Overnight – Fed “Grinch” Powell spoils Christmas rally hopes

Equities fell overnight as Federal Reserve chairman Jerome Powell played the “Grinch” as he signaled that monetary policy wasn’t at levels yet that were sufficiently restrictive to rein in inflation to target, denting investor hopes of a Christmas rally

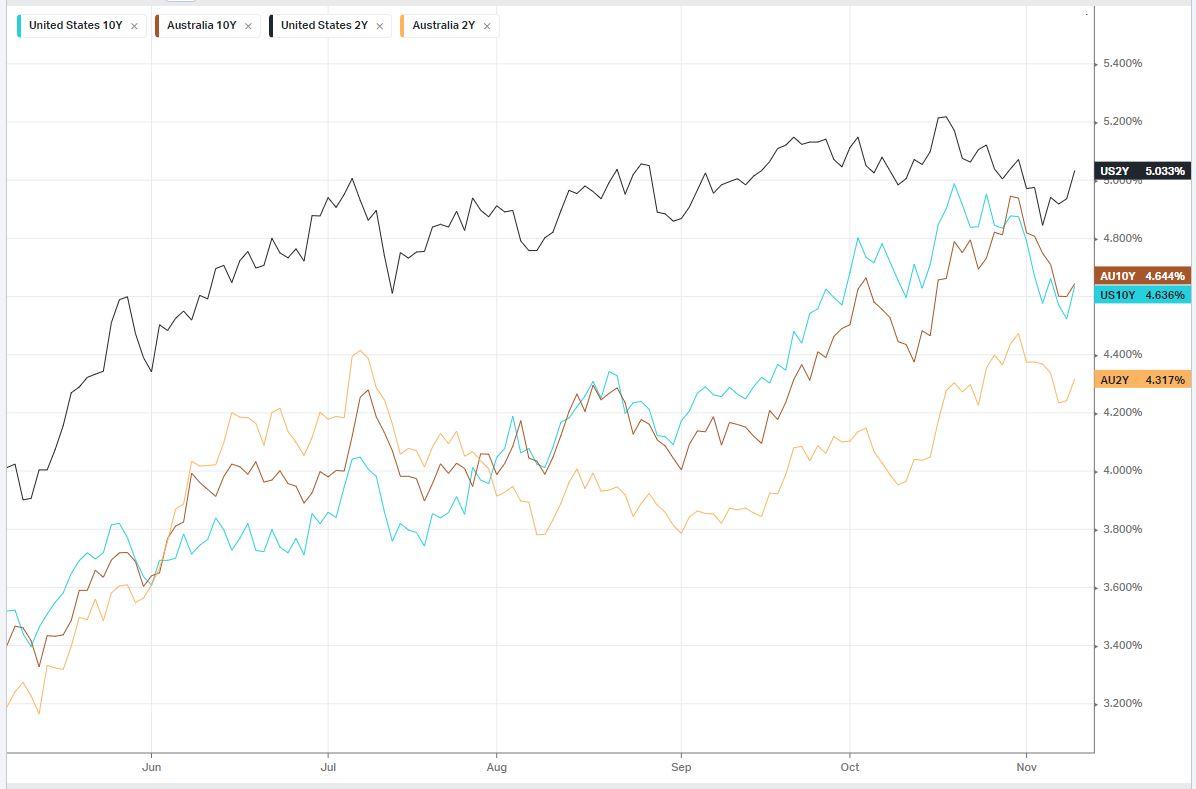

Federal Reserve Chairman Jerome Powell said Thursday the Fed wasn’t confident yet they had reached a sufficiently restrictive level on monetary policy to bring inflation down to target, suggesting further rate hikes cannot be ruled out.

“The Federal Open Market Committee (FOMC) is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2 percent over time; we are not confident that we have achieved such a stance,” Powell said in opening remarks Thursday during a policy panel at the 24th Jacques Polak Annual Research Conference, hosted by the International Monetary Fund.

The fed chief acknowledged that U.S. inflation had come down over the past year but said it remains “well above our 2 percent target,” Powell said, but signaled the Fed is far from ready to accept that inflation is on a sustainable path lower. Inflation “has given us a few head fakes

