Overnight – Stocks end mixed ahead of inflation numbers, US Credit Rating on “Negative” watch

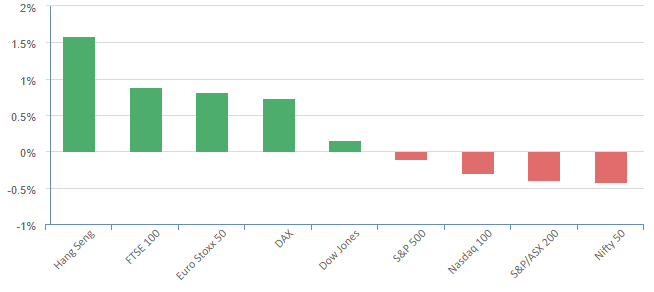

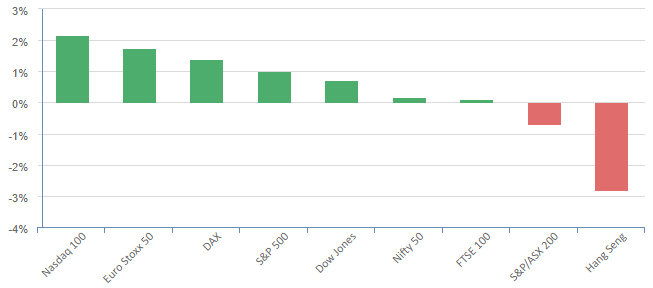

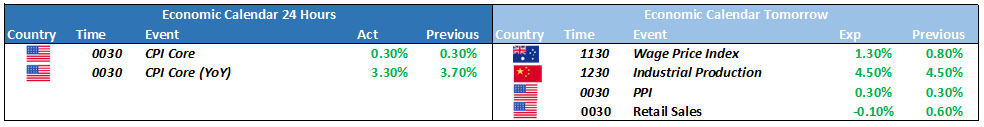

Equities finished largely unchanged supported by energy and health care stocks, but upside momentum was kept in checked as traders awaited fresh inflation data due after midnight Tuesday

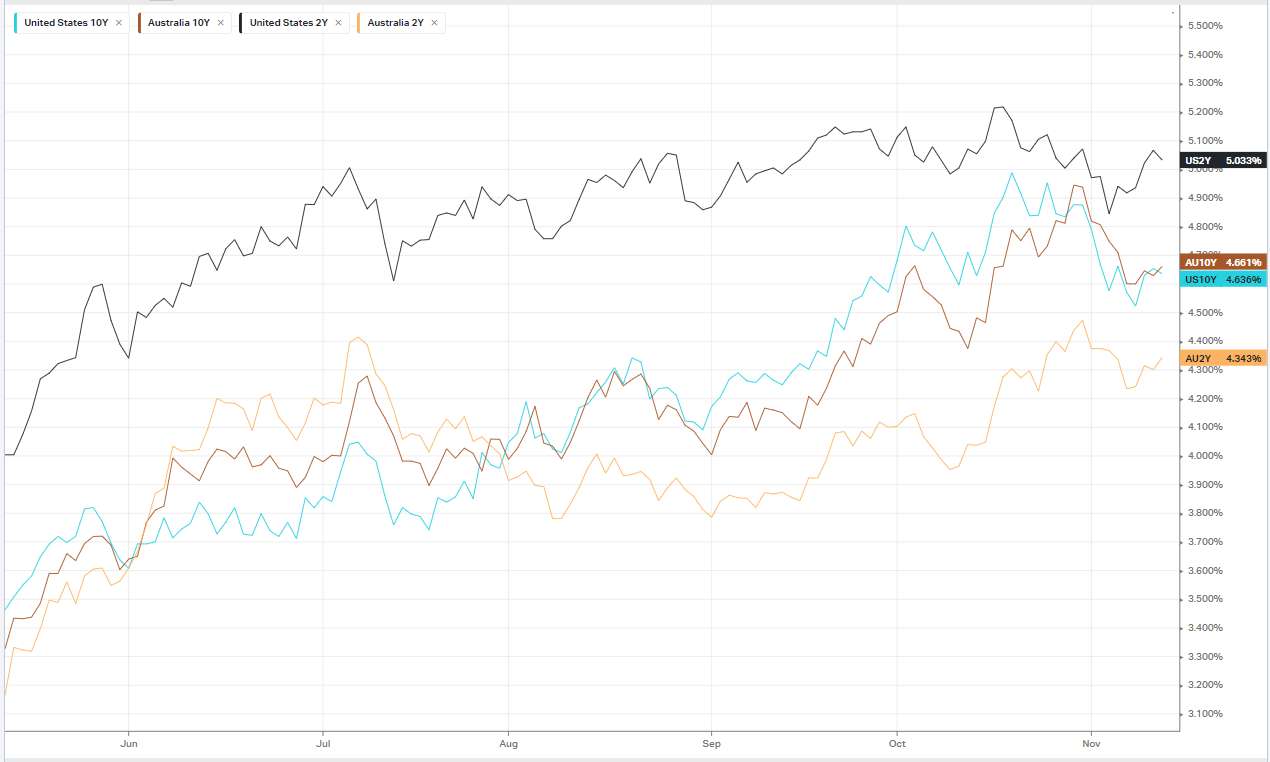

Initial weakness was caused by credit rating agency, Moody’s changing its outlook on the U.S. credit rating to “negative” from “stable,” while affirming its “AAA” long-term rating. The warning comes just as concerns about another government shutdown enters the fray, with the Nov. 17 deadline for Congress to pass a funding bill to keep the government open fast approaching.

