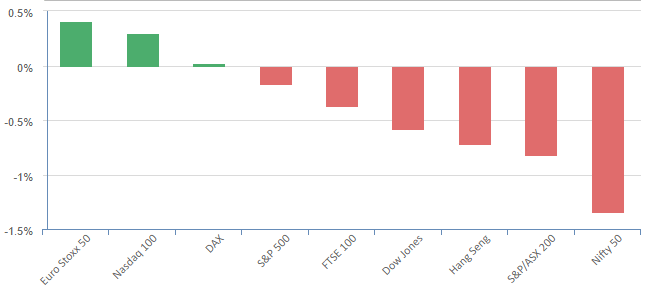

Equites were mixed to higher as Tech stocks started the week on the front foot as investors look ahead to big tech earnings, with Microsoft and Alphabet set to report September quarter results on Tuesday.

Alphabet climbed despite fresh regulatory concerns after the Japanese Federal Trade Commission launched an investigation for alleged antitrust violations concerning whether the company shared ad-revenue with android phone makers in return for pre-installing Google’s apps including its search engine rather than rival apps. Meta, IBM, Amazon and Intel report results on Wednesday and Thursday, respectively.

Treasury yields slipped following their recent multi-year highs, with the yield on the US10Y falling to 4.854% after rising to a 16-year high of 5.025% in the European session. The surge in longer-term Treasury yields have been driven by several factors including stronger-than-expected economic growth and stubborn inflation as well as a jump in supply as the U.S. Treasury steps up the pace of borrowing. The move comes just over a week ahead of the Federal Open Market Committee two- day meeting slated for Oct. 31

Crypto has been rallying on getting one step closer to legitimacy, on optimism a spot-Bitcoin exchange traded fund, or ETF, is drawing closer. This will bring the largely unregulated into the realm of a properly regulated exchange listed asset, which could entice investors previously unwilling to be involved.

Energy stocks were dragged down by easing concerns over the conflict in Gaza as 2 hostages were released

Earnings Results

Cadence Design Systems – Beat Wall St estimates on both top and bottom line, however the stock fell in post market trade by 4% as broader concerns about a comeback from competitor Huawei resuming shipment of chips.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6805 (-0.02%)

The ASX may continue to see weakness as the rally in the tech sector overnight will have little affect on the upside, while softening oil, gold and commodity prices due to an ease of geopolitical tensions will weigh heavily. The weak lead from US banking stocks is also unlikely to help the ASX200

A very defined switch yesterday from cyclical stocks to non-cyclical stocks may continue. Materials, Financials and Consumer discretionary were sold off heavily yesterday as recently downtrodden healthcare sector saw gains for the likes of RMD and CSL.

AU Quarterly CPI numbers will be released tomorrow and a huge day of US earnings tonight could make investors nervous at these levels and prompt a risk-off attitude