Overnight – Stocks hit as Treasury Yields test multi-decade highs

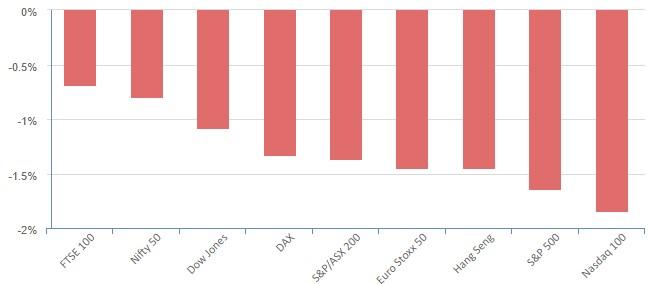

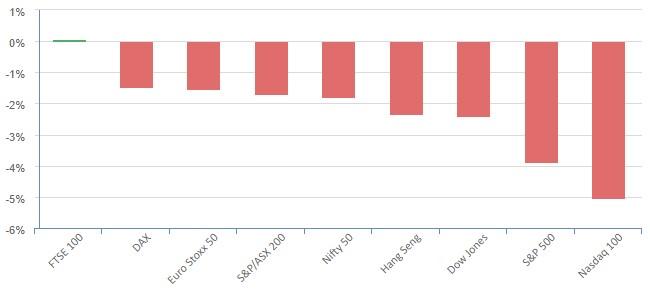

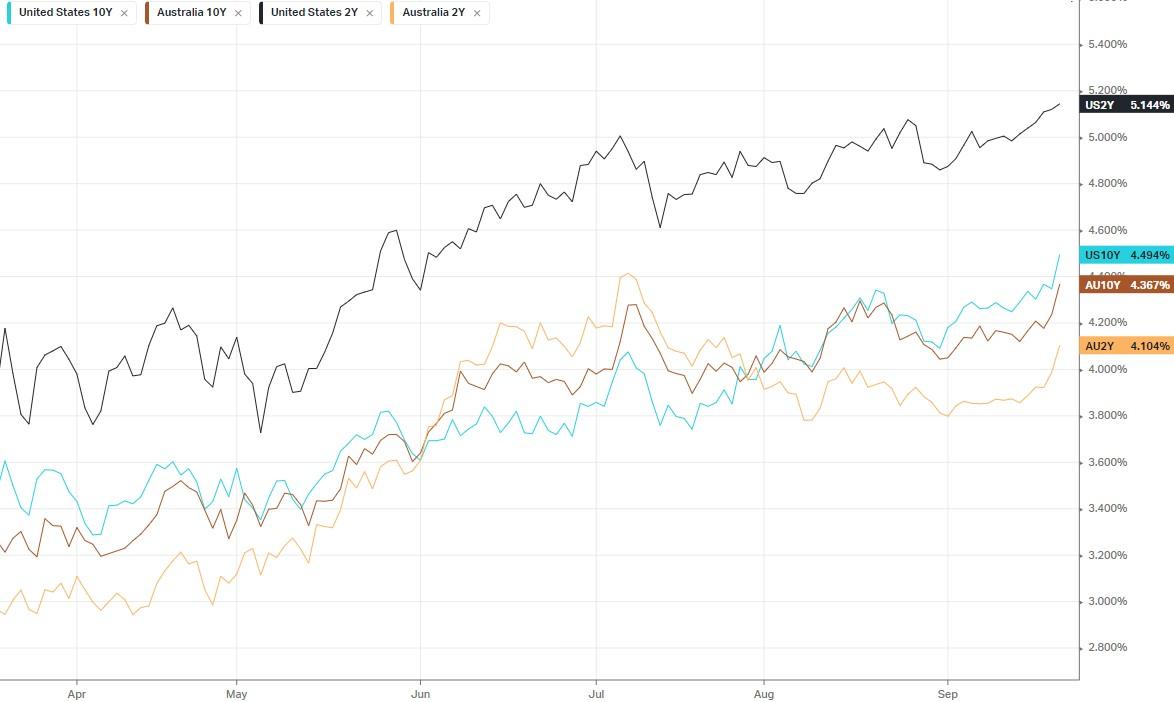

Equites, particularly growth stocks, slumped overnight under pressure from a spike in Treasury yields testing multi-decade highs as investors continued to digest the prospect of a higher-for-longer Federal Reserve interest rate regime as the Bank of England made very clear they will be in no rush to pivot

Treasury yields continued to advance after fewer than expected weekly initial jobless claims flagged ongoing strength in the labor market and the potential for a pick up inflation. Initial jobless claims fell to 201,000 in the week ended Sept. 16 from 221,000 in the prior week, marking lowest level of claims since January. A still-strong labor market added to fears that the Fed may have to do more to quell inflation – just a day after the Fed delivered a “hawkish pause” – sending the 10-year yield to highest level since 2006.

