Overnight – Hot Inflation & employment data lifts yields, weighing on equities

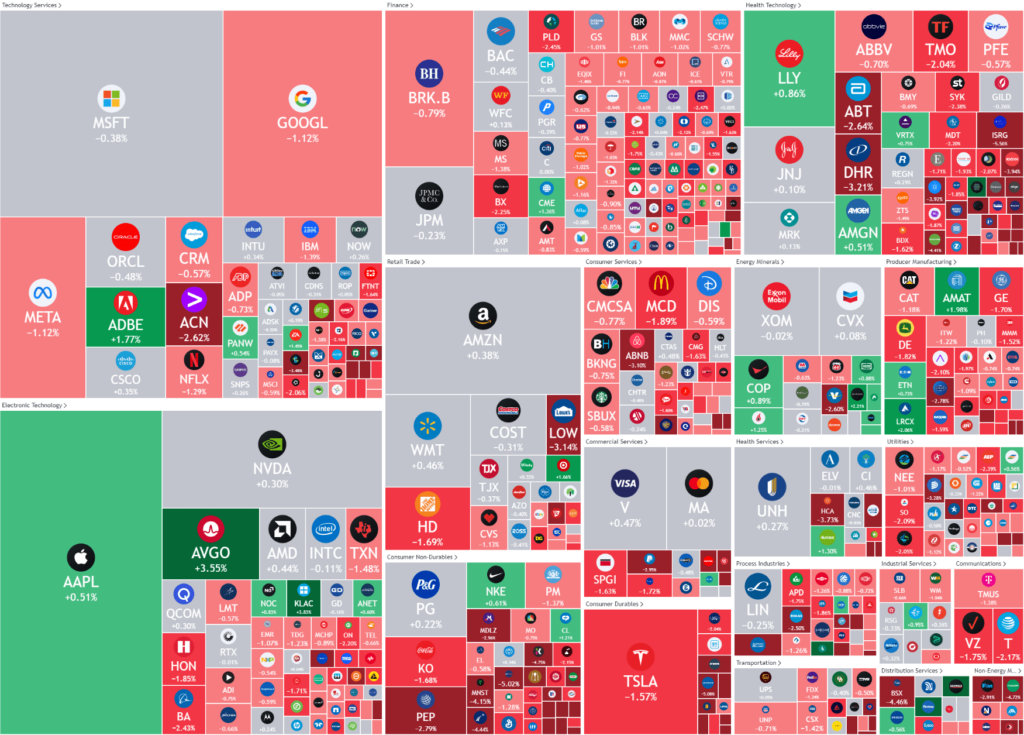

Equities gave up early gains to finish lower amid pressure from rising Treasury yields after inflation came in hotter than expected in September and the job market continues to show strength, weighing on hopes that the Federal Reserve was done with rate hikes.

The CPI rose to 0.4% in September, taking the annual rate to 3.7%, slightly above expectations for a 0.3% and 3.6% rise respectively.

The core measure, which excludes food and energy and is more closely watched by the Fed, remained steady at a 0.3%, with the pace of improvement remains uncomfortably slow. The labor market, meanwhile, continued to surprise to upside as the initial jobless claims were short of the expectations.

Delta Air Lines reported third-quarter results that topped analysts estimates, but airline cut its full-year revenue outlook, sending its shares more than 2% lower.

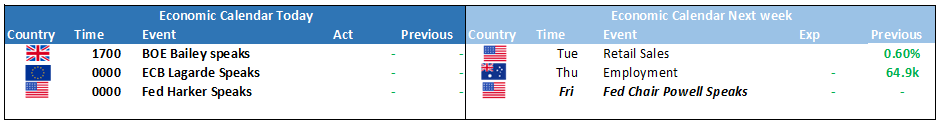

Tonight we will see earnings season shift into gear with major banks Citi, JP Morgan and Wells Fargo, regional Bank, PNC Financial and Healthcare goliath United Healthcare all delivering results

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7067 (-0.58%)

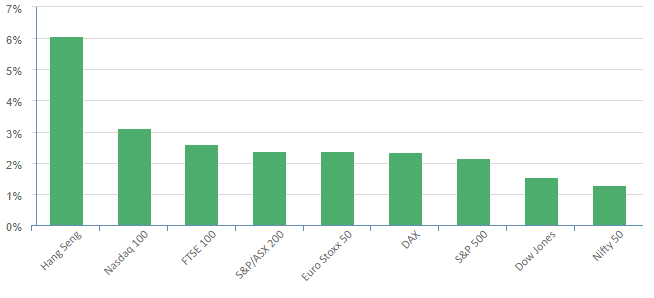

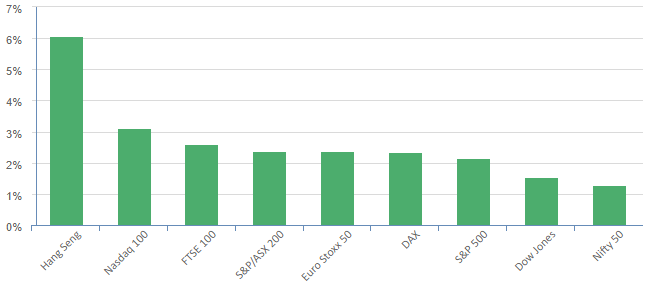

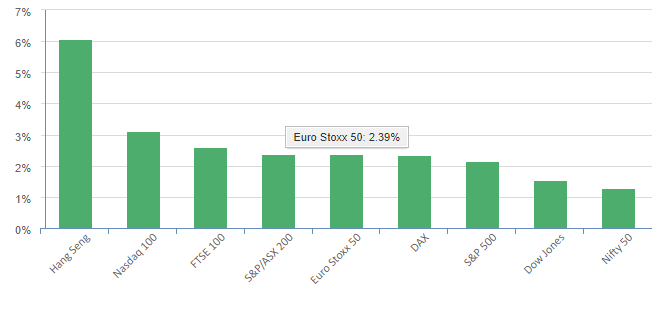

The AU market is likely to give back some gains after a pretty positive week. A rise in the USD is likely to dent commodity prices and with US bank earnings tonight we may see some profit taking in the index. Global equity markets have done remarkably well to be positive for the week, with hot inflation, the Israel conflict and Country Gardens default. In normal circumstances, one of these would rattle the market, let alone all 3 of them which is either a positive sign for markets, or indicative of how much cash is on the sidelines

Perenti and Silex Systems both host AGMs. Harvey Norman shares trade ex-dividend.