Overnight – Equities edge higher despite geopolitical woes

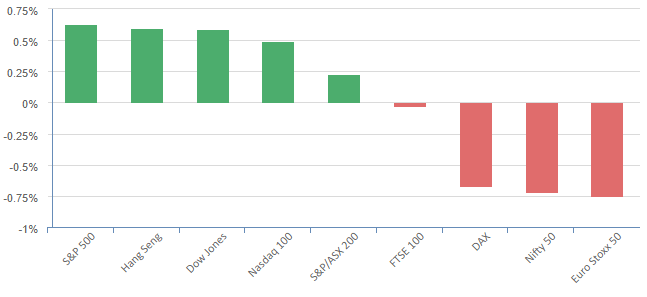

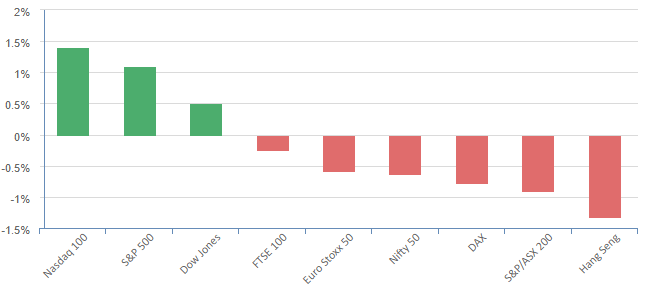

Equites edged higher as investors bought the early-day weakness after weighing up a more cautious tone rate hike from Federal Reserve officials and rising geopolitical tensions amid fears the Israel-Hamas conflict.

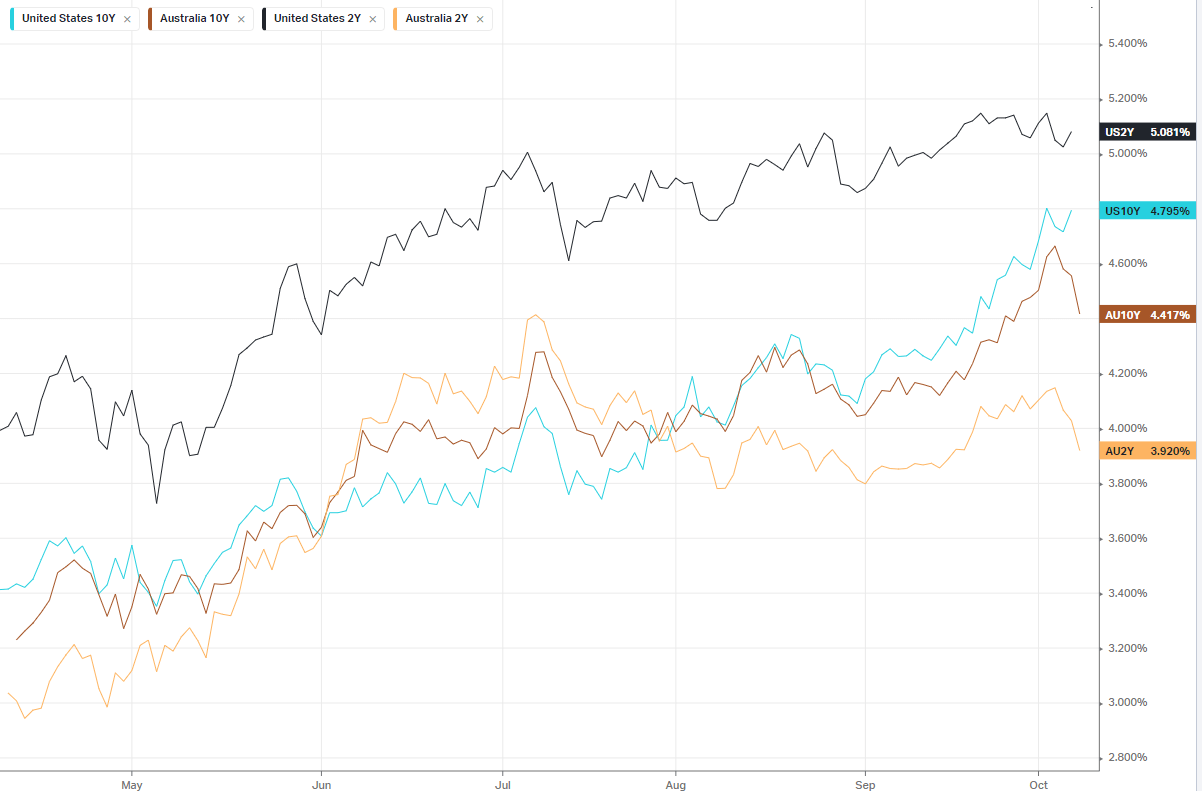

Fed Vice Chair Philip Jefferson and Dallas Fed president Lorie Logan struck a caution tone on the need for further rate hikes, indicating that the recent climb in Treasury yields, which has tightened financial conditions, would help the Fed in its battle against inflation. Vice chair Jefferson commented “We are in a sensitive period of risk management, where we have to balance the risk of not having tightened enough, against the risk of policy being too restrictive,” while Logan said “there may be less need to raise the fed funds rate following a rise in long-term interest rates”.