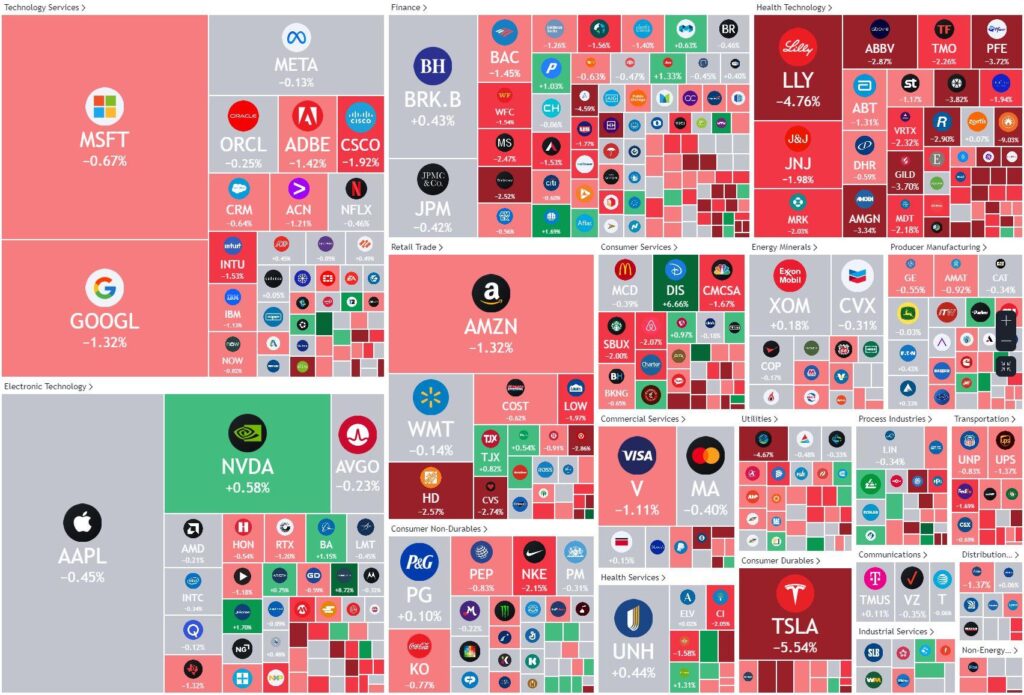

Tesla was down 6%, and led the move lower in consumer stocks after HSBC issued a sell rating on the electric vehicle maker on concerns that it may longer-than-expected for the company to execute on its ideas. HSBC also flagged a stupidly obvious point of “considerable singleman risk” at the group and slapped a $146 price target on the company.

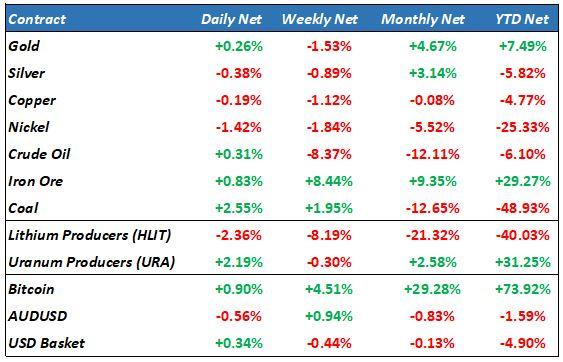

Oil prices edged higher Thursday, attempting to recover from their lowest levels in more than three months although worries of waning demand in China and the U.S., the two biggest economies in the world, remain. Data released earlier Thursday showed that China, the world’s biggest oil importer, fell back into disinflationary territory in October. This followed the American Petroleum Institute, an industry body, stating that U.S. crude oil stocks rose by almost 12 million barrels last week. If confirmed by official data, that would be the biggest build since February

Earnings Results

Walt Disney (DIS) – rose more than 6% after the entertainment giant beat earnings forecasts in its fiscal fourth quarter, supported by subscriber growth at its streaming services as well as higher attendance at its theme parks in Shanghai, Hong Kong and California.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7022 (-0.01%)

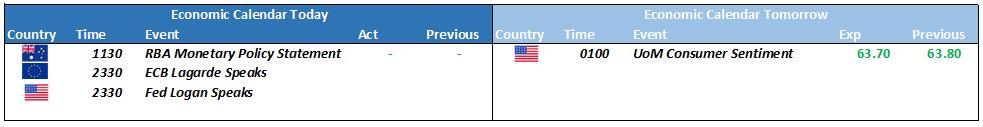

The local market is likely in for a soft day with the main focus on the RBA Monetary Policy Statement at 1130. This will be the first insight into the RBA’s view on inflation and if further rate hikes will be needed and confirmation of the dovish post-hike statement.

With Iron ore reaching 16-month highs and oil rebounding, we should see a healthy energy sector, while tech is likely to suffer. The banks may see some influence from broker upgrades/downgrades with NAB’s result yesterday not taken well by investors.

News Corp and Light & Wonder are poised to release earnings, while REA Group and Jupiter Mines are set to report sales data.

Hosting annual meetings on Friday: KMD Brands, Lithium Power International, Kelly Partners and nib.

Janus Henderson will trade ex-dividend.