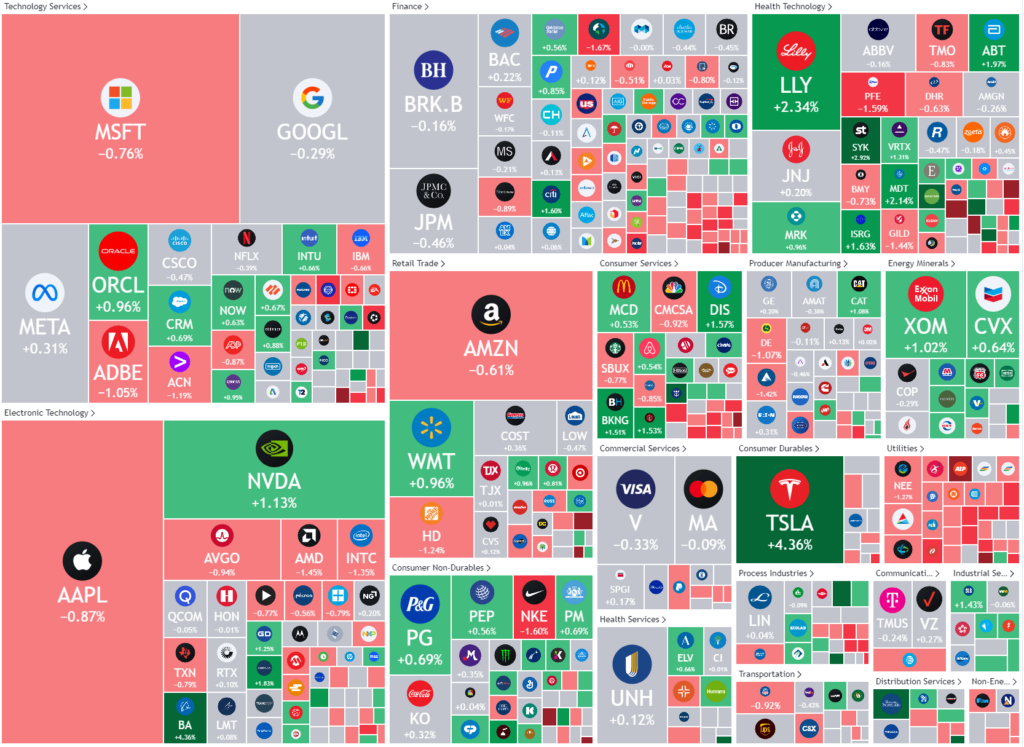

Energy stocks were supported by rise rebound in oil prices following last week’s sharp losses amid ongoing concerns about slowing global demand, particularly from China, the world’s biggest crude oil importer.

Semiconductor stocks fell nearly 1% to weigh on the broader tech sector despite a 1% jump in Nvidia after the chipmaker rolled out its H200 chip, a successor to the H100 chip. The H200 chip, which is set to launch in Q2 next year, boasts computational speeds that is nearly double that of the H100.

Boeing rose more than 4% after the aircraft maker won a $52 billion order from Emirates for the delivery of 95 aircrafts.

Tesla, meanwhile, rose more than 4% after updating the terms of its agreement with future Cybertruck buyers that includes a restriction to prevent them reselling their Cybertrucks within the first year of purchase.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7028 (+0.97%)

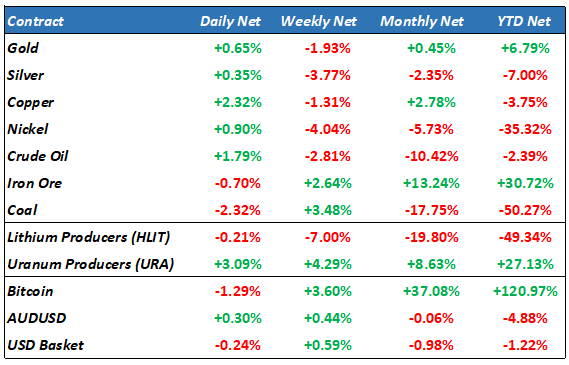

We should see a fairly quiet market today with all eyes on US CPI and AU employment figures to be released later in the week. Some upside gains overnight in the SPI futures suggest we should have a positive day. Energy, materials and uranium stocks should lead the pack

- The Commonwealth Bank releases earnings.

- There are scheduled sales updates from ALS, OFX and Catapult.

- Goodman Group, Michael Hill, Bubs Australia, Beach Energy, Resimac & Aurelia Metals all host AGMs. NAB shares trade ex-dividend.