Overnight – Equities bounce ahead of Fed and Apple earnings

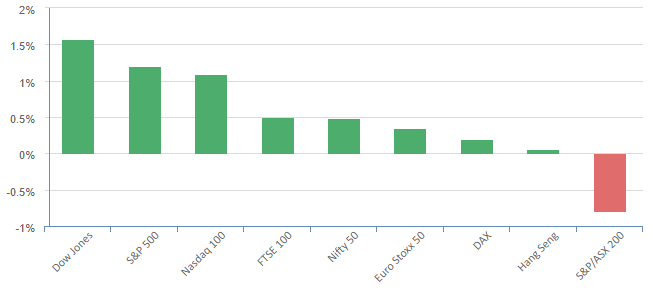

Equities bounced overnight, led by big tech, ahead of the earnings from Apple later this week, and the Federal Reserve’s interest rate decision due Wednesday.

Big tech including Alphabet, Meta, and Microsoft rallied to lift the broader tech sector as investors awaited earnings from Apple.

Apple is expected to report results for its June quarter – typically a seasonally weak quarter for the company – on Thursday after the market closes, with many Wall Street eager for insight into iPhone sales amid reports of slowing demand. In a throwback to the early 2000’s new competition from Motorola who showcased a bendable, flexible and wearable phone last week. Apple is also expected to announce its third-generation Apple Silicon chip later on Monday.

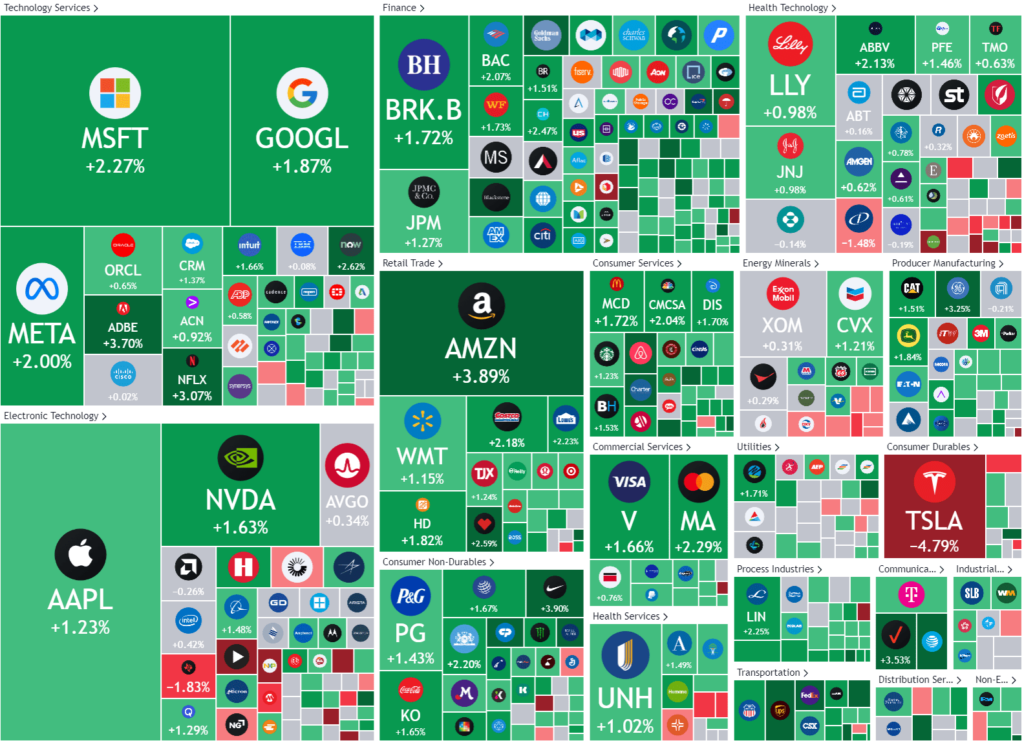

In further evidence of weakness in demand for semiconductors, ON Semiconductor fell more than 15% after the chipmaker’s better-than-expected Q3 results were overshadowed by Q4 guidance that fell short of analyst estimates.

United Auto Workers and General Motors struck a deal Monday, ending a six-week-long strike at Detroit automakers, Bloomberg reported, citing unnamed sources. The terms agreement are similar to the recent accord signed by Ford and Stellantis with the UAW, including wage hikes and cost of living allowances. General Motors was marginally higher intraday.

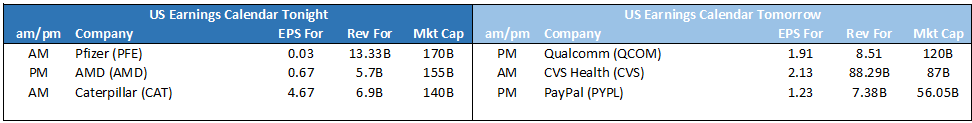

Earnings Results

McDonald’s (MCD) – rose more than 2% after the fast-food maker reported quarterly results that beat analyst estimates on both the top and bottom lines as recent price hikes underpinned growth.

SoFi Technologies (SOFI) – also delivered better-than-expected quarterly results, and raised its full-year outlook as student loan refinance demand was better-than-expected. The stock cut gains to trade less than 1% higher.

S&P 500 - Heatmap

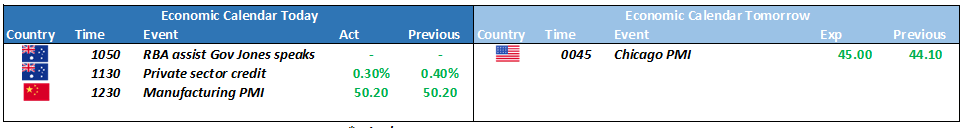

The Day Ahead

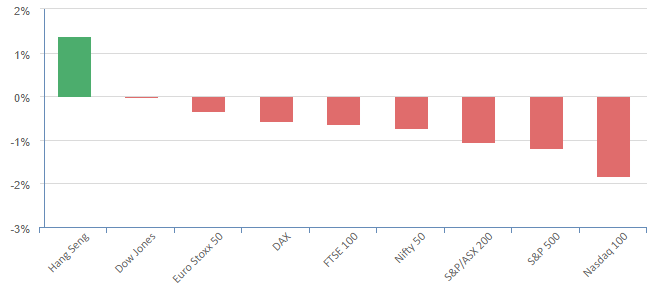

ASX SPI 6810 (+0.42%)

ASX SPI 6810 (+0.42%)

The ASX should bounce today, with the last weeks heaviness unlikely to continue with a global bounce from offshore markets. Evergrande has been given a reprieve in China, which should see some positivity, while Chinese manufacturing data at 1230 could also provide some positivity if it is in-line with the recent string of improving numbers.

A speech by Brad Jones, RBA assistant governor (financial system), at the AFIA Conference, Sydney at 10.50am could trigger if any clues are dropped on interest rates.