Overnight – Market calms ahead of key US employment figures

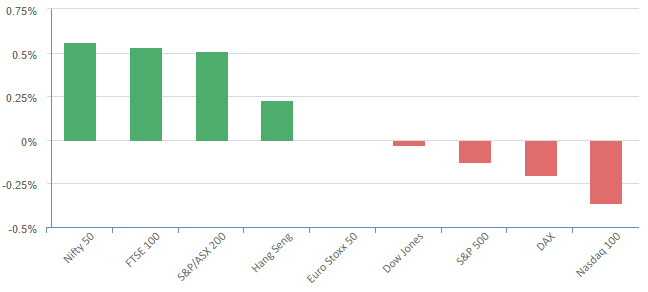

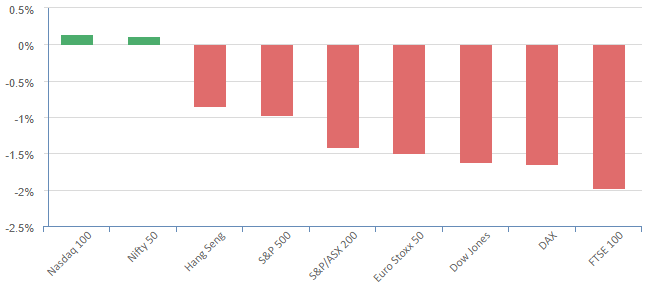

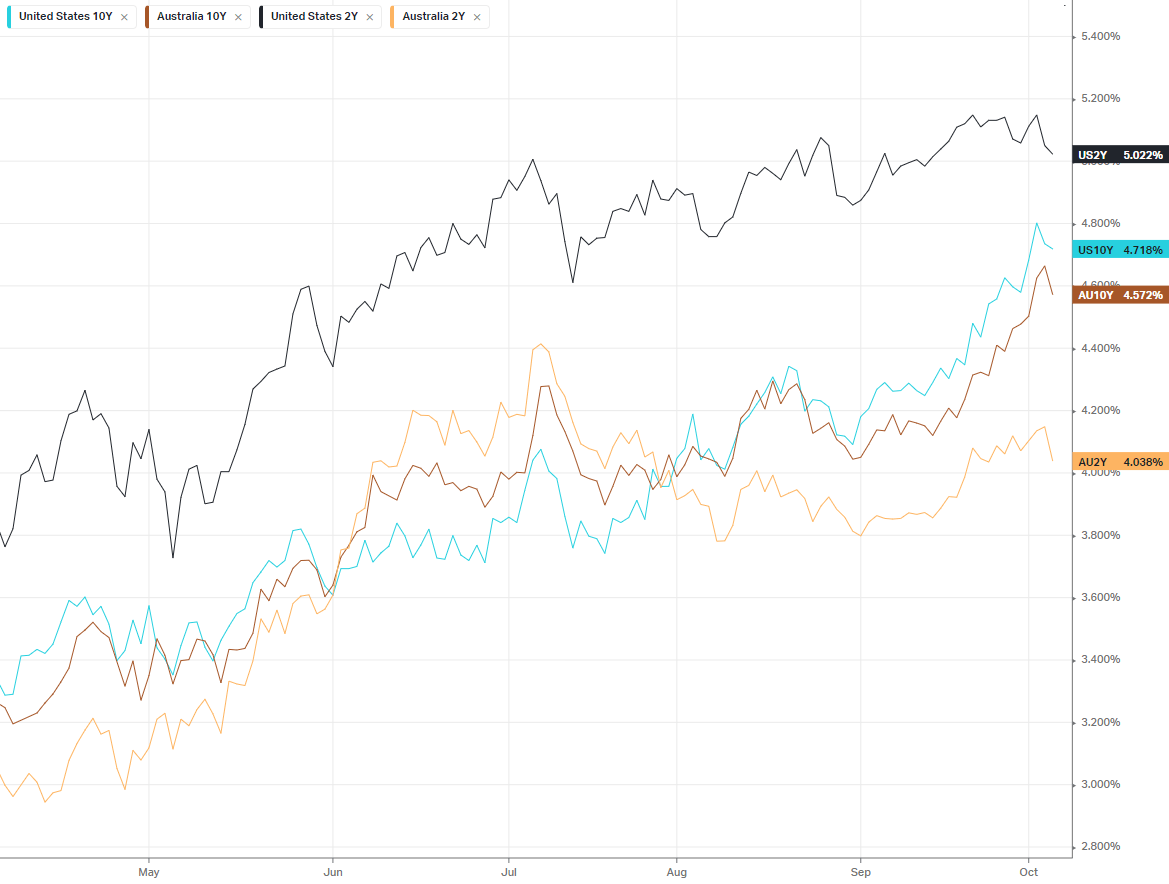

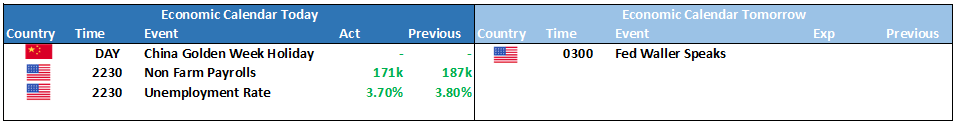

Equites finished mixed overnight leading into key employment numbers as the market took a breather from this week’s unhinged indecisiveness. The labor market continued to give mixed signals with the weekly jobless claims coming in at 207k, slightly less than expected. Tonight’s Payrolls numbers will be the week’s most important economic news, as it could fuel investor concerns about whether the Federal Reserve will keep rates higher for longer. the tight labor market is set to continue with another 170k jobs expected to have been added last month, with an unemployment rate hovering around record lows at 3.7%. Any number above 200k will likely trigger another bond rally which will weigh heavily on the equity market.

