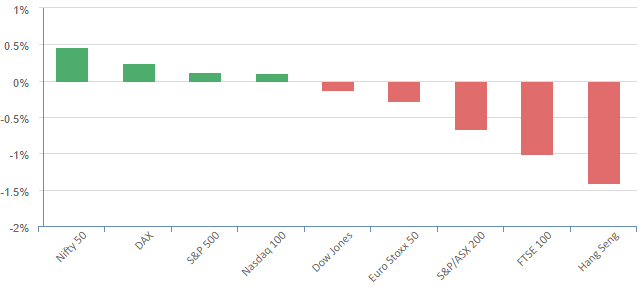

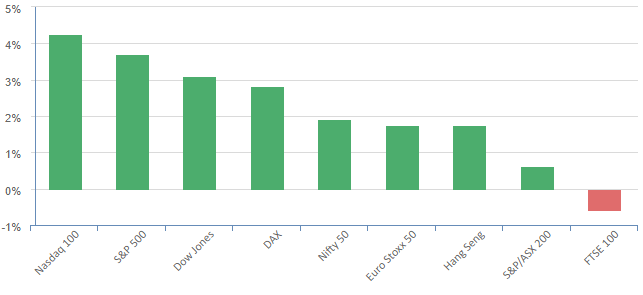

Overnight – Equites rally takes a breather as poor economic numbers pile up

Equities drifted lower overnight with pressure from Cisco and Walmart after disappointing forecasts, while a drop in Treasury yields cushioned some megacap stocks.

The rejoiced fall in inflation this week is slowly turning to jitters, as a slew of softer economy data is making investors reconsider the “bad news is good news” thesis. This week alone we have seen higher-than-expected weekly jobless claims, Philadelphia Fed manufacturing index remaining in contraction, and retail sales falling for the first time in seven months as motor vehicle purchases and spending on hobbies dropped. This pointed to slowing demand at the start of the fourth quarter, raising concerns about the pace of slowing in the economy at a time when the Fed is expected to keep rates higher for longer.

This makes the equity market positivity short sighted, with investors too focused on the Fed finishing their hiking cycle, ignoring the reasons why they are finishing….a slowing US economy.

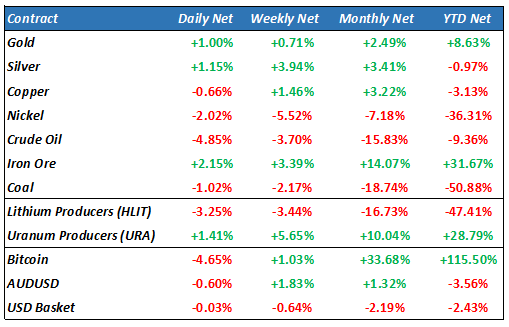

Oil prices dropped around 5% on Thursday to their lowest in four months, as investors worried about global oil demand following weak data from the U.S. and Asia. This view contrasts the firming Chinese economic activity in October as industrial output increased and retail sales growth beat expectations. Adding to the conflicting signals, the apparent escalation in the Israel-Hamas conflict, with U.S. officials on saying they would enforce oil sanctions against Iran, which has long been a backer of Hamas

Earnings Results

Walmart (WMT) – the largest retailer in the U.S, lifted its annual guidance, forecasting adjusted EPS of $6.40 to $6.48, but that was short of estimates for EPS of $6.50 and offset quarterly results that beat on the top and bottom lines. Its shares fell more than 7%.

Cisco Systems (CSCO) – stock fell more than 11% after the company cut its full-year revenue and profit forecasts in a sign that demand for its networking equipment was slowing.

Palo Alto Networks (PANW) – stock fell 6% after the cybersecurity company posted solid first-quarter results but issued second-quarter and full-year billing guidance below estimates.

S&P 500 - Heatmap

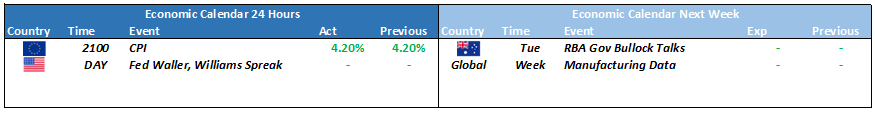

The Day Ahead

ASX SPI 7085 (-0.01%)

Today is likely to see a very mixed market with very conflicting (and confusing) forces driving parts sectors in complete isolation to the broader market. We are seeing underlying commodities like oil, drop on economic concerns in Asia, while the recent rise in Iron ore to 2 year highs sparked by optimism on a Chinese economic recovery. We have the US megacaps rallying on a possible peak in interest rates, while the rest of the market is starting to worry about the slowing in economic activity. I would like to be able to explain this to readers, but in my 30 years of watching markets, I cant think of a period where each sector is seemingly “choosing their own” macroeconomic outlook

- Jupiter Mines is set to provide a sales update

- Holding annual meetings: Abacus Group, Accent Group, Centuria Capital, Ingenia Communities, Lendlease and ResMed.

- Washington H Soul Pattinson trades ex-dividend.