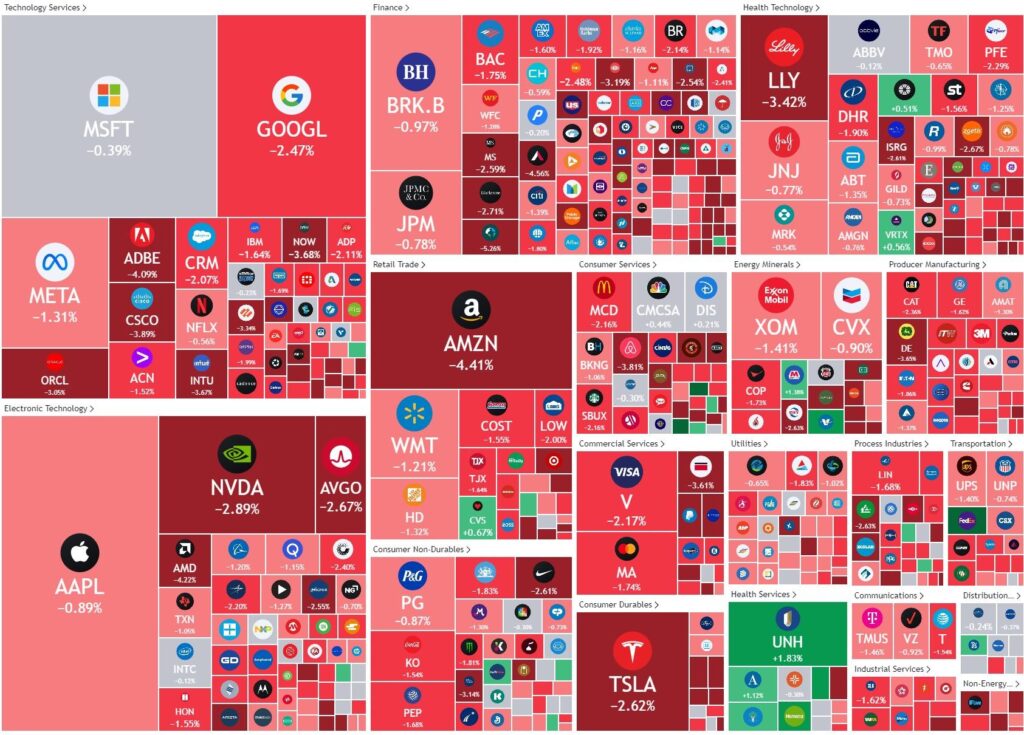

Big tech added to losses from a day earlier as ongoing climb in Treasury yields on expectations for the Fed to keep rates higher for longer continued to weigh.

The recent tech rally has been driven by the idea of the Fed not being as hawkish as they have stated, but with Fed Chairman Jerome Powell doubling down at the FOMC meeting this week, taking two rate cuts next year off the table, the markets blind optimism of a “goldilocks” scenario are looking near impossible

Rising yields also added concern to the semiconductor sector as Broadcom led the decline for chip stocks as Google is reportedly mulling whether to ditch Broadcom as its artificial intelligence chip supplier for its own in-house chips by 2027.

Mirroring a rise in Treasury yields, Germany’s 10-year government bond yield touched a fresh six-month high of 2.73% and Britain’s 10-year gilt yield rose to 4.29% after falling on Wednesday to its lowest since July.

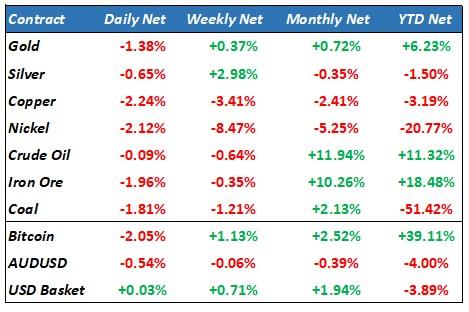

Oil prices settled lower in choppy trading, rising as much as $1 a barrel after a Russian ban on fuel exports snatched the focus from Western economic headwinds that had pushed prices down $1 a barrel early in the session.

Brent futures settled down 23 cents to $93.30 a barrel, while U.S. West Texas Intermediate fell 3 cents to settle at $89.63.

Gold extended its decline for a third straight day as the dollar and Treasury yields rallied on the Fed’s warning of a possible additional rate hike.

S&P 500 - Heatmap

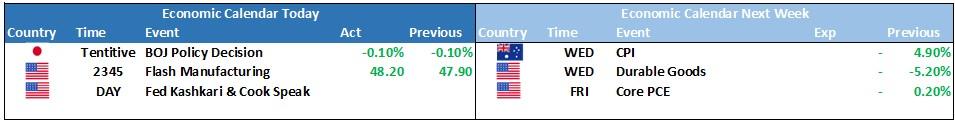

The Day Ahead

ASX SPI 7013 (-1.36%)

it will be hard to find any “green on the screen” today as the reality of the “higher for longer” from multiple centrals banks sinks in for those investors betting on a “goldilocks” scenario and soft landing.

The fall in energy and commodity prices will add to the ASX200 pain with 6900 a critical technical level of support.

Defensive sectors like health and consumer staples may find some support as they present value due to being out of favour recently against the growth end of the market