Overnight – Stock market Bulls call the defeat of inflation as CPI cools

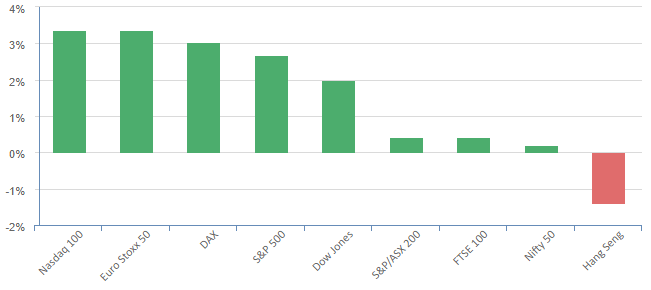

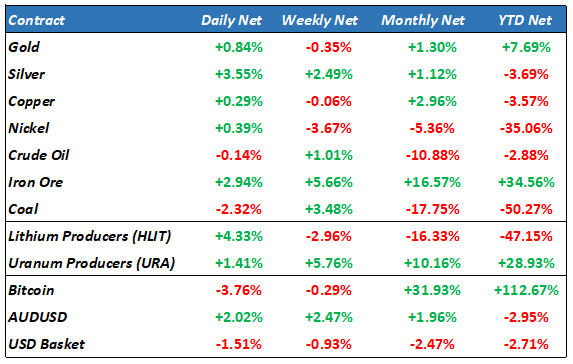

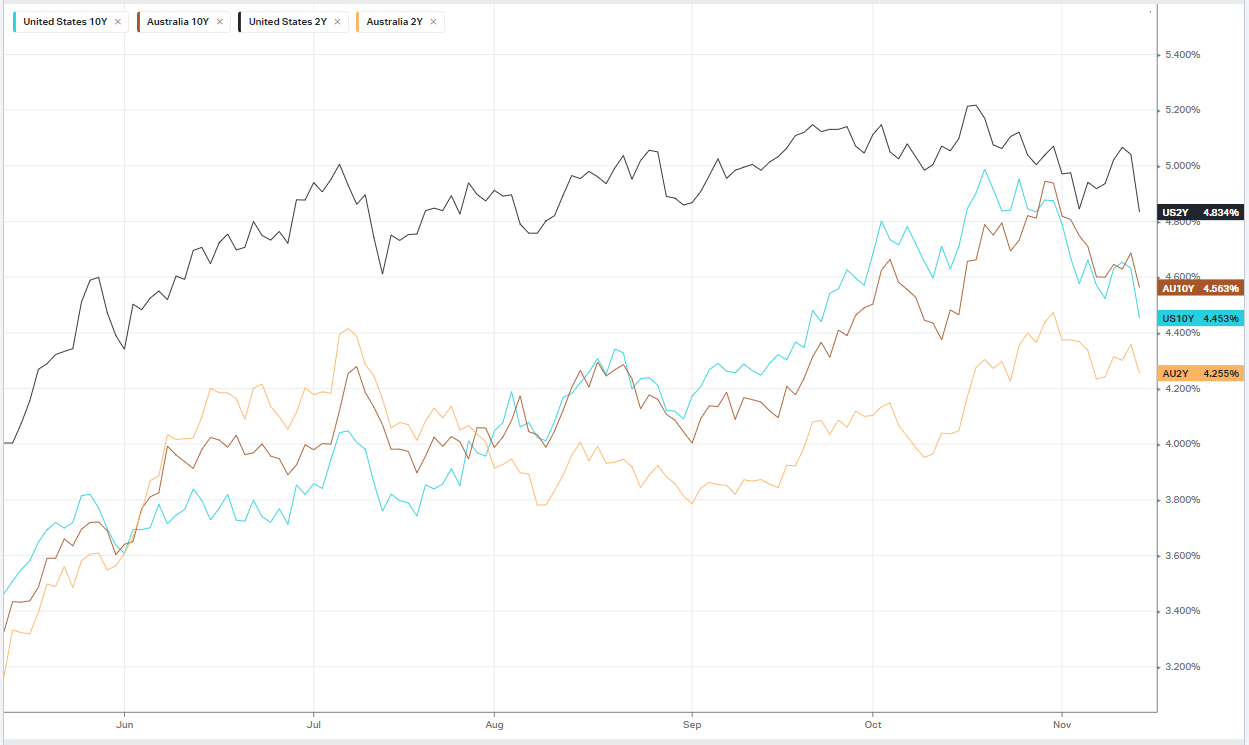

Stocks rallied strongly while Treasury yields plummeted as US inflation numbers cooled by more than expected in October, bolstering investor expectations that the Federal Reserve hiking cycle is finished and inflation defeated.

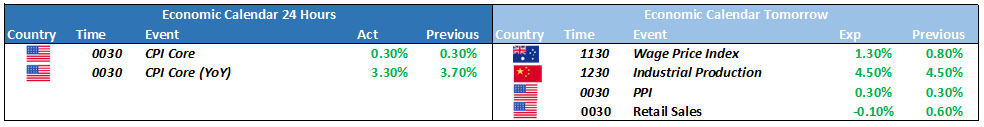

The consumer price index in October slowed to a reading of 0% from 0.4% the prior month (exp 0.1%). The lower than expected reading, added to expectations that the Federal Reserve isn’t likely to raise interest rates again. Analysts pointed out that October CPI was soft on the services side, and a November print like this would not meet the bar we previously set for an additional hike in December with 99.7% of traders now expecting the Fed to hold rates.

Big tech was led higher by a more than 2% rise in Alphabet (Google) and Meta Platforms as sentiment on growth sectors of the market was supported by dip in Treasury yields. A 3% rise in chip stocks meanwhile also supported the broader tech sector amid a surge in Global foundries, Novanta, and Marvell Technology Inc with latter rallying on positive remarks from Wall Street.

Energy stocks were up less than 1%, lagging the broader market move higher despite rising oil prices amid a stronger demand outlook. The economic pessimism in the energy and commodities sector is completely at odds with the extreme optimism in the tech sector, a gap which will have to close one way or the other soon.

Small caps outperformed on the session, starting to play some catch up after lagging all year. the small cap index the Russel 2000 finished up 5.4%

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7116 (+1.29%)

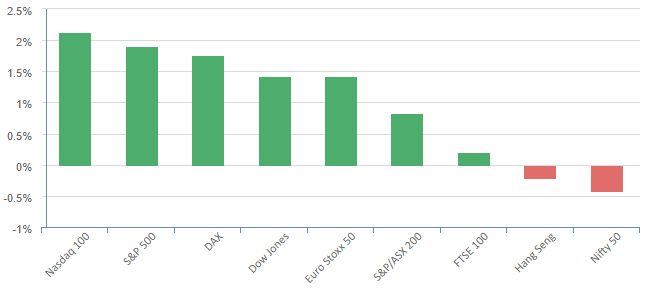

We should see some considerable catch up from the ASX today with a strong day from the broader market in the US, not just the “Magnificent 7”.

Iron ore continued to push to 2-year highs, while commodities strengthened on a weakening USD. Lithium stocks bounced 4% globally while uranium stocks surged back towards year highs

Some focus will be on wages data in AU and industrial production in China which may have an influence around lunchtime

- Earnings are expected from Aristocrat Leisure and Nufarm.

- It will be a busy day of annual meetings: Computershare, Flight Centre, HMC Capital, Imugene, Paladin Energy, Platinum Asset Management, SEEKand Tyro Payments.

- Dicker Datatrades ex-dividend.