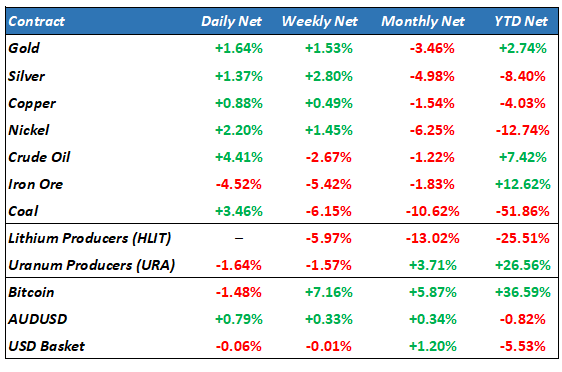

Following the surprise Hamas’ attack on Israel, and subsequent declaration of war by Israel, geopolitical tensions in the Middle-East dominated investor attention and briefly kept a lid on their appetite for risk.

The escalating conflict comes just as optimism was building that the U.S. was inching closer to brokering a deal that would normalize ties between Saudi Arabia and Israel, potentially paving the way to the end of the Arab-Israeli conflict.

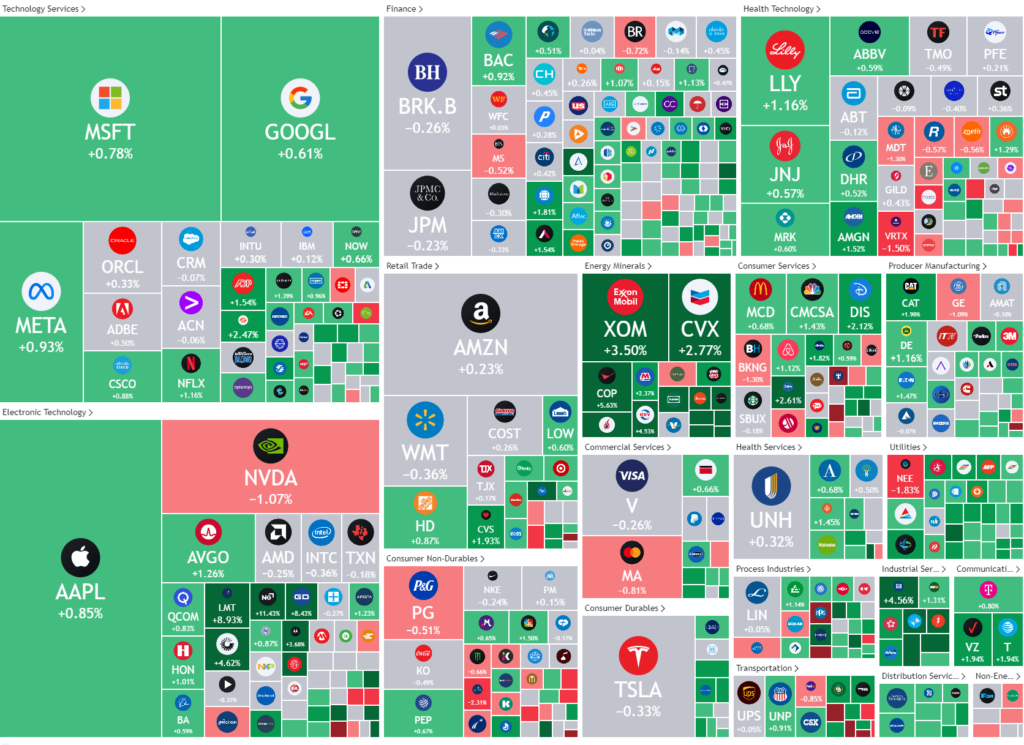

There was a move higher in energy stocks as Israel shut down natural gas production in the Mediterranean. Major player, Chevron lifted 3%, while Haliburton and Marathon Oil were the biggest gainers in the sector, rallying around 7%

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7032 (+0.42%)

The ASX should remain firm today as bond yields have pulled back on dovish talk from US central bankers. We don’t expect another big rally in materials as most of the benefit from the geopolitical tensions for gold, energy and commodities were already priced in yesterday’s move up to 4pm and Iron ore took a hit on the re-open from golden week in China, down 4.5%

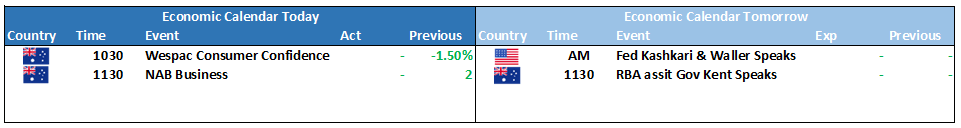

Some small figures may attract attention with NAB business survey and Westpac consumer sentiment due mid-morning.

It is likely a second technical bounce this year off 6900 in the ASX200 will bring some buying from investors in the short-term, with little resistance until 7100-7200.