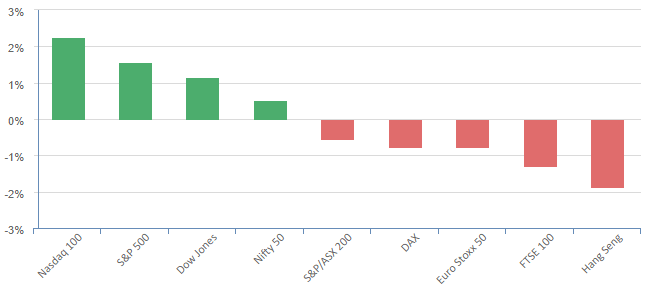

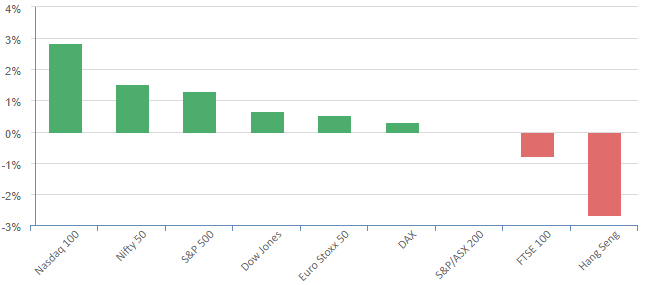

Overnight – Stocks end week higher on Tech led rally

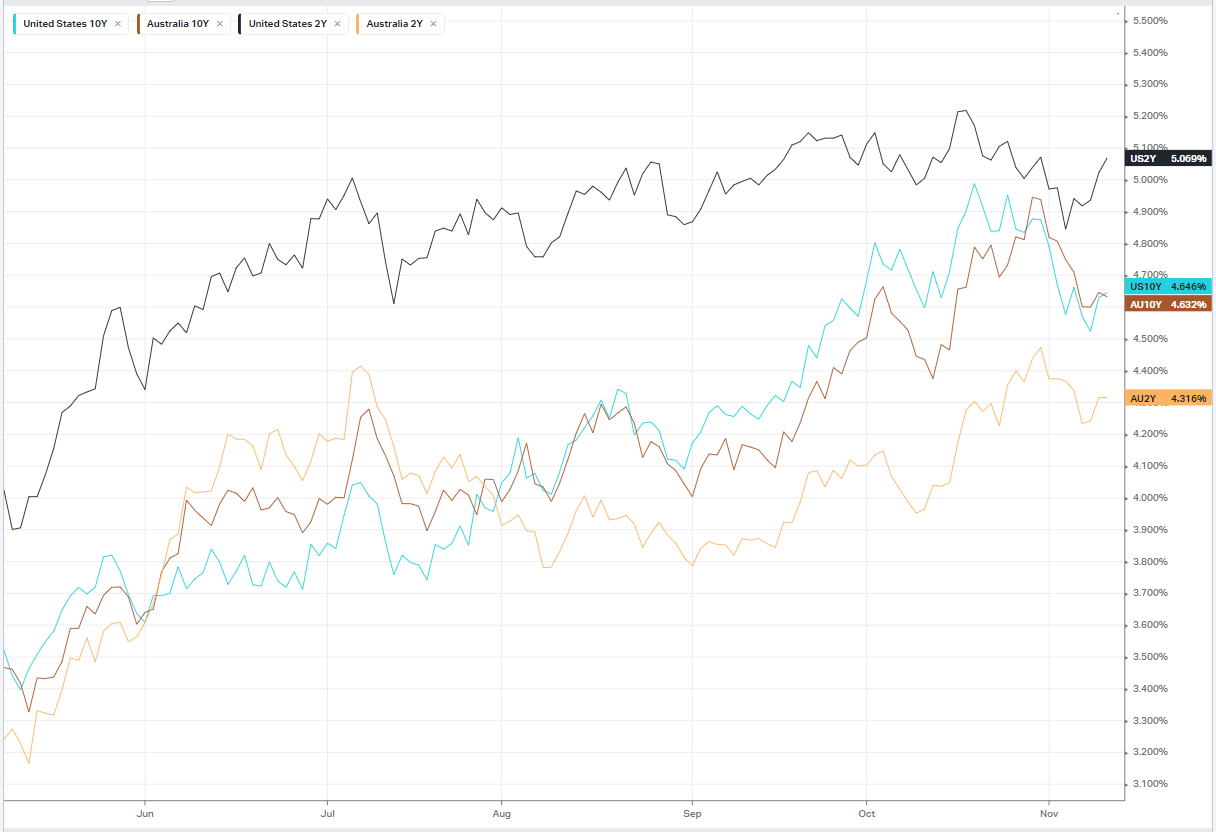

Equities rallied in the face of hawkish comments from Fed Chair on Thursday as comments from Fed’s Bostic voiced a conflicting viewpoint. Atlanta Fed president Raphael Bostic said Friday he believes the the Fed will get to its 2% target “without us having to do anything more,” as the full impact of the rate hikes delivered need more time to filter through the economy. The remarks were in contrast to Powell’s remarks on Thursday, when the Fed chief said the Fed “was not confident” they had reach a sufficiently restrictive level of rates to bring down inflation.

Apple is set to pay up to $25 million to settle claims from the Justice Department that the tech giant favored hiring immigrant workers over American citizens and legal green card holders for some jobs. Shares rose 1%.

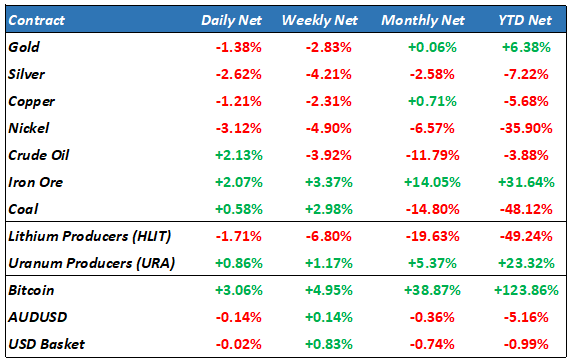

Oil prices rose Friday, but were still heading for a third straight week of steep losses on persistent concerns over slowing global demand and resurgent fears of rising U.S. interest rates. Both benchmarks are currently down over 5% this week, and on course for the longest weekly losing streak since a four-week drop from mid-April to early May

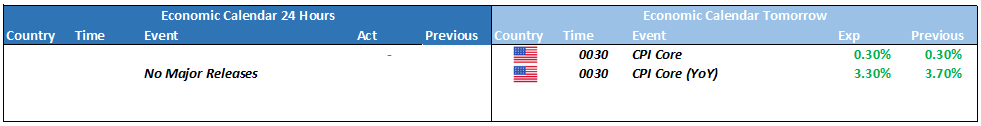

An update on inflation and retail sales will dominate investor attention next week following a week of Fed speak that largely pushed back against expectations for sooner rather than later rate cuts.

The core consumer price index, which is more closely watched by the Fed, is expected to have remained steady in October at a monthly and annual pace of 0.3% and 4.1% respectively.

Retail sales, meanwhile, could flag a slowdown in the consumer, which has been stronger than many expected, with economists forecast a 0.1% decline in October following a 0.7% a month earlier.

After market close on Friday, ratings agency Moodys lowered its outlook on the U.S. credit rating to “negative” from “stable” citing large fiscal deficits and a decline in debt affordability,

Earnings Results

Plug Power (PLUG) – the Hydrogen energy company reported third-quarter results that fell short of analysts estimates on both the top and bottom line owing to hydrogen supply shortages that disrupted operations. It’s shares fell 40%.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7016 (+0.34%)

The ASX should start the week positive with the lead from US, however the downgrade of US credit rating may see a US equities futures give back some of those gains. Gold, Oil and Iron ore had a solid session Friday which should see a large chunk of the market supported.

This week sees key inflation data from the US and employment numbers in AU. We expect the market to remain in the range until then

ANZ has declared its interim dividend at 81¢ a share fully franked, according to full-year results. The major bank recorded a 14 per cent increase to its cash profit to $7.4 billion. Statutory operating income rose 5 per cent to $20.46 billion.