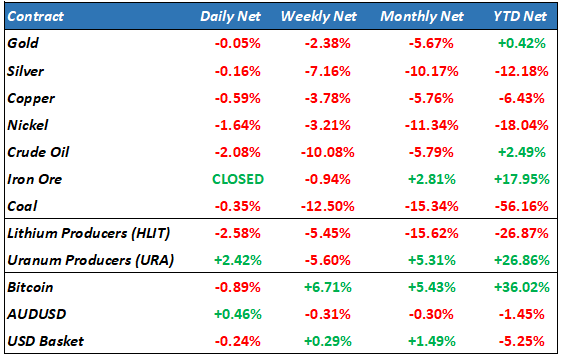

Crude prices fell another 2% on Thursday, adding to the previous session’s 6% plunge (already the most in a year) as the market continued to reel from disappointment over the absence of a new announcement on production cuts at the just-concluded OPEC+ meeting chaired by the Saudis. Threats of further cuts were treated as white noise, although given the recent rally, crude is likely to find some support around the 80’s as Russian missiles killed 60 in Ukraine overnight.

The market is finally starting to get the message from the Fed, that instead of further hikes, the central bank’s tactic is to keep rates at an elevated level as the labor market continues to cool and inflation heads back to the Fed’s 2% target. This was reinforced by San Francisco Fed’s Mary Daly (non-voting member) that “we can hold interest rates steady and let the effects of policy continue to work.” This comment is at odds to the markets expectations of rate cuts next year and a quick bounce in economic activity

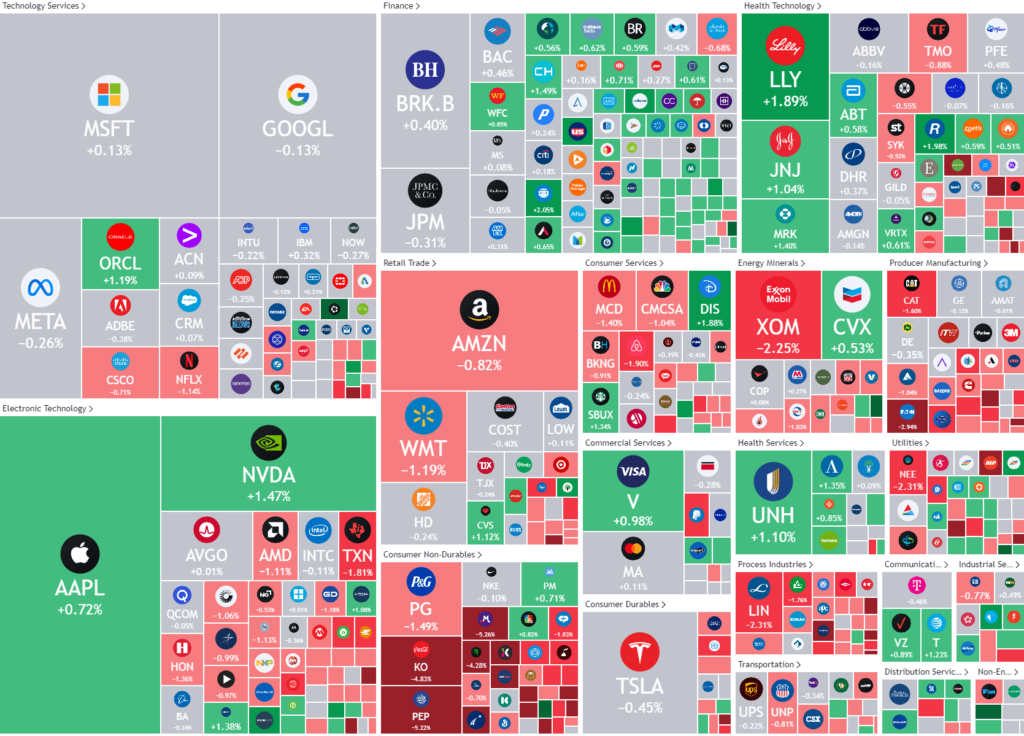

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6915(+0.02%)

The local market is in for a quiet day as investors take a breather after a heavy week. Bargain hunters could potentially keep the market supported at the current year lows. Healthcare and financials will benefit from the positive offshore lead, while energy stocks will suffer under the weight of the falling oil price. Citi and JP Morgan have downgraded the lithium outlook, a move that has seen lithium stocks find support and go the opposite way over the last 2 years.

Strength in tonight’s Payrolls numbers in the US could trigger a significant reaction from both bonds and equities, we recommend investors take the chance to review holdings and exit marginal positions

Chinese markets are closed this week for the Mid-Autumn Festival and China’s National Day.