Overnight – Equities get bond yield relief as Fed speak turns dovish

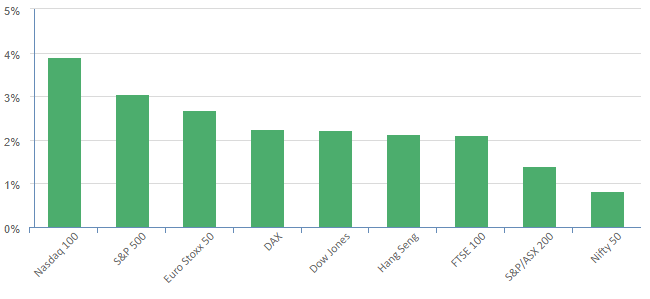

Equities closed higher on Tuesday after dovish comments from U.S. Federal Reserve officials pushed Treasury yields lower while investors cautiously monitored developments in the Middle East.

The market latched onto dovish comments from top Fed officials on Monday, Fed Bostic (2nd most dovish on the board) said the U.S. central bank does not need to raise interest rates any further, and that he sees no recession ahead. Bostics comments are not out of character being the second most dovish board member on the FOMC, however, comments from Fed Kashkari, the most Hawkish Fed member, said he believes “the U.S. economy is on track for a soft landing in which inflation falls back to the Fed’s 2% goal but the unemployment rate does not rise sharply” commentary not usual for him. This sent bond yields lower giving relief to the equity market, although the breakout of war in Israel would also be weighing on yields as investors take safe haven in government bonds.

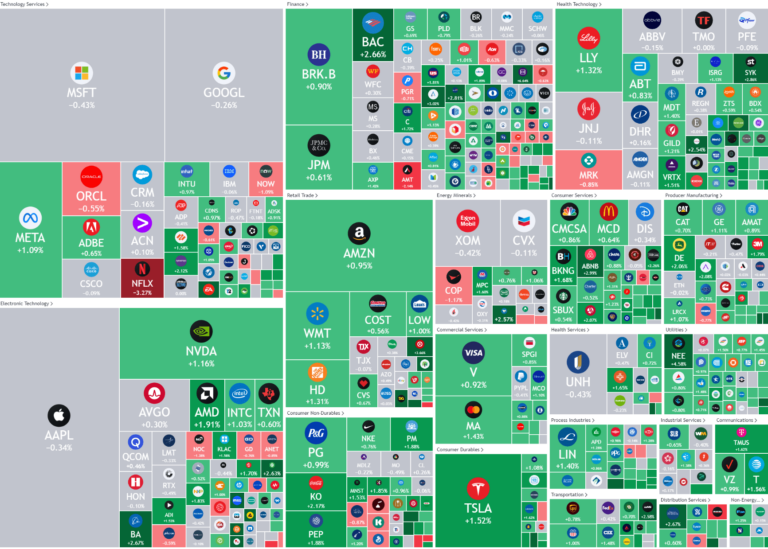

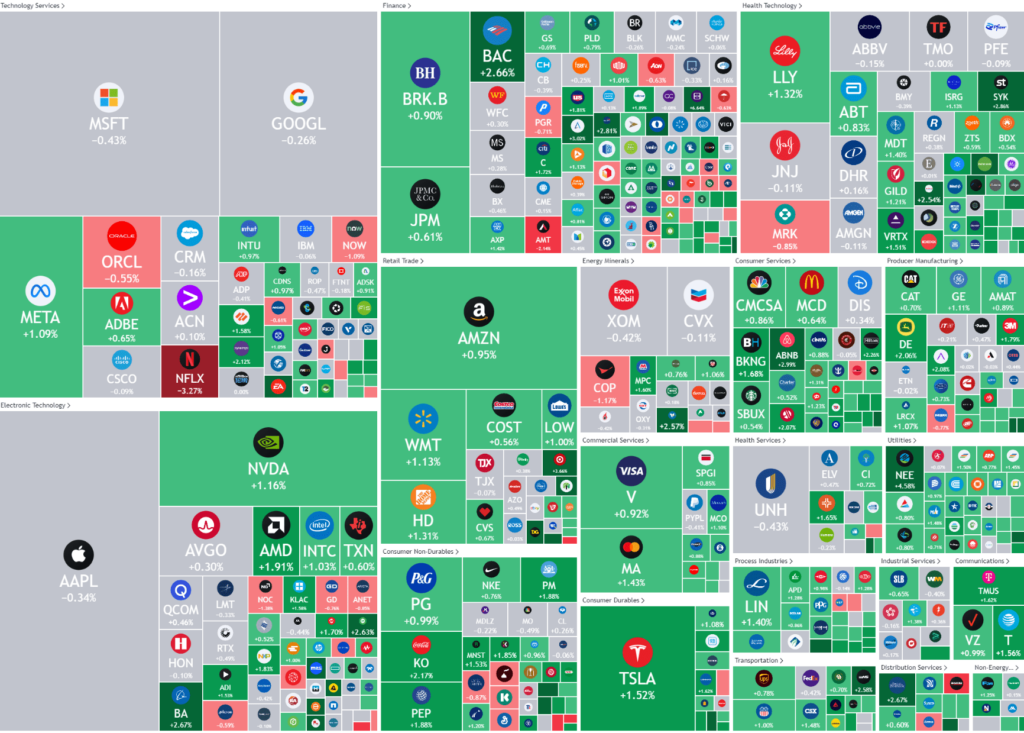

Moves of note were Microsoft, initially rising after a Morgan Stanley upgrade to finish -0.43%, PepsiCo +2% on earnings and Truist Financial +6% leading the financials higher on M&A talk

While the geopolitical situation in the middle east continues, markets seem to have taken a “same old, same old” view of the terrible conflict. While investors will obviously keep one eye on the situation in the event it escalates further, any market-related panic seems to have passed for now.

The end of this week sees the start of quarterly earnings updates from US companies with Delta Airlines on Thursday, followed by healthcare giant, United and financial names JP Morgan, Wells Fargo, Blackrock, Citigroup and PNC Financial delivering updates Friday

S&P 500 - Heatmap

The Day Ahead

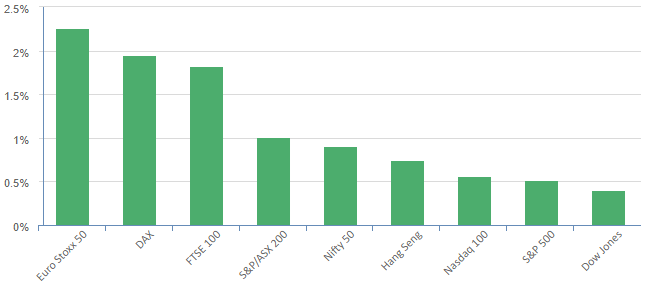

ASX SPI 7102 (+0.42%)

Today looks like it will be another firm day as falling bond yields and softer talk from central banks ease investor concerns. There remains a number of risk events bubbling away in the background, with the Israel/Palestine conflict, Country Garden defaulting on payments yesterday and higher bond yields (still up 95bps since July) but markets seem to be treating them as white noise for now. This attitude leaves room for short term plays with disciplined risk management (available in our Alpha portfolio)

As mentioned in yesterdays report, a technical bounce off 6900 in the ASX200 looks to be playing out, with little resistance until 7150.