to inflation is that getting inflation back to target will take time,”

Energy and materials stocks are likely to be lethargic on falls in oil and commodity prices.

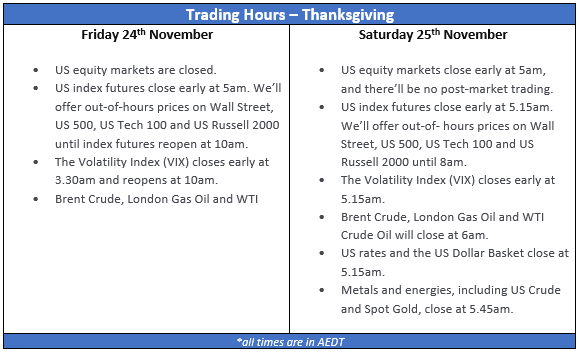

We are in for another Traditionally the Thanksgiving period is very quiet for global markets and we don’t expect this year to be any different.

- Virgin Money UK and Select Harvestsissue earnings results.

- Origin Energyshareholders are set to vote on Brookfield and EIG Partners $20 billion takeover offer.

- More than 25 companies are scheduled to host annual general meetings, including Evolution Mining, Insignia Financial, Karoon Energy, New Hope, Pilbara Minerals, Regis Resources and Weebit Nano.

- ALSshares trade ex-dividend.